A 288,800 USD, the illiquidity crisis of BTC?

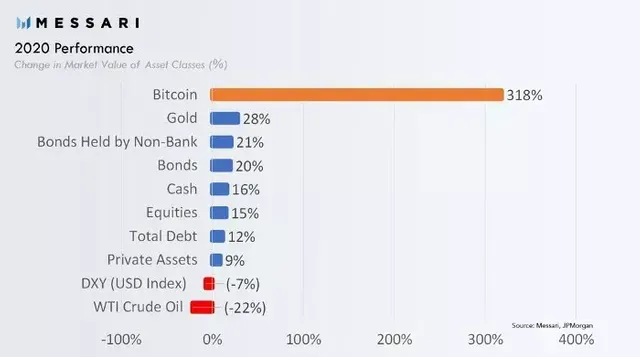

There is no doubt that Bitcoin has been developing rapidly from the beginning of 2021, but overall, the return rate of major currencies for the entire crypto world has reached an astonishing percentage.

Although the cryptocurrency market is in turmoil, the throne of Bitcoin will always exist in terms of news and rumors . On January 3, 2021, 12 years have passed since Bitcoin's first block was created. Under the global economic and social situation, Bitcoin has increasingly become an inevitable asset in global investor portfolios. More and more institutions are investing huge sums of money in an agreement whose market value is still less than one trillion dollars. At present, the market value of Bitcoin is about 600 billion U.S. dollars. It is a "digital bank". Given the nature of the project, it is the largest in the world, far surpassing JPMorgan Chase, Industrial and Commercial Bank and Bank of America.

The British "Financial Times" also paid tribute to cryptocurrencies. On the cover of January 4, 2021, the headline was "Bitcoin is worth more than $30,000" and an article was published specifically. In recent weeks, institutional interest has turned into media interest, and more and more newspapers, news and even radio broadcasts are talking about it. In the traditional financial sector, Bitcoin is no longer a novelty, on the contrary, it is becoming a necessity for any type of investor. The historical period and nature of Bitcoin is creating a very interesting and enlightening phenomenon , and in the next few months, it will definitely become famous.

The problem of insufficient liquidity

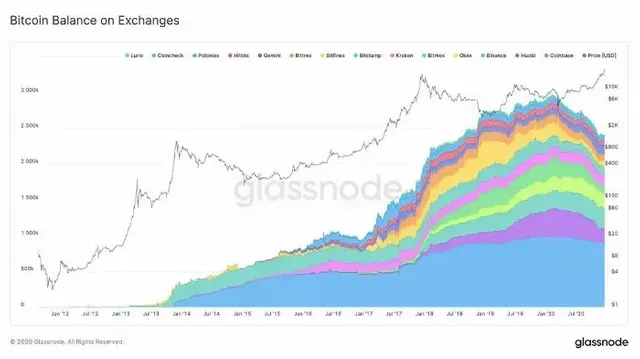

As we know, the supply of Bitcoin is mathematically certain 21 million units, which will be reached in approximately 2140. The scarcity of cryptocurrency in absolute value makes anyone studying this industry need to consider the following points. In fact, Bitcoin has entered a very important stage since its birth, which is defined as the first real liquidity crisis. The biggest sellers of bitcoin are exchanges and miners, who provide bitcoins to all those who want to buy bitcoins at market prices through their services. If in the first few years before 2017/2018, supply can absorb demand from retail investors alone, the situation today is different.

With the entry of large institutions and investors, Bitcoin is now facing huge amounts of funds brought by these participants. Even a simple 1% investment fund will have quite a lot of problems to find the corresponding amount of Bitcoin. It is estimated that 70% to 80% of people who buy bitcoin are unwilling to sell bitcoin. On the contrary, they believe that bitcoin is a long-term investment, both for ideological reasons and to protect themselves Protect against the devaluation of legal tender. In this case, all the weight falls on the exchange. In order to satisfy all the demand for assets, the exchange must be willing to consume their reserves and make Bitcoin an illiquid asset day after day.

In one situation, the demand for capital increases while the supply of Bitcoin continues to decrease. This pattern is obvious . In the short to medium term (half a year), when the gap between the deadlines just presented becomes very large, the price will be subject to great fluctuations. After analyzing one of the most famous models in Bitcoin price prediction, the stock flow model, the price given does not seem so impossible anymore. If we analyze it from the perspective of insufficient liquidity, then in 2021, the price of Bitcoin (such as $288,000) seems to be more and more reasonable.