Bitcoin could reach $ 15,000 this week analysts say

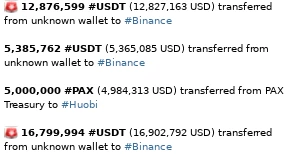

The market has recovered again and of course from the hand of Bitcoin, its main reference which has taken off strongly after a series of movements over the weekend originated by some 'Whales' that pushed its price when liquidating a sale of 340 BTC in the BTC \ USDT pair in a matter of seconds, following the movement of more than $ 40 million of stablecoins to acquire BTC at prices above its 11k psychological resistance.

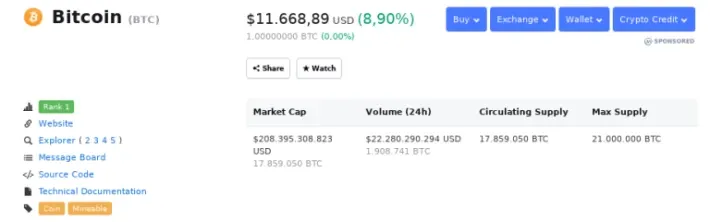

At the time of writing, the market sports a large green carpet with its main references generating profits and with Bitcoin increasing its dominance in the market share with 67.4 percent, in addition to the crossing of the MarketCap barrier of the $ 300 billion Dollars.

The Litecoin halving performed successfully in block 168,000 with its reward of 12.5 LTC made and that has triggered the price of this altcoin above the $ 100 barrier, as announced by its creator Charlie Lee on his official Twitter account.

The halving of LTC for many experts is a mirror of what may happen this May 20, 2020 with BTC, and therefore the media importance that has revolved around this event has managed to boost the price of BTC in some way and delay the ALTS season.

At the time of writing, BTC is trading at the price of $ 11668.89 with an excellent profit of + 8.90% and a daily volume of just over $ 22 billion.

The feeling of Bitcoin is totally positive, with a value of 64 totally in the index of fear and greed, which indicates the willingness of traders to acquire BTC positions.

In the short term, BTC presents a strong upward channel that originated on August 30, 2019 based on the $ 9400 level and that projects an immediate resistance of up to $ 11958.08 for the main market reference. Its key support rests on the $ 10,983.22 level which was crucial a few hours ago for the current BTC rally.

The Aroon indicator projects its bearish signal to the bottom and a feeling that soon there will be a small price correction in BTC to continue taking off at key levels of breakage of the ascending channel.

Stochastic for its part is in oversold levels, with positions higher than expected in this rally for BTC, so a correction is likely to be seen in the coming hours to push this indicator value to purchase levels.

The key support of BTC in this 1H time frame is projected with the value of EMA @ 12 days that rests at levels of $ 10,983.22.

In the medium term, Bitcoin presents two possible scenarios that could well happen given its downward trend that projects in the medium term and whose current movement is crucial to break this trend and move to higher levels that could trigger up to a value of up to $ 13883- $ 15000 a medium term.

The worst case scenario could result in a BTC correction up to lower levels of its key support of S1 @ $ 9227.50 that would take it to the 8k line and then mark the altcoins season, with a maximum of BTC prices of up to $ 10,000 in the best case.

Therefore, the outcome of these next hours that BTC can break this bearish channel above the $ 12k barrier will be crucial in order to see the asset position at values greater than $ 13,000.

The EMA @ 20 Dy indicator is the key support for BTC not falling deep.

The RSI indicator for its part begins to take flight to overbought levels, with an average of 65 currently.

The Awesome Oscillator indicator has changed its downtrend and is projected bullish, beginning to denote green candles in a negative sense with less depth. If we were able to project a candle positively in the next few hours, we would be talking about the delay of the ALTS season.

Many analysts have begun to speculate where this new short BTC rally could reach and many already indicate that we could see Bitcoin reach a level of USD 15,000 per unit this week, as this experienced trader showed in its official account of Twitter.

I’m sensing #Bitcoin will cross $15,000 this week. Confidence in central governments, central banks, and centralized, fiat money is at a multi-decade low.

— Max Keiser, tweet poet. (@maxkeiser) August 3, 2019

STEM rewards have been removed from this content.