Geyser (GYSR) rewards analysis: When to pull out ?

Is time for GYSR follow up and a reward analysis. GYSR is the Ethereum 100% configurable and decentralized platform set for yield farming and asset distribution. Anyone can deploy a configurable yield farm, and use the GYSR tools for yield farming. An in-depth explanation on how Geyser works can be found on GYSR.io

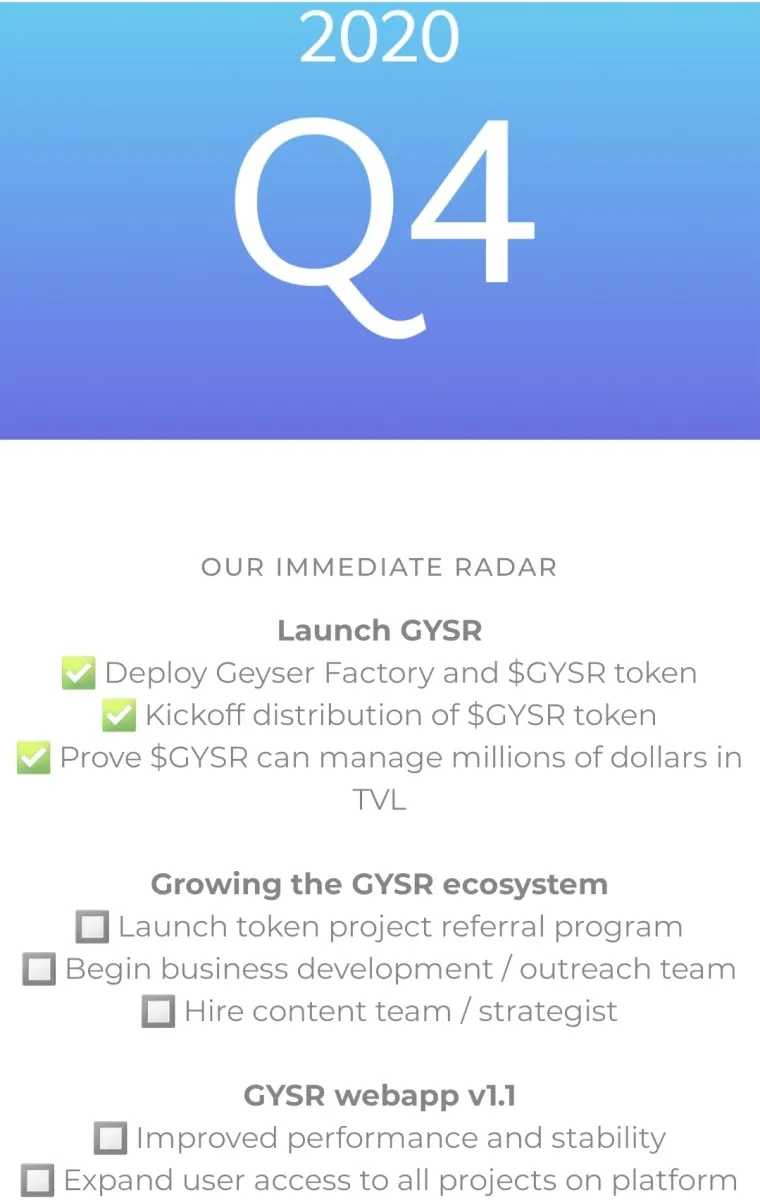

Geyser updated the Roadmap and the planned expansion targets were released. The GYSR platform was launched successfully, the Geyser Factory was deployed without issues and the $GYSR kickoff distribution took place smoothly. The next goals on the RoadMap are the launch of the referral program, and business development. The webapp v1.1 will be improved in terms of performance and stability.

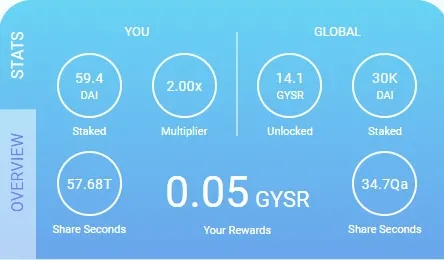

Today's focus will be on how the rewards are calculated and the strategies that will influence the rewards. I found the DAI geyser the most accessible and added a handful of stable-coins in the boiling GEYSER hoping to get a bucket of $GYSR. I spent 3 DAI to send them from Binance and $3.40 as fees so I hope that the experiment will at least cover the expenses. I joined the DAI during the boiling period, meaning that I will have a better reward rate than someone joining later, as my accumulated share seconds will boost my reward share. The formula was easy to understand as Share Seconds = Amount Staked x Length of Time Staked. I turned away from classic yield farming so fast, leaving smoke and dust behind as a drift competition in the supermarket parking.

"Your share seconds" means the number of seconds a user accrued multiplied with the amount staked into the pool and is the amount earned in the Geyser. "Your reward share" represents the percentage of the unlocked reward the user is entitled to, based on share seconds while the Global Share Seconds are the number of seconds for each stake in the Geyser globally. So my reward is calculated based on the time and not just the amount. I started accruing share seconds from the moment I staked the DAI in the geyser. Staking during the boiling period made me be one step ahead of others.

Now that the DAI accumulates GYSR rewards, my next questions were related to how to maximise the reward and what happens when I will unstake my investment. I found answers to all my questions (obviously the GYSR related ones not existential dilemmas) on the GYSR medium, where the unstaking mechanism was explained in details.

How to withdraw the rewards?

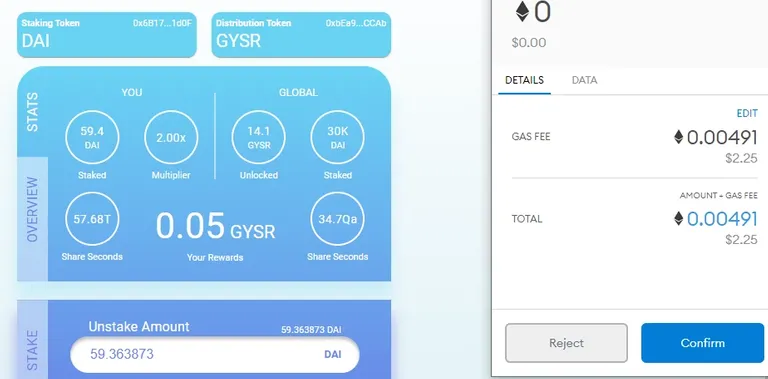

On GYSR, user have the option to unstake all and get my funds back, or unstake a portion, and any rewards generated up to the unstake process. When unstaking, the multipliers and accrued share seconds associated with the withdraw amount will go back to null value. The Geyser will calculate the user's share seconds in relation to all the shareholders and will allocate the portion of the unlocked rewards.

While reading, I learnt that the multipliers are increasing the share seconds, not the $GYSR reward while the time multiplier are rewarding users for HODL in the geyser. Each stake in the Geyser has a separate time multiplier so different deposits will have their own multiplier. GYSR automatically unstakes the tokens with the lowest multiplier, therefore simplifying the unstake process and allowing the shareholder to keep the biggest multiplier active.

The kickoff Geysers were the 5 initial geysers and the multiplier went up to 2X for the 10 days lifespan. The community Geyser multiplier limit is 3X over the 90 days lifespan.

Staking strategies that can affect the reward

GYSR was designed to allow flexibility, giving users the opportunity to stake how much they want, for whatever period they desire. Timing can be used as a strategy to outsmart the other players and improve the level and value of the reward. I created a resume of staking strategies after reading the GYSR guide and I will list the pros and cons of each strategy.

Finishing Early: This method reduces the risk of being affected by other big dogs applying multipliers that increase their share, reducing yours as a result. Unstaking rewards early will allow users to move the $GYSR into the Uniswap community Geyser. The early pull-out is similar to real life situations, when you added another name on the trophy list but the passion was missing. Finishing early can leave you unsatisfied, as fractions of the reward will remain locked.

Lasting for longer: The endurance and loyalty will be rewarded with a maximal reward, as more tokens are unlocked. The long period will benefit from accrued multipliers. As a downsize, other users may already received a large slice of the rewards, leaving just breadcrumbs for the rest. A longer time doesn't mean more satisfaction, as the delay can deliver a less valuable experience.

A hybrid method out of Kama-Sutra

Remember the partial unstake? Unstaking small portions can create advantages, and users can use an stake - unstake - restake system to gain a diversified list of staked assets and a stash of GYSR that can be reinvested. In - out - try something new - in again can be a routine that will avoid boredom. Balance is the best strategy and no one can say when is the perfect moment to end the adventure.

How it worked for me?

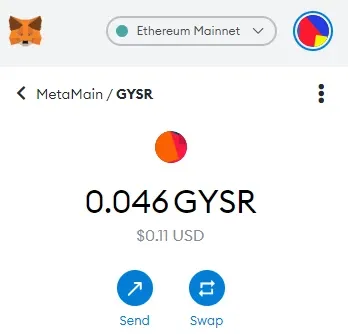

You know what Julius Caesar said in the Roman Senate around 47 BC? It didn't worked like that for me even with the advantage of joining during the boiling period. My bounty from the Geyser was 0.05 GYSR ... and another $2.25 to unstake.

When checking this on Metamask, I noticed that the 0.05 was a round-up, as the real value is 0.046 GYSR, about $0.11. This experiment lasted about 2 weeks and I spent $8.85 on various fees and generated a $0.11 reward, resulting a $8.74 deficit. Dear Caesar ... Veni, Vidi, Time to move on!

🎵 We've come a long way from where we began

🎶 I'll tell you all about it when I see you again

Resources:

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, ReadCash, LBRY & Presearch

- This article may have been published on ReadCash or Publish0X