DEXToken, DEXG and The Gauntlet of Infinity

Making history since... 2018

The DEXtoken protocol is the newest player on the DeFi ecosystem. It was developed and launched by the Flowchain Foundation, a reputed block-chain infrastructure-level technology developer based in Taiwan. The company was registered at the Singaporean Accounting and Corporate Regulatory Authority (ACRA) in 2018, and constantly evolved since than, adding offices in Singapore and Chaina, as part of today's glory.

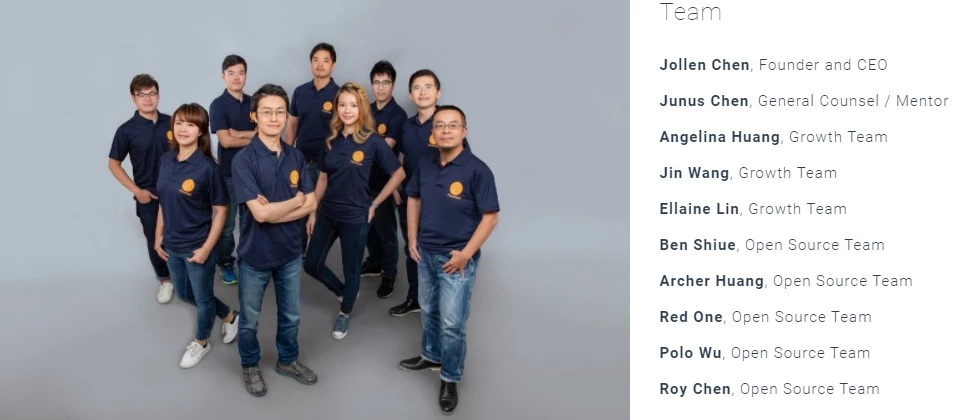

The Flowchain Team

Jollen Chen is the Flowchain founder, CEO and lead developer . He is an expert in open source IoT block-chain solutions, an excellent Android and Linux developer, and holds a Master's degree in Manufacturing Information and Systems from the National Cheng Kung University. In over ten years as software architect and developer, Jollen created many successful projects in the data security field and Distributed Ledger Tech. He is very active on multiple social media platforms, and an approachable person.

Junus Chen is member of the General Council and acts as a mentor. He is an experienced lawyer, specialized in patents, regulatory compliance and risks for block-chain. He shares his Flowchain attributions with involvement in technological progress initiatives such as the development of Smart City Taiwan. Jin Wang and Ellaine Lin are leading the Growth Team while the Open Source Team has five divisional leaders. The whole team looks solid and with higher standard of block-chain and programming knowledge.

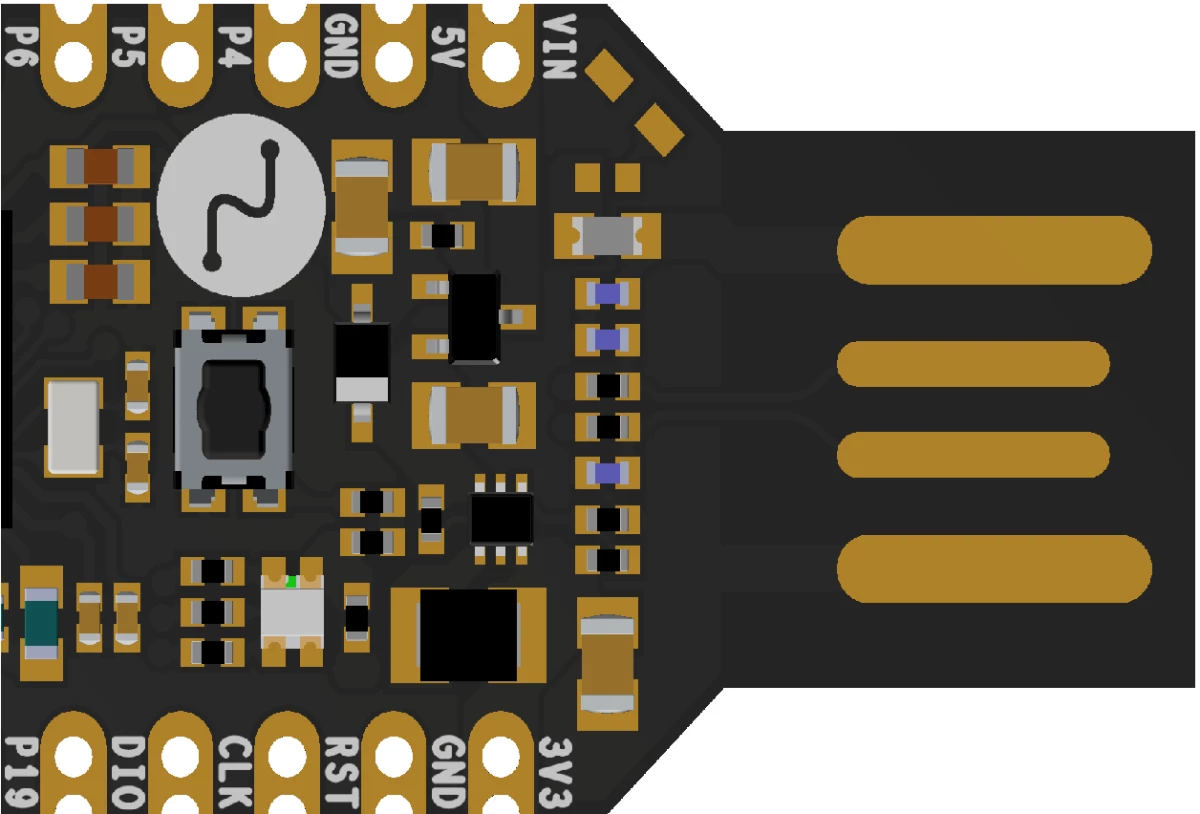

The Flowchain USB Dongle - The Jewel of the crown!

Flowchain and the subdivisions has many software and hardware products, but this USB dongle looks like alien technology. It is equipped with nRF52840 system-on-chip platform that enables multi-protocol such as Bluetooth 5, Bluetooth Mesh, Thread, IEEE 802.15.4, ANT and 2.4GHz. The low cost IoT kit is supporting Flowchain Distributed Ledgers, has an ARM® Cortex®-M4F processor optimized for ultra-low power operation, on-board 2.4G chip antenna and is slim and light (42mm x 18mm x 4mm).

DEXToken Crash Course

The Dextoken ecosystem has many components, all interlinked in harmony and synergy. The Universal Price Model will not work without the Speculative AMM, and will be less successful without DEXG staking. This complex mechanism is used for the Decentralized Exchange and Token Swap Exchange.

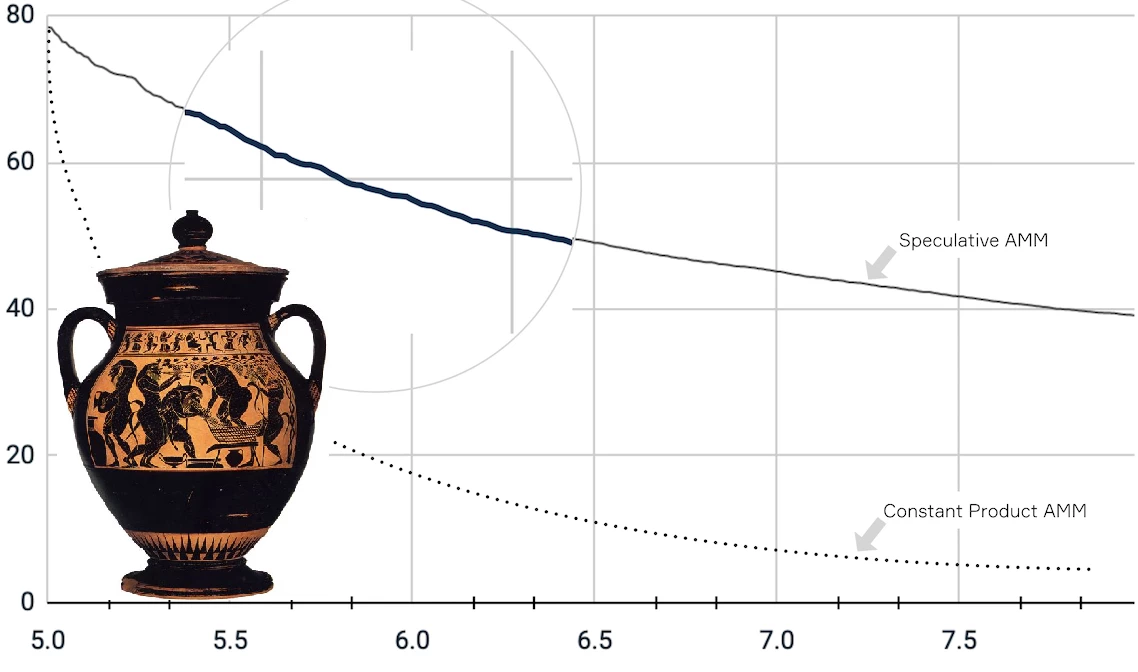

The Universal Price Model is part of the AMM and has the sole purpose to reduce market speculation and control volatility. This makes DEXG the perfect token for staking, due to the low market fluctuations and low interaction with speculative behaviour. The Speculative AMM uses the Price Model to adjust the price by trading at high value and buying at low value, giving balance to the price. This method will mitigate the over-speculation. Imagine that the Universal Price Model and the Speculative AMM is guarded by a spartan, one of Leonidas legendary warriors. Do you want to upset the Spartan?

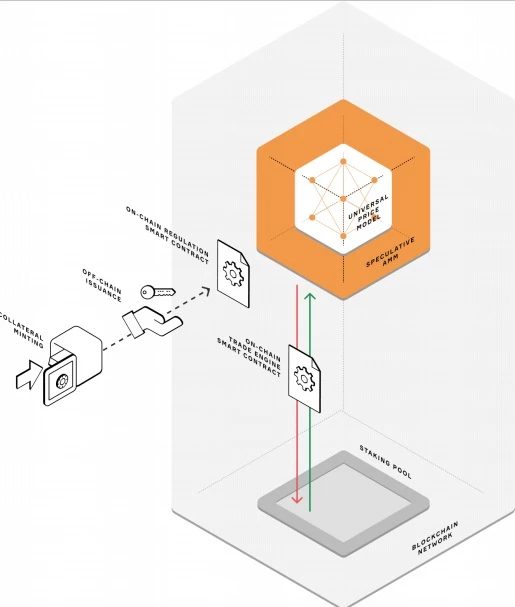

The Speculative Automated Market Maker is the foundation of the DEXToken Governance Protocol. The DEXToken off-chain technology is used to mint tokens, redeem rewards and assist users with claiming and withdrawing their gains. All off-chain transactions are verified and validated by the on-chain smart contract.

As a result of volatility control, the DEXG token holders will get a portion of the exchange's transaction fee profit. They are also actively involved into the governance and evolution. The Token Swap Exchange, Decentralized Exchange with Fast Orderbook and Staking Pool are all projects which were approved by the token holders community.

The order's quality will affect the token price. If you don't shake the Amphora, no price slippage will occur and this is how the DEXG Speculative AMM will provide a good price and a low volatility.

DEXG ... wanna be my G?

In British slang , "G" means a good mate, one of your closest friends. You walk on the street and when you see Charlie you must shout "What's up G!", and than wait for Chaz to say "Sound G! Sound!" DEXToken put the G into Governance, giving an amount of control to token holders. This is not as decentralised as a DAO structure, where the community has total control over development and innovation.

DEXtoken Governance (DEXG) is the native token used on the Dextoken ecosystem and sounds gangsta enough, specially with all the upgrades planned on the road-map. DEXG has $1,031,931 Market Cap, and over $100,000 daily trading volume. From the total of 30,500 total supply, 65.57% (20,000 tokens) were provided to the community via Uniswap. The remaining tokens will be distributed as staking rewards. The DEXG theoretical maximum is 200,000 tokens which will probably never be achieved due to burning, assets stuck in locked wallets and many other reasons.

Whitepaper highlights

DEXToken was introduced back in 2018, in the Flowchain Foundation whitepaper. The ‘The Tokenized Hardware Whitepaper’ acted as a work-frame and the blueprint for hardware tokenization in the real world. This vision needed an in-depth analysis of the volatility effect and a clear understanding of speculative behavior. This is how the AMM (Automated Market Maker) was created, and the main source of inspiration for the Speculative AMM which is the heart of the DEXToken Protocol. The 2019 whitepapers brought clarifications over the Speculative AMM.

As crypto market has always been prone to speculative behaviour and volatility, not everyone is a winner. Price fluctuations most often offers gains to the whales and huge losses to the common investor. This is where the DEXToken and the Speculative AMM comes in action, building pricing power for the tokens in high demand by using a priceless automated market maker that solves the issue of over speculation and reduce significant price fluctuations. This model creates a reasonable price

DEXToken protocol is a hybrid block-chain, a combination of private and public networks that allow miners around the world to share idle computing power and unused storage space, helping the IoT and AI systems to run smoothly and efficient. The hybrid build allows businesses to develop software and customise their products on the Flowchain platform.

Inside the DEXToken ecosystem, the collateral minting is introduced into the on-chain trade engine smart contract only after passes the on-chain regulation. Than the Speculative AMM and the Universal Price Model integrates the DEXG in the Staking Pool

RoadMap

The journey started in 2018, when Flowchain Foundation released "The Tokenized Hardware Whitepaper". Next year, they established the Tokenomics Research Center and released the "Volatility effect on the adoption and valuation of tokenomics". Both whitepapers are the framework of what DEXToken is today. Even if 2020 was a catastrophically year for humanity, the launch of DEXToken Swap Exchange was not affected. The AMM will be the core of the decentralised exchange. The Speculative AMM algorithm will provide the crypto ecosystem with a new approach to achieve stability.

The Speculative AMM expantion is planned for 2021, focusing on thee aspect: Inflationary Tokens Speculative AMM, Off-Chain Tokens Speculative AMM and Derivatives Tokens Speculative AMM. Flowchain's goal for 2022 is the evolution into a service provider for IoT finance, digital finance, and decentralized finance. Let's hope that the DEXToken and Flowchain's journey will not end in the middle of the woods with an empty fuel tank, no phone signal and a torch without batteries.

How to join LUNA staking

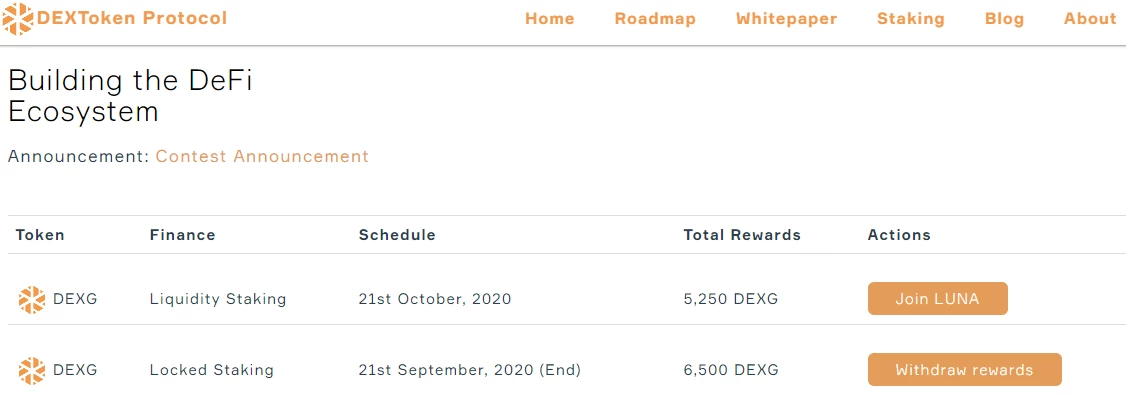

The DEXToken website design is very friendly and pleasant. All the tabs are listed on the top of the page, easy to access.

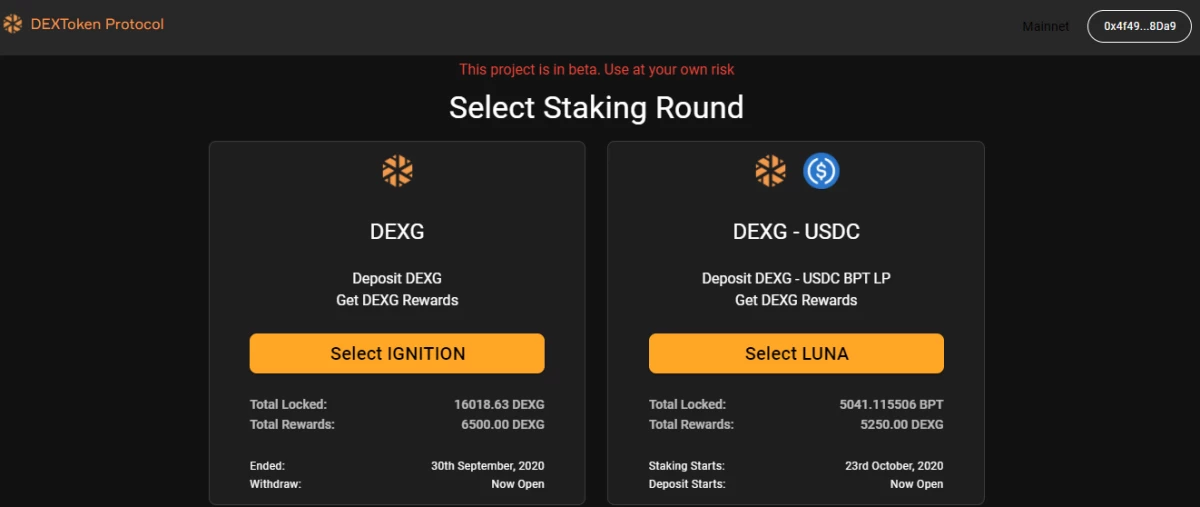

The Locked Staking, called IGNITION took place on the 21st of September and a total of 6,500 DEXG were rewarded. During the Ignition phase were staked 80% of the existing tokens. Soon after the Ignition stage was concluded and all the rewards were claimed, DEXToken announced that the next stage will be on a newly created Balancer Shared Pool, under the name of LUNA. This will solve the 50/50 issue of Uniswap pools, as the Balancer Pool can customise the weighting of assets. Therefore, the LUNA pool will be made of 90% DEXG and 10% USDC. This model is less sensitive to impermanent loss and can prevent losses for liquidity providers. Flowchain has locked 100% of the initial liquidity for two years, and no liquidity of DEXG can be taken out from Uniswap until then. This means that the DEXG/USDT trading pair is a safe trading pool.

The LUNA Liquidity Staking is scheduled on the 21st of October, and users will be rewarded from the 5,250 DEXG reward pool for staking DEXG - USDC. This round will integrate a liquidity staking model based on a DEXG/USDC Balancer Pool. When this round will conclude, the total supply will increase to 35,750 DEGX. Please note the message in red, stating that the project is only a beta, and users are staking on their own risk.

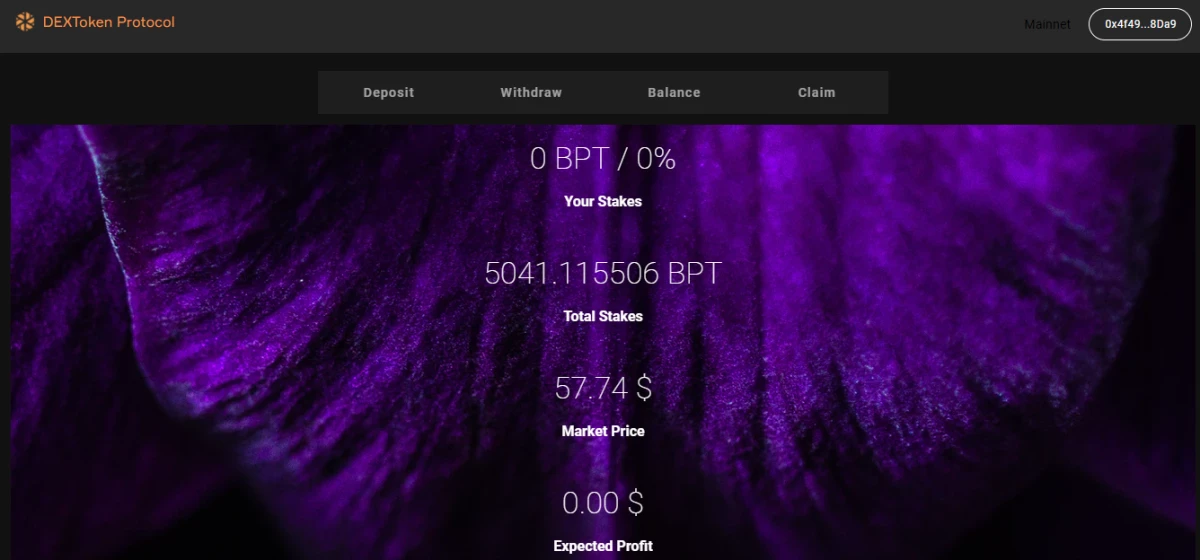

To access the Balancer Pool, I logged with my Metamask account. The layout is straight-forward and will show the personal stake, total stake, DEXG market price and expected profit. Deposits in the pool will start from the 21st of October but the staking will start 2 days later, on the 23rd. The staking will be open for a week, until 30th of October, when the pool will close and the reward can be claimed. Everyone providing liquidity into the Balancer pool will receive automatically BPT (Balancer Pool Tokens). During the LUNA staking period, users can add more BPT which will immediately increase the amount of DEXG staking rewards claimable. The DEXG staking will only use the unique Balancer Pool Tokena for deposit and staking. The USDC deposits will be used by the Balancer Pool to buy DEXG tokens at low price, for low gas fees.

Zeus seal of approval

The staking reward distribution will have eight stages, over-watched by Zeus himself, from on top of Mount Olympus. Hopefully Pandora will not let all the bad things out of the box. I personally prefer Prometheus cause he invented the "sharing is caring" movement, when stole the fire from the gods and gave it to use, the humble mortals.

Let's wrap it up!

This project is cool, backed up by real people. I am feed up of anonymous DeFi creators, DeFi memes and food tokens, and the insecurity around projects backed by unknown entities. Knowing who is leading the project makes the potential customer feel protected from scams and Jollen Chen has a good reputation.

The LUNA pool looks similar to Statera and their Pheonix Fund, the only difference is made by the high slice of DEXG, 90% of the pool. The DEXG will offer stability and great potential for top rewards, as will benefit from the full spectrum of the Speculative AMM.

DEXToken protocol brings benefits to all stakeholders. The investors will avoid over-speculation losses, while the stakers will receive rewards based on the amount of the deposits. The Speculative AMM allows traders to arbitrage transactions between exchanges while quantitative trading algorithms can skip technical indicators as this type of trading doesn't require historical data.

Will be interesting to follow how Flowchain will adapt on the long term and how they will maintain a step ahead from competitors. If the development of DeFi infrastructure will make DEXG the perfect token for exchange, with low volatility on short term and superior store of value on the long term, than Flowchain can successfully implement digital finance and other services. If the market leader position will be achieved on multiple sectors, Flowchain will become a titan stronger than Thanos.

Links and resources: