Central Banks Adopt Generative AI for Enhanced Cyber Security

KEY FACT: Central banks of BIS membership are increasingly turning to generative AI technologies to bolster their cybersecurity defenses, marking a significant shift in their approach to safeguarding financial systems. This retooling effort involves integrating advanced AI capabilities to detect, predict, and neutralize cyber threats with unprecedented speed and accuracy.

Created on Corel Paint, Image source: BIS building

Central Banks Adopt Generative AI for Enhanced Cyber Security

Generative AI as a class of artificial intelligence systems designed to create new content and data by learning patterns from existing datasets, has made significant inroads into various sectors and institutions, offering innovative solutions and improvements. It represents a transformative technology with vast potential across multiple sectors.

The emergence of generative AI models, which gained significant momentum with the launch of ChatGPT in late 2022 unveiled opportunities for banking improvements as well as challenges for the management of cyber risk in the financial sector. On the other hand, gen AI has been proven to strengthen cyber security by enabling the processing of increasingly larger data sets with more sophisticated analytics. It could also help users employ more proactive cyber security and fraud prevention strategies.

On the other hand, there are emerging specific threats including AI-generated social engineering, zero-day attacks, and malware attacks for data leakage. The adoption of gen AI for internal organization purposes and potentially also for cyber defense also creates the risk of attacks against AI systems directly.

In a recently released BIS Paper No 145, the Bank for International Settlements (BIS), an international financial institution comprising 63 central banks and monetary authorities, has expressed its belief in the potential for widespread adoption of generative artificial intelligence (AI) for cybersecurity. BIS members include the central banks of prominent economies such as Australia, Belgium, China, France, India, Italy, Japan, South Korea, Switzerland, and the United Kingdom, among others.

Source: BIS Papers No 145

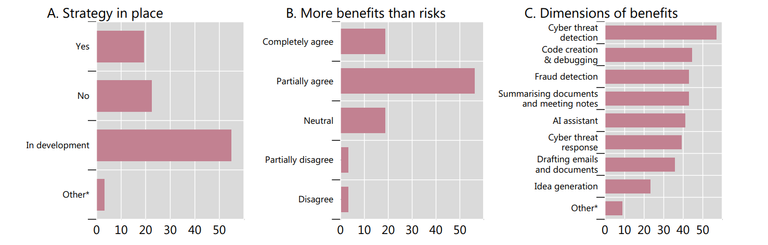

In a survey of 32 central banks of BIS membership, assessing their interest in adopting generative AI tools for cybersecurity, the report indicates that 71% are already using it and more planning to follow.

“Over two-thirds (71%) of respondents are already using gen AI, and 26% have plans to incorporate such tools into their operations within the next one to two years.”

Adoption of generative AI in central banking, as a percentage of respondents. Source: BIS

The BIS report predicts that all its members will adopt generative AI to enhance their internal cybersecurity measures. The report also revealed that Central banks that have already implemented generative AI have praised its effectiveness in detecting cyber threats compared to traditional tools.

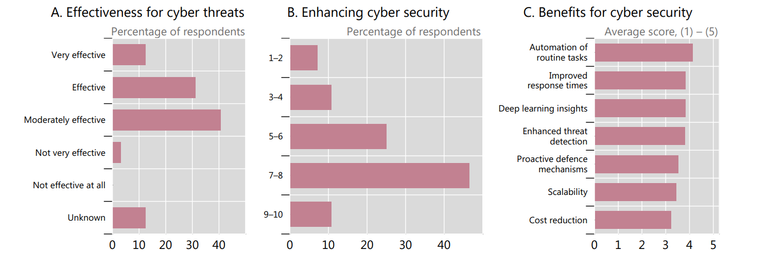

Effectiveness of generative AI for defense against cyber threats. Source: BIS

Experts foresee that AI tools will improve cyber threat detection and reduce response time to cyber attacks. Central banks unanimously believe that adopting generative AI tools can eventually replace cybersecurity staff for conducting routine tasks, thereby freeing up resources for other initiatives. Though there are imminent related risks of social engineering attacks and unauthorized data disclosure, central banks anticipate a need for substantial investments in human capital, especially in staff with expertise in both cyber security and AI programming. Thus, as respondents expect generative AI to automate various tasks, they also expect it to support human experts in other roles, such as oversight of AI models.

By leveraging the power of generative AI, central banks aim to enhance their resilience against sophisticated cyberattacks, protect sensitive financial data, and ensure the stability of global financial markets. This innovative adoption will not only strengthen their cybersecurity posture but also set a new standard for technological advancement in the financial sector.

Do you think the Central banks and BIS are on the right path?

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha

Artificial intelligence is here to stay and many can benefit from it in different ways. As an artist, I use AI to improve my creations and to give insights on perspectives for my art. Like the post say that the advent of gen AI could be positive and negative, so it is in every sphere.

I hope that BIS can help to reduce the spate of cybercrimes.

Definitely, the ate of cybercrimes would reduce with this development. Great to know you're maximing AI in your career.

Nice move by the central bank, now it will be very possible to trace cyber crime when this level of security is there. AI is a good innovation the world and every sector needs to embrace. Thanks for sharing this interesting piece

Cybercrimes may not be out rightly eliminated, but it would be minimized.

Adopting the use of Generative AI in banks, would bring a vast improvement, changes and it would save a lot of purposes.

Thank you sharing.

Do you think this is a positive innovation?

the importance of Artificial Intelligence cannot be overemphasized, definitely!, the Central Bank and BIS are on the right path and are making a great move, the adoption of generative Ai in cyber security is a great step they've taken to protect sensitive financial data, and ensure the stability of global financial markets. i hope their decision helps them achieve their goals effectively