NFT collectible cards, a new way to own collectibles or an asset bubble?

NFT collectibles are still booming, but are they a bubble about to burst or a revolution about to burst?

Unique items have long been attracting collectors, who remain willing to shell out big bucks to get them. Paintings, baseball cards, stamps, stage cards and rare coins have been sold at gigantic premiums to collectors in the past. Now, such items remain moving to the digital environment, thanks to the use of blockchain technology.

Such items remain represented on different blockchain networks as unique digital assets known as non-fungible tokens. The use of blockchain technology means that veracity and ownership are easily verifiable, especially in a world where scarcity plays an essential role in the valuation of an asset.

A work of art originally spawned by reputed urban artist Banksy has been converted into an NFT version of the physical painting that has been destroyed on target and then sold for around $400,000.

By decentralizing the concepts of origin and veracity, NFTs continue to revolutionize the way we think about ownership and cost.

Source

Collectible cards, like works of art, are unique items, and their move into the digital environment is growing at a rate at which collectibles in your group remain becoming an investment class.

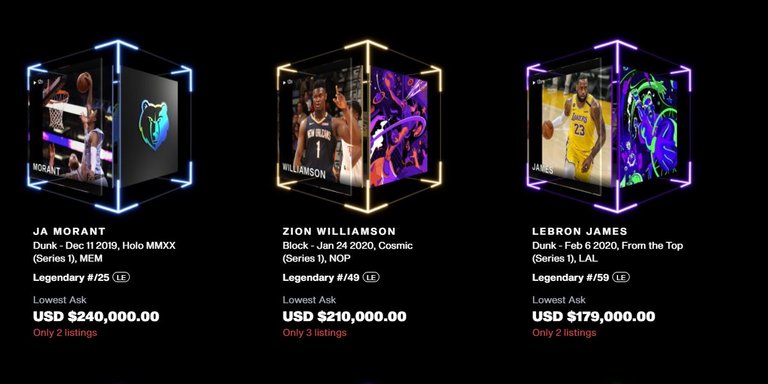

There are several examples of trump organizations within collectible NFTs. The cost of mint condition cards on the barter platform StockX has gone from $280 to an average of $775, as recently as a year ago.

Several classic investors started turning to riskier asset classes such as cryptocurrencies and blockchain organizations.

NFTs are a totally new technological revolution, however, as with any new technology, they are commonly misused. There are several projects that want to use them only as a promotion strategy, instead of a really important goal. Investors should be very careful not to invest in all NFT projects, as happened with blockchain two years ago.

Such developments are unfolding as millions of individuals are being laid off by confinements ordered as an attempt to curb the rise of the coronavirus. As the economy fell, territories like the USA, Brazil, Germany and Japan lowered interest rates and bought government bonds, making them less attractive to investors.

Simultaneously, quantitative easing has additionally caused the fear of hyperinflation, which has driven classic investors away from activities and fiat currencies, and into beautiful metals and cryptocurrencies; with the most current object of interest being NFTs.

In conclusion, the collectibles and collectible cards industry has been around for a long time now, however authentication and preservation models, which value their condition in superb condition, have become a difficult component.

Source

Blockchain technology could provide a solution to such drawbacks. However, this changes the whole dynamics of the collector market, as the scarcity of cards in outstanding condition is where the cost is born.

Although some activities have been created that participate in this initial market, NFTs have a high degree of risk. Traditional market cards and sports memorabilia alone through 2020 are estimated to be worth more than $5 billion.

Therefore, it is not surprising that NFT has not yet reached this point, but they contain a valuable asset that can drive the market. Furthermore, owning an NFT does not automatically mean that a physical version of the card should not exist. As with Bitcoin, it could be a physical version of the coin and prove ownership of the wallet containing the property.

Bitcoin and other cryptocurrencies and tokens allowed people to be their own bank and own their own money. NFTs now do the same for other types of assets, but the use of NFT does not end there.

Posted Using LeoFinance Beta

NFTs are a good used case for the blockchain for sports memorabilia. But the number you have pegged it at is far more astonishing and an eye opener. Keep posting !