The total market value of decentralized stablecoins is expected to exceed US$5 billion

.jpeg)

In 2021, the crypto asset market is off to a good start, with Bitcoin breaking through $34,000 and Ethereum breaking through $800. After experiencing the richness and magic of 2020, we know that now you are either in the hesitation and regret of to da moon, or in the optimism and longing of to da moon, there are also some "outsiders" who are eager to try and want to jump into this market. . In any case, there is still a big opportunity in 2021 (at the same time be sure to "drive" carefully). Mars Finance APP will continue to interview 40+ senior industry observers and practitioners from January 1st to January 10th to "foresee 2021 " for you .

The main business of Blue Fox Note is writing DeFi. I think DeFi is the biggest trend in the encryption field. DeFi has found a fit between the product and the market, and these changes can be seen in the areas of lending, trading, and derivatives.

In 2021, with the two-wheel drive of Ethereum and Bitcoin, the new and cutting-edge forces in DeFi will accelerate and attract a large number of talents, and innovation will continue one after another. However, the biggest problem now is that the infrastructure has not been significantly improved, there is still a big gap in scalability, extremely high transaction costs, and low throughput, which severely restricts the advancement of DeFi on a larger scale. I believe that with the development of Ethereum Layer 2 and cross-chain DeFi, the potential of DeFi will be further released. These two directions will also be important breakthrough directions in 2021. Here, I suggest you pay close attention to Polkadot's cross-chain DeFi and Rune's cross-chain DEX.

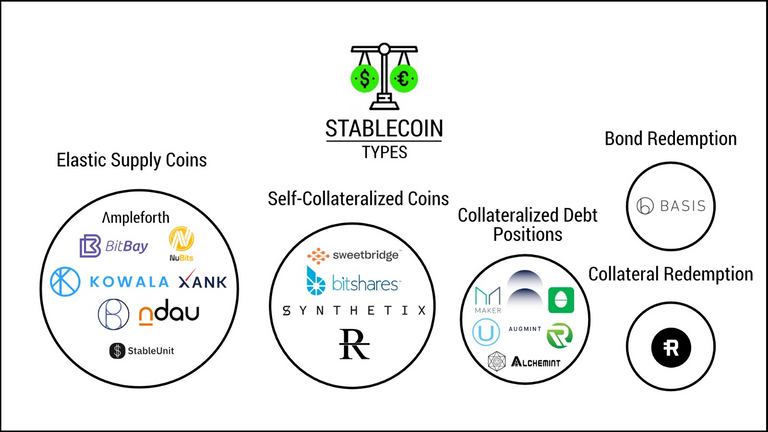

The breakthrough that can be expected in 2021 is that the market value of decentralized stablecoins exceeds US$5 billion. Taking DAI as an example, the market value has risen from about 40 million US dollars in early 2020 to nearly 1.2 billion US dollars. Almost 30 times.

For everyone, a potential black swan incident is that due to supervision or hacking incidents (the top ten projects in DeFi market value were attacked), the price of ETH fell sharply, which led to the liquidation of a large number of DeFi project collaterals, which led to the entire DeFi The market plummeted instantly. This 312 in 2020 has been a lesson learned. Systemic risk is still the number one risk in DeFi.

I personally estimate that Bitcoin will reach $110,000 in November, and Ethereum will rush to $6,000 in December. Very optimistic, isn't it? (This is just my personal judgment) Due to regulatory risks, XRP may be squeezed out of the top 10 of the total market value list; UNI will unexpectedly squeeze into the top 10 of the total market value list; BAS is expected to become the most potential digital asset in 2021 .

Posted Using LeoFinance Beta