market thoughts on 2022, January 12th

I want to answer some questions for my own curiosity. Though the matter concerns my capital, I speculate for the sake of conversation.

What is going to be the killer app of the 2020’s? For 2010’s, Amazon; for 2000’s, Facebook, what does this like in the metaverse space and how do you onboard millions of non-crypto users?

I mentioned it briefly before, but the key is education. Folks not yet introduced to the world of blockchain will dive sooner or later- with multiple macroeconomic factors like inflation, monetary policy from the Fed, generally greater risk tolerance and a comfortable digital environment, I reckon sooner. I knew what I wanted when I heard about the ownership of data. I felt a need for privacy of data and a hustler’s ambition saw a lane in monetization. The gamification of interactions isn’t new; my sister wants primogems to roll for her in-game characters, while my brother pays for in-game skins with greenbacks from mom. People tasted the appetizers of financial freedom. Their appetites whetted, I sense we are hungry for an Internet of value. What application will take us there might be different, but I suspect wallets take off. I have a hunch, but readings highlighted a significant pattern. Over a period, only a few adopt a given change, say the Internet, or the smartphone, followed by a large constituent. I felt that payment applications grew in adoption as public health concerns encouraged digital meetings and less physical exchange. Thus, as Venmo, Paypal and Cashapp pivot towards stablecoin offerings, the wallets like Phantom, MetaMask for several chains: Fantom, Polygon, and Harmony, as well as Terra Station for Luna Terra, will enable users to learn the way of seed phrases. To onboard millions, public facing companies might offer incentivized learning.

I do not believe Coinbase Earn is a proprietary concept; the students of America took pop quizzes for years, and currently enjoy Kahoot, or even Trivia Crack on occasion like myself. Pointed, multiple choice questions following 15 second to 2 minute videos will instruct generations of independent bankers near instantly. Here’s to another round.

What market segment isn’t being discussed now that will be more popular over the next few months, even next year?

I begin with games to highlight the obvious. Almost unanimously, the general tone agrees. Games stand to influence a large audience in many ways. Talk of NFT’s continues in tandem- I completely agree; I play Gods Unchained, a combination of a game and NFT's, for example. Their roadmap names the creation of an economy as one of their goals. They aim to withstand the waves of volatility and crush of doubt in skeptic markets by adding both exchange and utility value. I did not understand the significance of the following narrative but I feel this may answer the above question best. Digital finance grew in times of isolation; decentralized finance may blossom in times of inflation from central banks’ fiscal policy, championed by stablecoins. Defi Summer’s first season, period or epoch depending on your proficiency, involved over-collateralized loans, options and stablecoins backed by assets. The second season followed up with some players introducing their own stables backed by algorithms; ‘numbers’ check the balance enabling trust. You either believe your nation will properly value your dollar or at least mathematics and code will; smart players will always hedge their bets. I made uninformed and partly informed plays, but here’s the deal breaker.

I lost more in my ignorance than I made in my knowledge. Ignorance is bliss most likely if you’re unaware of the pain. Knowledge is power, as it enables us to avoid danger and benefit in peace. If the metaphor does not resonate, the most consistent scare headline aside from China’s ban on crypto remains the speculation on the backing of Tether. Folks believe Tether prints to inflate Bitcoin, others suspect there is not cash to back every single Tether, but I find them dubious. Richard Nixon severed ties between the dollar and gold on August 15th, of 1971.

I cannot contend with those who still fault the ‘backing’ or intrinsic value of tokens. Aside from the discussion of utility versus exchange, smart contracts establish trust mechanically. Wherever you find yourself in the discussion, I aim to cover both sides of the bet. Protocols offering their own backed stablecoin are worth following this year, I believe. Stables also connect to another narrative for more seasoned players in the game, the task of yield farming. With a large portion of entrants profitable, stables coupled with the opportunity to park capital for variable or fixed return rate looks prime for those hungry enough to leave ‘skin in the game’. This past week, I spent time learning about an ecosystem a day and now, even today, my research shows these tokens stand to grow even in the face of a market downturn, though the only certainty appears to be uncertainty. A mirror world, the market reflects our image distorting what we believe to understand about ourselves.

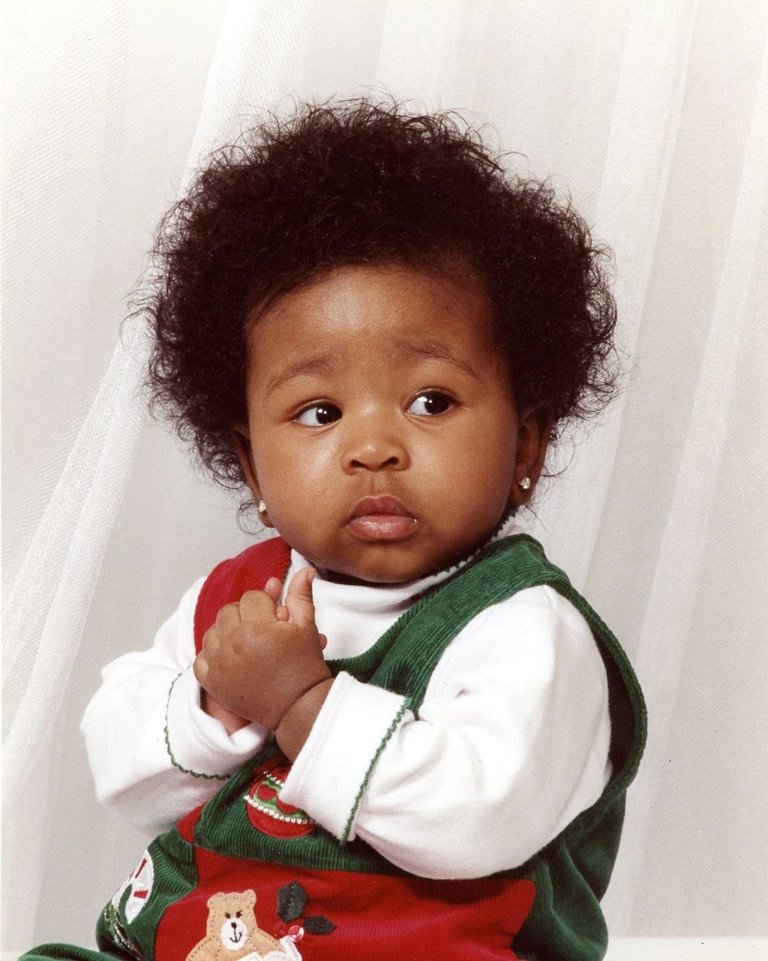

I wish to avoid selling too early, especially on emotion while off the strategy behind long term plans. As aforementioned, my tokens are not only bets on asymmetric information about the platforms themselves, but the potential to be catalysts for greater- finance, games and commerce. With all this information entering the mind, notebook and devices, I offer an exit for my health, wealth and knowledge through posts on my platforms. I fixed my lack of exposure to the space by collecting some tokens on each chain- the same formula I used years ago to grow here. Use the platform. I also did not account any of the exorbitant fees I took on Ethereum. Regrettably, in a sense much of my capital sits moated by traffic and transaction fees. Some amount must go to liberating the ‘princess’, profit. Ultimately, a learner improves as they teach. Regular entries serve myself just as much as those interested enough to skim. I want to end by saying this. I cannot say when, but I can see it clearly. Picture a day where parents begin a nest egg or college fund for their newborn via yield farms, on their USD, digitally. That is the focus.

Only a Mercy main would post this jejeje. DBcacahuetes