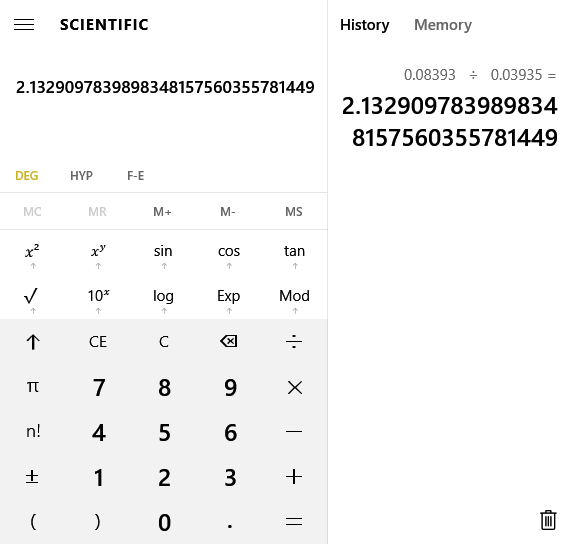

Make 3.79% Instant Arbitrage Profit Trading SPS and GLX Tokens on DEX

Alameda Research grew to become a multi billion dollar company starting out as a small group of traders doing arbitrage trades. Later they grew up to be a scam playing with customer funds while being more of a deep state affiliated crony capitalist cancer on cryptosphere. The main point I want to convert here is that arbitrage can be a smart thing to engage in that can lay the foundation of much bigger operations.

I have a history of publishing many articles on great arbitrage opportunities. Most of them have been related to DEC. Those who read those articles should have made good profits out of it. These arbitrage opportunities do have two main prerequisites.

- Small trading volume (not useful for whales)

- Interest in investing in specific assets

GLX Airdrop Being A Blessing To SPS Investors

This trade is most valuable for those who are already interested in GLX and SPS. I will keep this article short so you can get started with trading. If you have been a smart investor, you should have staked some SPS which should be giving you GLX from he Airdrop.

A Story in 3 Images

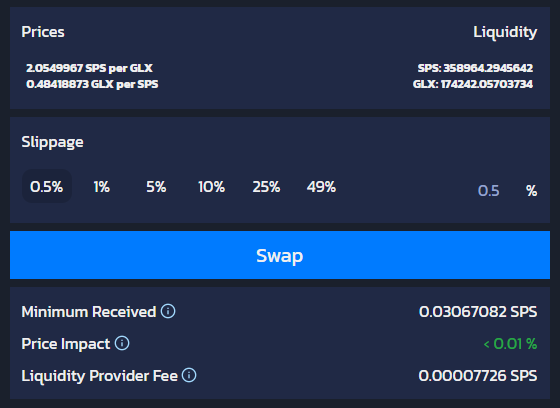

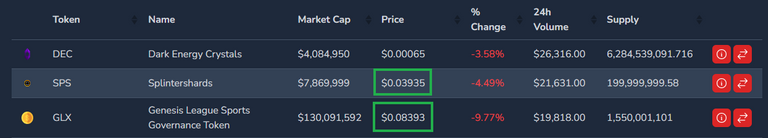

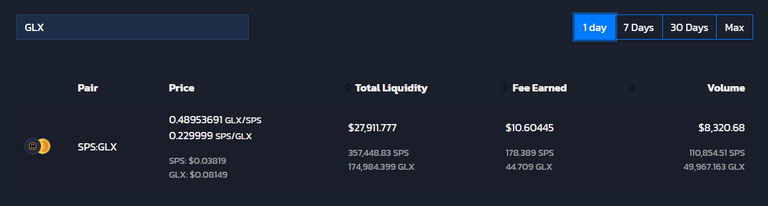

Diesel Pools vs Regular Trading

These are creating two markets for the same asset. Diesel Pool has relatively low liquidity and it is creating constant price differences. When there is a difference, there is an arbitrage. Whether you would manage to make a profit while the market conditions last is another story. The potential is most certainly there.

Best of Luck With Your Trading!

Posted Using LeoFinance Beta

Similarly to FTX. They also played with the money of their customers. And who knows how many other companies are doing leveraged and/or any other types of trades with the money of their customers without their knowledge. Traditional banks are doing it too, but they do not lose the funds (they often steal it by applying certain fees on the accounts of their customers).

When you use a CEX, there needs to be a great deal of trust. The worst part is the public cannot audit what is going on inside these centralzied servers. In the case of FTX and Alameda Research, most of the insiders where unaware of the fraud that was going in. This is why I recommend sticking to a DEX where the public can verify things and not have to trust a central party.

!PIZZA

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

But the trade should be big enought to cover the fee's that's the problem some times with this

this is the problem with many small traders , we dont have enough to play like the big boys but have the same wishes

HIVE-Engine trades don't have fees. You only pay when you deposit/withdraw your crypto.

!PIZZA

!PGM

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

I gifted $PIZZA slices here:

@vimukthi(5/5) tipped @jfang003 (x1)

vimukthi tipped stefano.massari (x1)

torran tipped vimukthi (x1)

vimukthi tipped malos10 (x1)

vimukthi tipped xplosive (x1)

Learn more at https://hive.pizza!

It looks like I was too late as the arbitrage has already balanced out the pools already. Either way, it's always nice to see things like this work out as intended and those who see it can profit.

Posted Using LeoFinance Beta

These trades come and go all the time. You will have enough time for a good arbitrage trade eventually. Best of Luck!

!PIZZA

I did not understand your article very well but due to my problems, my low cognitive skills do not make me understand the arbitrage issue well. However, I always enjoy reading your posts

The basic idea is that there is the same asset at two different exchanges trading at two different prices. In the screenshots you can see,

You can buy from the place where prices are low and sell where the prices are high. Usually these price differences get closed down fast as more trades happen. You can make few quick trades while the price difference is large enough.

!PIZZA

Thanks for this clarification,

now I understand