The first principles of on-chain lending

What is on-chain lending?

The financial world on the chain is fragmented and free, and there is no unified central bank/sovereign credit issuance. At the financial level, it is also based on the simplest exchange of digital assets to directly create a lending market. The interest rate determined by the loan agreement is both the top-level interest rate and the terminal interest rate of the financial system on the chain, and it is the total source of liquidity.

The lending market has always been a battlefield for the financial industry, especially in the DeFi field. With the development of more financial scenes on the chain and the emergence of hot spots, it can mortgage everything to issue bonds, and secondly it is all chains. The anchor and transmission core of the interest rate derivative market is the most objective arbitrage market. The on-chain lending agreement can accommodate almost all types of on-chain assets, and can automatically and accurately define the deposit and loan interest rate of each asset and the market supply and demand. With the help of the blockchain on the agreement can be freely combined, the interest rate of the lending agreement itself can be instant and easy Directly transmitted to other derivative interest rate markets with arbitrage space, on-chain finance is an alternative investment market with unlimited growth and unlimited risks. This nature will give rise to a derivative market that far exceeds the constraints of modern financial supervision and does not have any authority. What restrictions on human nature such as "Basel Agreement", "Libor", and "fuse" can be formulated.

The value of on-chain lending

The most basic financial infrastructure on the chain, the lending rate and the market, seems to be the source of a chain of leverage. The interaction between the assets on the chain around it is discovered in the true sense. Some have strong interactions, such as mainstream assets and cooperatives. For regulated stablecoins, some have weak interactions, such as mainstream assets and emerging vertical assets. Assets need a market to automatically distinguish between good and bad. It should not be separated. It only relies on the project party’s own island operation and credit endorsement. The consensus of assets needs to reach as many C-end investment users and other ecosystems through the lending agreement. , Only if its network is wide enough and deep enough, its value will be further strengthened. In a sense, the birth of the lending agreement gives the asset a way to deepen the consensus value, instead of being carried out like Bitcoin for ten years. Search.

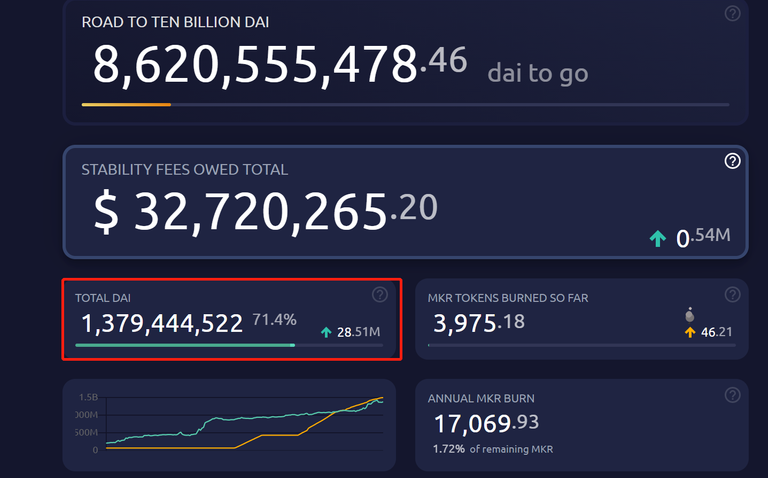

Successful expansion of MakerDAO and DAI

We see that DAI has greatly expanded this year. Whether it is Curve, liquid mining, algorithmic stablecoins, or various exchange trading pairs on the chain, after flowing out of the local central bank of MakerDAO, the largest two Class-level "dams" are just a lot of loan agreements. This is a grading and transmission of interest rates. The lending agreement allows DAI to reach other types of agreements and the path and cost of C-end users are simpler and smoother. When DAI flows out of the lending “dam”, the “tributary” is even more effective. As the index increases, things that MakerDAO can't do on its own will naturally nurture. In the traditional world, to complete such transmission requires a strong state and sovereign financial system to track, restrict and supervise, and the transparent and decentralized trust machine that naturally exists in chain finance makes all this without central supervision. Completed under. The central banks (MakerDAO) and the commercial banks (loan agreements) perform their duties, and the blockchain ledger is the balance sheet and currency circulation that are jointly followed.

The total amount of DAI issued, source: https://makerburn.com/#/

Why can lending become mainstream finance on the chain?

The early digital asset lending relationship existed in exchange contract leverage demand and PoW chain miner operation demand, especially the former, which is essentially a "borrowing gambling". Almost all rely on small blogs to attract users, and users often end up sacrificing their principal. This kind of lending relationship will only exist in the isolated market of leveraged contracts on the exchange. The exchange is as big as it is, which is why it has not moved into mainstream chain finance for many years. At most, it is a supporting facility. And today, the on-chain lending we are talking about is financial lending in the true sense. It stands in the entire cryptocurrency market and all public chains (except that Ethereum is still the main stage today). In theory, how many kinds of assets there are, can easily establish a square amount of borrowing and lending relationships on the agreement, allowing market demand to sort a reasonable correspondence relationship, and these needs are constantly updated and corrected with the development and changes of the industry, so this is a The distribution center for big demand among assets. This kind of extremely malleable lending agreement connects the original assets of the public chain, and continuously rebuilds it in its own melting pot, spraying upward the "flower of assets".

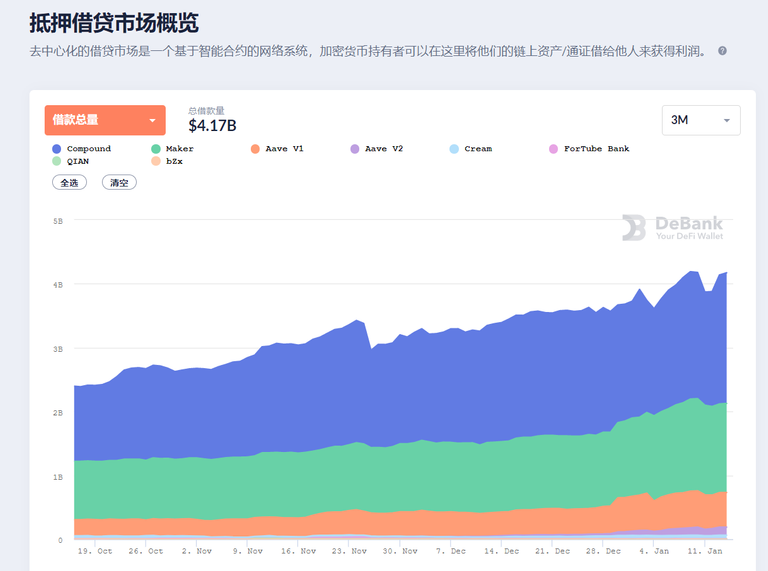

Throughout the domestic and foreign countries, lending agreements have reached a stage of development that is blooming everywhere. This is a market with obvious bilateral network effects. The stronger the stronger, and there will be niche markets in different segments. The well-known head markets Compound and Aave are the vane and transmission source of the entire cryptocurrency lending market. The ecosystem outside the ether that cannot be easily reached for the time being has given a lot of market space for public chains to compete, such as Acala on Polkadot , The Force Agreement, Ontology Wing, MOV Lending Agreement on Bytom Chain, etc.

The development of the lending market, source Debank.com

Loan agreement outside the ether ecosystem

These foreign lending markets for Ether are rooted in their own public chain ecology, relying on strong cross-chain infrastructure to absorb "world" assets, and empower their underlying public chain assets through lending agreements. This is consistent with the “lending agreement is an accelerator that accelerates the consensus value of assets” that we mentioned earlier. These leading public chains, second only to Ethereum, can rely on the establishment of the relationship between different assets in their own ecology to outward Recursively recurse its own underlying assets, once its own financial ecology and the Ethereum financial ecology form a sufficiently attractive arbitrage space, which can overcome the barriers of cross-chain and time cost, the value of its underlying assets will naturally be transmitted to other public chain ecology, at least others Ecological financial users know this kind of asset, and this will be a good start.

Bytom Chain should be the first project in China to transfer the public chain to the DeFi strategy as a whole. This "great migration" started in 2019, and it has continued to invest in 2020 strategic forces throughout the year, and has been focusing on comprehensive The concept of the Sexual DeFi protocol cluster has successively completed many complex infrastructure constructions, such as cross-chain, DEX matching, AMM exchange, quantitative market makers, etc., until today we are delighted to see the most important part of the protocol cluster, “lending” "Agreement" is finally available, which is of great significance to the MOV strategy. We have also given a lot of first-principle discussions on the strategic status of the loan agreement. I won’t talk about it here any more. The significance of the entire MOV strategic puzzle and the significance of comparing the ecological value of the original chain.

The order in which the MOV lending agreement is launched in the entire MOV protocol cluster is understandable, because the lending agreement itself relies on a strong clearing and liquidity infrastructure, and it also relies on a cross-chain infrastructure that can enrich asset types and shorten asset migration paths. These are inseparable from the assistance of the previously completed cross-chain, DEX, and professional quantitative market-making mechanism. The MOV lending agreement is also the first centralized integration of the existing agreement group. Relying on the inherent demand creation ability of the lending market, it promotes the prosperity of cross-chain transactions, DEX and quantitative transactions, and solves financial income and governance for users of the previous agreement. The problem is that the DeFi "tributary" of the Bytom chain will continue to emerge in the future, because after the loan relationship is formed, there will be a new flow of assets, which may flow directly out of the system, or flow back to the previous project (MOV superconducting protocol). It even flows to a new application on MOV, so the backward scalability of the lending agreement is higher than that of the DEX agreement, and the fixed value of its own public chain underlying assets (such as BTM) is also higher than that of DEX.

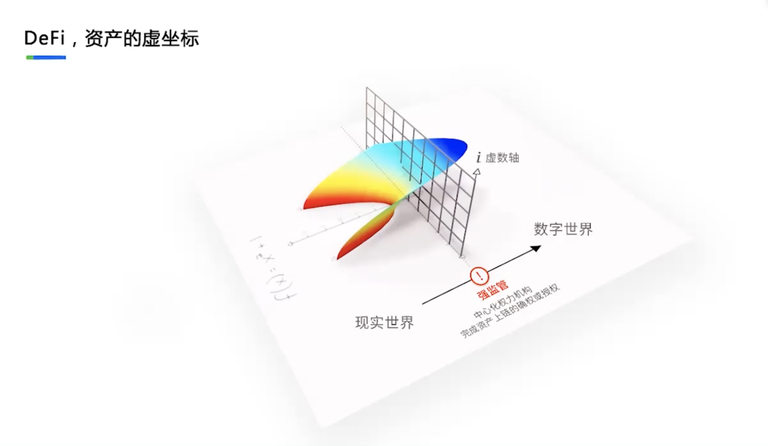

DeFi is another form of asset on-chain, source https://www.8btc.com/article/6577555

Anyone can sell the most convenient BTM in the DEX in a timely manner, but it is difficult to buy it back. After all, the stage of mainstream assets (BTC, USDT) is outside the system, and the system still lacks adherence to mainstream assets. Therefore, we can see that almost all DEXs outside of Ethereum have a sluggish mainstream transaction volume, and the one-way buying and selling relationship is also detrimental to the underlying assets of their own public chain. Lending agreements can change this situation. At this time, the assets at the bottom of the public chain (BTM) will become a value-fixed asset under the credit of the project party, allowing users in the ecosystem to easily replace their BTM with other mainstream assets. With the return of mainstream assets, even if it flows out of the system, some of it will still flow to DEX and other agreements within the system. The "tributary" flowing to DEX will accelerate the participation of ecological users in market making, arbitrage, and trading of superconducting financial management. If there is a continuous profitable design, for example, the arbitrage income from superconducting is greater than the borrowing interest, and the entire MOV system can be operated spontaneously. Of course, it does not involve other types of financial agreements that MOV will appear later.

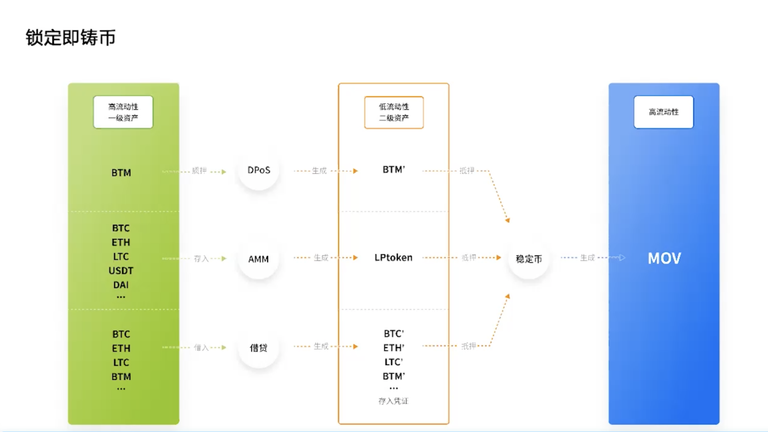

It is also difficult to predict the user usage of the MOV loan agreement. It also depends on whether it finds and launches the correct asset correspondence. The first thing that can be surely speculated is that the BTM asset will become a very important link in the MOV loan agreement. Assets, as to how much BTM consensus they can absorb, still rely on MOV's setting of arbitrage space between agreements in the system, and MOV's subsequent promotion of "integration" outside the system. From the white paper, we also seem to see the deliberate design of the MOV lending protocol in terms of derivatives, such as supporting the intercommunication with superconducting LP tokens, supporting the intercommunication between loan interest-bearing vouchers and stable currency protocols, and supporting more markets based on loan interest rates New features such as tiered interest rates, leverage and leverage. So it is certain that this is not a simple Ethereum-like lending agreement. It is based on the comprehensive consideration of the entire MOV and Bytom chain ecology to ensure that this key joint can really play a role in connecting the previous and the next.

The innovation of locking and minting coins, source https://www.8btc.com/article/6577555

There are three most important characteristics of a loan agreement-enough assets, fast enough liquidation, and strong enough derivatives. The development of any lending agreement under different platforms requires careful consideration of these three issues from the perspective of its own ecology. Lending platforms need to know where the biggest “outflow” assets are, whether it is inside or outside the system, and whether it’s hot. The market is still in a kind of arbitrage cycle, and then to actively support related agreements or ecology, it can complete the continuous output of its own engine. The most obstacle to the Ethereum foreign lending platform is the cross-chain link, which "flows out". The asset clearly knows its destination, but it has to face a big mountain. Therefore, if the Ethereum foreign lending platform does not have a strong cross-chain support, it will be useless. Whether MOV lending and MOV cross-chain will form a seamless cooperation is also It is worth looking forward to, this is also the meaning of the cross-chain mentioned by MOV.

Finally, what we need to know is that the loan agreement itself is still a stable financial product and market. No one can make a fortune in this market by luck, but it will be a kind of chronic "sunshine". Any supply-demand relationship on the Internet is exposed to form a basic financial order, and good assets will eventually be better

Posted Using LeoFinance Beta

Congratulations @torytory99! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSource of plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.

!hw ban

Made-2-Scam type of account