The Impact of a Central Bank Digital Currency on the Velocity of Money

I was recently asked by Finance Magnates about the potential impact a central bank digital currency (CBDC) might have on an economy. Of course, the context is China's recent announcement that they will be releasing their own DCEP (which stands for "digital currency electronic payment") within the next few months. I wrote about this last week, but I think there are some more general points to be drawn out.

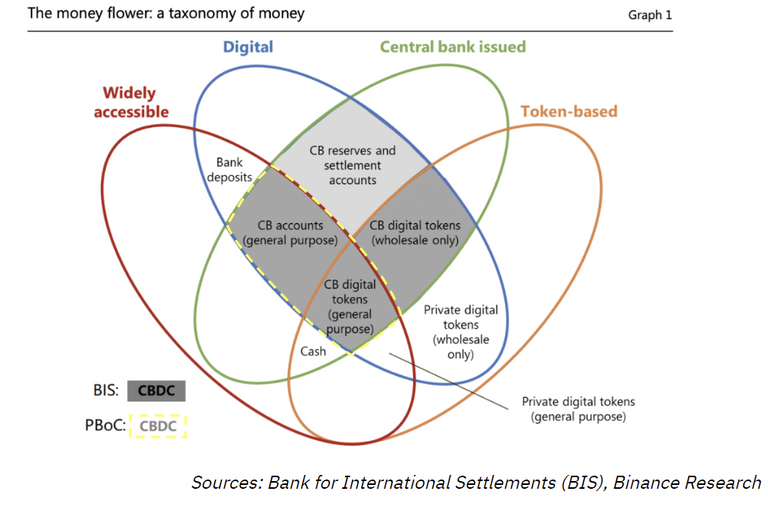

The result of Rachel McIntosh's inquiry led to an article published on Friday titled, "China’s Stablecoin is Likely the Only One the Country Will Allow." The first time she quoted me highlighted this theory that I've been kicking around since people repeatedly started asking me my opinion about China's new CBDC. Of course, I'm not a part of the Chinese government and it would be presumptive of me to pretend that I knew exactly about their motivation to release a CBDC right now. People tend to point to the trade war and the recent Libra announcement as the cause for this release, but I personally don't think that we can take too much from the timing of these announcements. Correlation is not causality and all that. Perhaps the best lens through which to view this situation comes from the financial formulas and tools that academia has rustled up over the past century or so. Let's take a look at my quote and the associated graphic Rachel associated with it.

“Let’s examine this impact from the perspective of the quantity theory of money (MV=PY). China has been relying on huge increases in its money supply (M) to provide inorganic growth in the country in an attempt to stave off a potential debt crisis,” he continued. “And yet, despite printing money at something like an 8+% rate per year since the financial crisis of 2008, price inflation (P) and the GDP (Y) have continued to stagnate.”

In other words, “Growth is declining.” However, “by introducing the DCEP to Chinese consumers, the PBoC may be hoping that they can start to reduce the growth in the money supply (M) by vastly increasing the velocity of money (V) by eliminating almost all barriers to transacting with the DCEP.”

“Currently, even though China is pretty much cashless in the first tier cities, there are still barriers such as you cannot transfer value easily from Alipay to WeChat Pay or from one bank account to another without incurring fees and delay,” Krapels explained. “A DCEP could drastically improve this situation and help to support GDP growth without the debt crisis risks that using the money supply lever imposes on society.”

MV=PY

When finance professors evaluate this formula, they nearly always assume velocity (V) is a constant, usually 1. Although the St. Louis Fed has previously pointed this out, that data has not really been proven and has certainly not begun to affect policy formulation. As usual, the prevailing rule of thumb about something is usually what is accepted, regardless of its quality of truth.

But if we look at where the DCEP will be existing in the money flower presented above, we can easily see that a central bank digital currency, particularly in the most advanced retail fintech society in the world, could have a very substantial impact on the velocity of money. When I say "substantial", keep in mind that the money supply growth (basically the QE component of the quantity theory of money formula) has a massive impact on a nation's GDP (essentially the right side of the formula, P*Y). In China, it does so with a rather small measurement of 8% growth.

No one is really sure what the impact of a CBDC will be on the velocity of money. It's never been implemented before. But I can assure you that that impact is certainly going to be non-zero. The only question is will it have up to a 10% impact, which could mean that the growth in money supply could be reduced to zero. Or will it have an even bigger impact, the consequences of which could be staggering.

It's all about the formulas, baby.

It certainly is going to be interesting to track what the impact of this new digital sovereign currency is going to have on the Chinese economy, especially if it is released by the PBoC before Alibaba Group's famed Singles Day shopping event on November 11. It sounds crazy fast for something like that to happen. But it's China, y'all. Things get built fast over here!

I appreciate your insight. In a globally competitive [monetary] landscape, China is certainly making waves. With the integration of a stablecoin at the central bank level, this moves China to the "head of the table" of monetary technologies. This is definitely something to keep an eye on.

Timing is one of the most significant factors in the finance and banking sector, and the United States is woefully behind.

How do you think this will affect the strength and performance of financial institutions in the East, and do you think there will be ripple effects, with other countries following suit?

Payments and Regulation in the US:

https://www.mercatus.org/bridge/podcasts/08122019/aaron-klein-real-time-payments-and-financial-regulation

No country is advanced as China when it comes to this stuff. But they've been studying the space since 2014. The Fed just doesn't get it... yet. So I think "innovation" at the national level will be coming from Asia, particularly ASEAN countries and those countries in the One Belt One Road Initiative.

Thanks for the response! I tend to agree.

China seems to embrace the reality of innovation - digital currencies in this case - and the value of such innovation seems to be lost (or hidden) within the United States.

What do you think will be the first of emerging benefits from this move to a stablecoin?

Well, obviously, @circa, I think increasing the velocity of money will be pretty huge. This is a factor that I think most pundits are overlooking.

But on the whole should be very beneficial: 1) Less illicit trade 2) Easier to collect and assess taxes 3) More demand to hold this DCEP currency vs. CNY because it is sovereign tender but it settles much more quickly.

Very interesting. I can see this being likely.

Do you think there will be a move to digitally-operated financial instruments as well? Stocks/bonds and the containers for these, like mutual/index funds, etc?

Absolutely, @circa, tokenization is the future. It’s just hard to say when that future will come. I’m excited about the interoperability chains gaining traction - Cosmos, Polkadot, Wanchain, and Aion - Because I think that many blockchains are just siloed away right now. In order to truly unlock their potential, we need to inter- them! That is really not unlike the internet, where there was a real exponential explosion in value once we networked them all up.

Tzero and Bakkt and others like them are bery interesting in the regulated digital asset space. These guys could really disrupt the traditional markets. But again, when? We’re not quite sure. Things that are inevitable are never as clearly seen with foresight. The future is foggy. We know what’s there. But honestly, traditional banks could hang on for another 20 years by adapting, cutting costs, pivoting, and just in general putting up a fight.

Posted using Partiko iOS

Congratulations @shanghaipreneur! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

I for one am impressed and in love with the pace at which tech is advancing in China. The introduction of the DCEP is sure a disruptive one in the world of Finance, I also look forward to seeing the impact on China's economy and the next country to follow.

Thank you for sharing this post with the realityhubs community, we look forward to your next review.

Realityhubs Mod