Evolving Payment landscape even during "you-know-what" !

- The WEF article argues that the experience of SARS in 2003 put China on an accelerated path to digital payments.

- There is an obvious COVID benefit to digital & contactless payment systems – limiting person to person contact, while allowing commerce to continue.

- They make the point that for digital payments systems to be successful they don’t need a credit card culture (which was absent in China)

- Now China has the infrastructure to make contactless payments (often via QR codes) to services as diverse as taxi drivers, street vendors & even temples & beggers => Been there, saw that.

Analysis and Commments

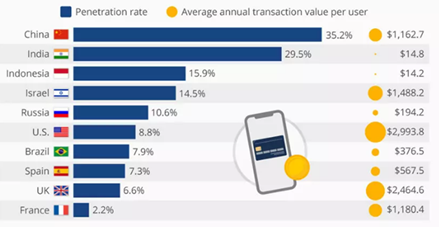

- Despite the temptation to write about the other side of changing food consumption (take away deliver), let's go for a different angle …how the lock downs are accelerating the shift to online payments.

- Yes, there are challenges. Payments for travel & events such as concerts, which were previously a big element of typical online spending, have dropped sharply. But they will be back, timing unclear.

- The crisis has accelerated what was an already growing sector. Worldline estimates that the cashless transition has accelerated by 1-2 years, PayPal estimates eCommerce adoption has accelerated by 2-3 years, and Mastercard saw a 40% growth in contactless transactions worldwide in the first quarter.

- As with online food retail, the question is how much these gains will be retained. Personally, I don’t expect consumers to go back to their old ways.

- Yes, there will be some shift back to physical shopping using cash, but my expectation is that the shift to digital will become a sustainable change in behaviour.

You don't want to miss a Crypto news?

Follow me on Twitter or Facebook

Proud member of:

-

-

0

0

0.000

I totally agree with you. After this lock down period, we will shape our new customs and re-organize new norms. In this process, people also see that using cash have more negative results than the positive ones. Our money is based on digits written on the screens. People shop online, send money online, get paid online... The paradigm is shifting explicitly.

In your post you pointed very crucial aspects of our changing world.

Thanks for your efforts 🤓

Thank you 🙏 @idiosyncratic1, I truly appreciate your comment and have seen you everywhere lately.

If you want to have your content curated in a nice community join #HODL for Cryptos 😜.

You would be a great addition.

Nowadays I spend more time on Hive I guess 😌

I'm a proud member of it and hopefully I'll be one of the ones enriching our community in near future 😋

Very good information @vlemon, it seems to me that the world is changing, little by little the technology is consuming us completely, I am not saying that this is bad, it depends from what point it is, it seems to me very good that this type of transactions are becoming viral, especially in times of quarantine, it is a benefit.

Dear @franyeligonzalez,

Thank you for the comment.

I would tend to agree with you because this space seems accelerating but I would also say our grand parents felt the same way before and our parents after them.

I believe, the difference is that before you could do some things in isolation (entertain yourself, maybe study...)

Nowadays you can still entertain yourself, do social activities online (playing with friends for example), work, order food...

You could stay forever in your flat if you had money coming.

I am definitely not saying this is healthy 😄.

Glad to have you around.

Best,

@vlemon