BTC, ETH, STEEM and HIVE analysis using Python (from 2020 to 2021)

Crypto Market study of BTC, ETH, STEEM and HIVE, from 2020 to 2021 (one full year). The main goal of this analysis, is to make a comparison of these four cryptocurrencies, using several python libraries and statistical analysis.

Import Python Libraries

import pandas as pd

import pandas_datareader.data as web

from datetime import datetime

import numpy as np

import seaborn as sns

from plotly.offline import iplot

import cufflinks as cf

import plotly.express as px

import matplotlib.pyplot as plt

cf.go_offline()

cf.set_config_file(offline=False, world_readable=True)

%config InlineBackend.print_figure_kwargs = {'bbox_inches':None}

%config InlineBackend.rc = {'font.size': 10, 'figure.figsize': (10.0, 7.0), 'figure.facecolor': (1, 1, 1, 0), 'figure.subplot.bottom': 0.125, 'figure.edgecolor': (1, 1, 1, 0), 'figure.dpi': 72}

%matplotlib inline

Define start and end date

start = datetime(2020, 3, 30)

end = datetime(2021, 3, 24)

Create Data Frames for each Cryptocurrency

BTC = web.DataReader('BTC-USD', 'yahoo', start, end)

ETH = web.DataReader('ETH-USD', 'yahoo', start, end)

STEEM = web.DataReader('STEEM-USD', 'yahoo', start, end)

HIVE = web.DataReader('HIVE-USD', 'yahoo', start, end)

cryptos = [BTC, ETH, STEEM, HIVE]

ticks = ['BTC', 'ETH', 'STEEM', 'HIVE']

Hive Data Frame Header

High Low Open Close Volume Adj Close

Date

2020-03-29 0.214535 0.181311 0.193561 0.193029 37124.0 0.193029

2020-03-30 0.198990 0.164887 0.192400 0.178775 35451.0 0.178775

2020-03-31 0.203500 0.169290 0.178704 0.197060 35316.0 0.197060

2020-04-01 0.205896 0.170124 0.196492 0.182773 45439.0 0.182773

2020-04-02 0.191577 0.172460 0.182715 0.179288 60969.0 0.179288

Concatenate Data Frames for better visualization

cryptos_df = pd.concat(cryptos, axis = 1, keys = ticks)

cryptos_df.columns.names = ['Cryptos', 'Info']

cryptos_df.head()

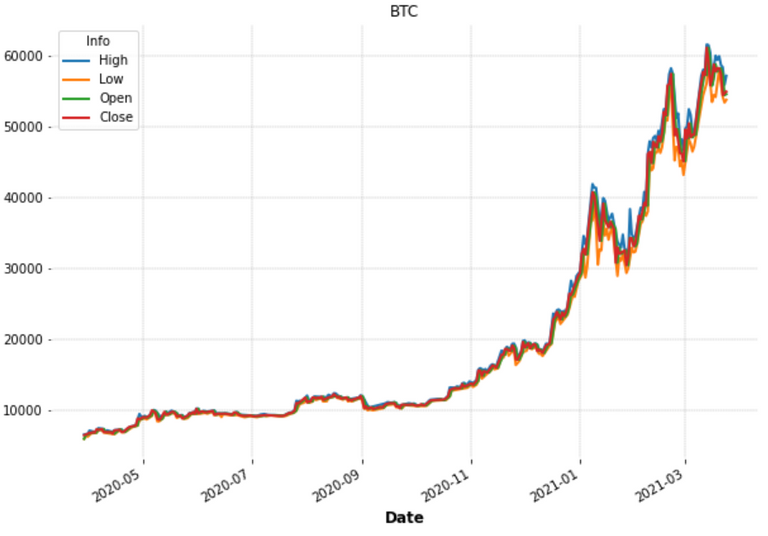

Plots of "Open", "Close", "High" and "Low" for each Cryptocurrency

for i in ticks:

cryptos_df[i].drop(['Volume', 'Adj Close'], axis = 1).plot()

plt.title(i)

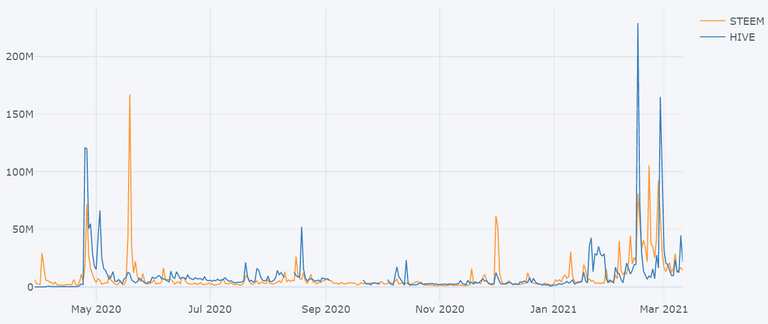

Volume of each cryptocurrency

volumes = pd.DataFrame()

for i in ticks:

volumes[i] = cryptos_df[i]['Volume']

volumes[ticks[:2]].iplot()

volumes[ticks[2:]].iplot()

Obtain dates for the highest volumes

max_vols = []

for i in ticks:

value = volumes[i].iloc[[volumes[i].argmax()]].to_frame()

max_vols.append(value)

high_volume = pd.concat(max_vols, axis = 1)

high_volume.head()

| Date | Volume | |

|---|---|---|

| BTC | 2021-02-26 | 3.509679e+11 |

| ETH | 2021-01-11 | 6.073363e+10 |

| STEEM | 2021-03-22 | 475655991.0 |

| HIVE | 2021-03-23 | 846450368.0 |

We can see that both HIVE and STEEM had the highest volumes on this month (March 2021)

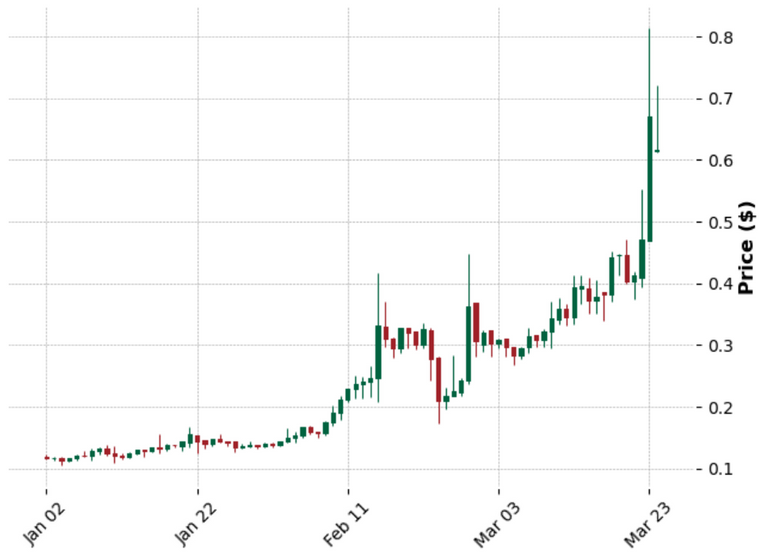

HIVE Candlestick Chart of 2021

import mplfinance as fplt

#from matplotlib.dates import DateFormatter, date2num, WeekdayLocator, DayLocator, MONDAY

fplt.plot(

HIVE.iloc[250:],

type='candle',

style='charles',

title='HIVE Candlestick (2021)',

ylabel='Price ($)',

)

Daily Percentage Change (Returns)

r = (P1/P2) - 1

returns = pd.DataFrame()

for i in ticks:

returns[i + ' Returns'] = cryptos_df[i]['Close'].pct_change()

returns.head()

Returns Data Frame Header

BTC Returns ETH Returns STEEM Returns HIVE Returns

Date

2020-03-29 NaN NaN NaN NaN

2020-03-30 0.001369 0.005184 -0.026310 -0.073844

2020-03-31 0.026113 0.015278 0.021583 0.102279

2020-04-01 0.028281 0.047146 0.001803 -0.072501

2020-04-02 -0.008867 0.000438 0.140814 -0.019067

Obtain maximum returns for each crypto

for i in range(len(ticks)):

print('Date: ' + str(returns[ticks[i] + ' Returns'].idxmax())[:10] + " Max Return " + ticks[i] + ': ' + str(returns.iloc[:, i].max()))

Date: 2021-02-08 Max Return BTC: 0.18746473766529936

Date: 2021-01-03 Max Return ETH: 0.2594753293956862

Date: 2021-03-22 Max Return STEEM: 0.32037727117672854

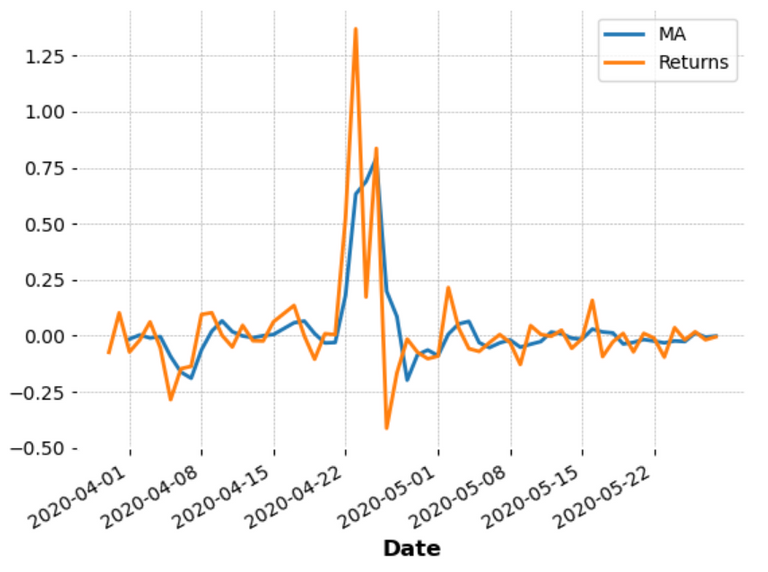

Date: 2020-04-23 Max Return HIVE: 1.3697716791032435

Obtain worst returns for each crypto

returns.idxmin() # worst single day returns

BTC Returns 2021-01-21

ETH Returns 2021-01-21

STEEM Returns 2021-02-23

HIVE Returns 2020-04-26

Even though the coronavirus outbreak had a great impact in the single day returns, the highest and the minimum values for BTC, ETH, and STEEM were already in 2021, probably due to the beginning of the bull market. HIVE is the exception, the best and worst single day returns occurred in April 2020, when HIVE spiked due to the STEEM fork

Moving average on HIVE around the maximum returns

HIVE['Returns'].argmax()

24

HIVE['MA'] = HIVE.iloc[:60]['Returns'].rolling(3).mean() # smoothing with Moving Average

HIVE.iloc[:60].drop(['High', 'Low','Open', 'Close', 'Volume', 'Adj Close', 'Total Trade'], axis = 1).plot()

Volatility

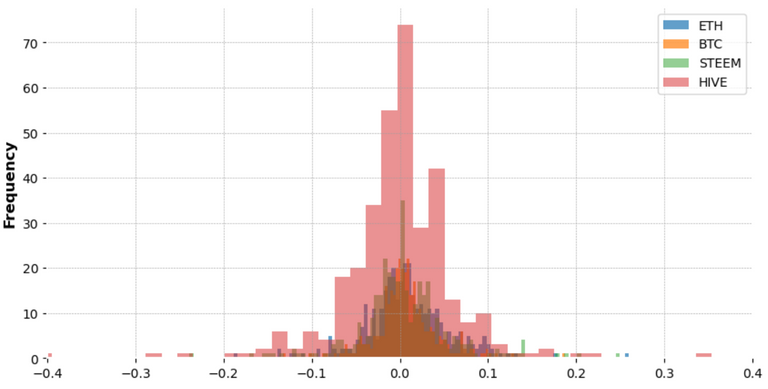

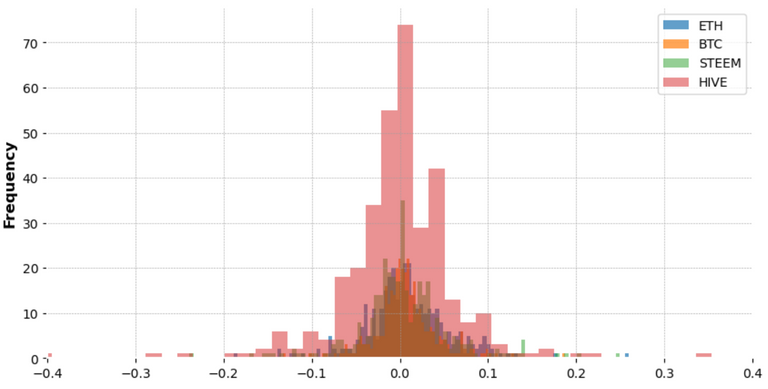

fig = plt.figure(figsize=(10, 5))

returns['ETH Returns'].plot.hist(bins = 100, label = 'ETH', alpha = 0.7)

returns['BTC Returns'].plot.hist(bins = 100, label = 'BTC', alpha = 0.7)

returns['STEEM Returns'].plot.hist(bins = 100, label = 'STEEM', alpha = 0.5)

returns['HIVE Returns'].plot.hist(bins = 100, label = 'HIVE', alpha = 0.5)

plt.xlim([-0.4, 0.4])

plt.legend(fontsize = 10)

From the histograms above, we can see that all the cryptocurrencies are volatile because they show a big deviation. Nevertheless, HIVE is the one with higher volatility in the defined range. This volatility, might be related to the STEEM fork, some days after HIVE's launch, the price peaked to ATH very rapidly.

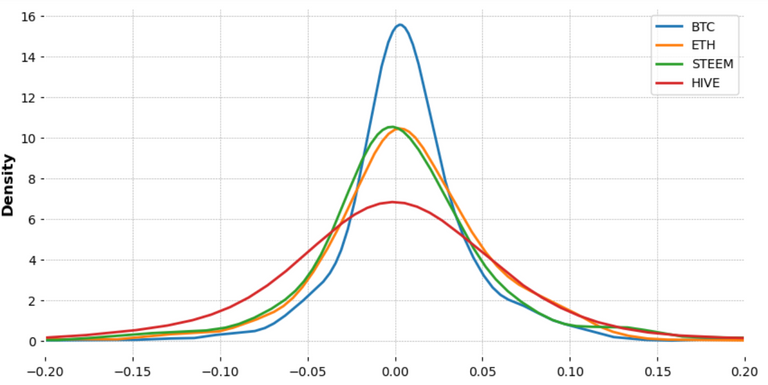

fig = plt.figure(figsize=(10, 5))

returns['BTC Returns'].plot(kind = 'kde', label = 'BTC')

returns['ETH Returns'].plot(kind = 'kde', label = 'ETH')

returns['STEEM Returns'].plot(kind = 'kde', label = 'STEEM')

returns['HIVE Returns'].plot(kind = 'kde', label = 'HIVE')

plt.xlim([-0.2, 0.2])

plt.legend(fontsize = 10)

The kernel plots above confirm that HIVE is the one with higher volatility. Easily confirmed by the large distribution. BTC is the less volatile from the following cryptocurrencies, in the defined range.

Standard deviation of the Returns

returns.std()

BTC Returns 0.035037

ETH Returns 0.047000

STEEM Returns 0.056024

HIVE Returns 0.116130

dtype: float64

For this year only...

returns.loc['2021-01-01':].std()

BTC Returns 0.049388

ETH Returns 0.063443

STEEM Returns 0.080352

HIVE Returns 0.102327

dtype: float64

This year HIVE keeps on showing higher risk compared to the other cryptos. However, it is the youngest crypto of the four, so more risk/reward associated, but at the same time, more space to grow.

Congratulations @macrodrigues! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I really love to read the tutorials in python which helps in analysis of the crypto currencies and financials as a whole

I should look into this :) thank you for sharing it . I had totally forgotten about the standard deviation function so yeah this will help .

Posted Using LeoFinance Beta