Tech's Greatest Contribution: Massive Deflation

Over the past couple months I wrote a number of articles detailing how, contrary to the opinions of many, who unknowingly are Keyneisans, we are in a deflationary environment. This was the case for the last 40 years.

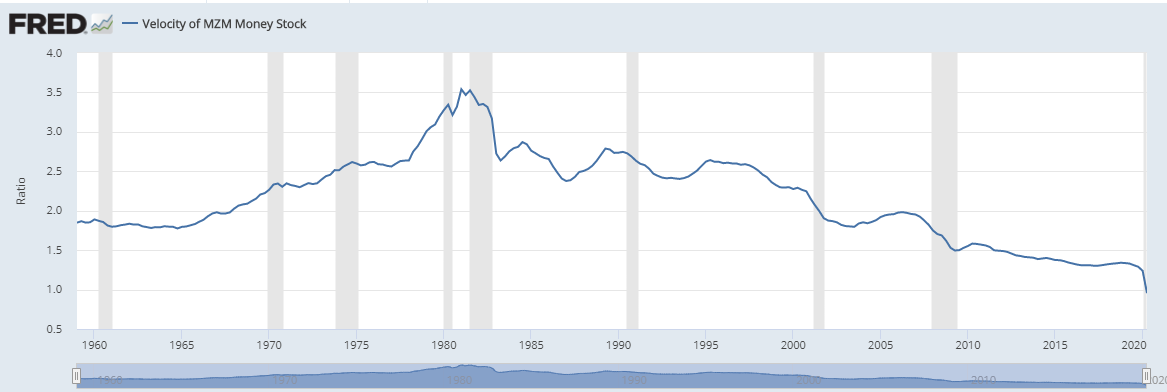

One chart that I utilized is the velocity of money. It is one that drives home the point since the formula itself deals with the money supply.

Velocity of money = GDP/Money supply.

There it is. It accounts for all the money printing over the last 40 years.

Source

How can this be? This flies in the face of everything we are told by the Fed bankers, economists with advanced degrees, and the Harvard educated Winklevoss Twins. It is amazing how many can be so wrong when group think is engaged upon.

I asked on a number of occasions, what is the economic impact of technology on monetary policy?

Do not worry about not knowing the answer, the ones I just mentioned have no clue about it either. In fact, it is likely they do not even know to ask the question.

After all, their mindset is that money printing will ultimately lead to a FOMO (in market terms) where there is too much money chasing too few goods, services, and labor. This will cause price increases which will be reflected in the growth in GDP.

Through this, they use cute phrases like "planting the seeds", "priming the pump", and "growing green sprouts", the reality, as we can see from the chart, is the exact opposite happens. Instead of the numerator increasing at a greater pace (more GDP) as a result of an increase in the denominator (increase in money supply), they get the reverse.

How is that so? Simply put, money printing has not led to inflation as the bankers expected. In fact, looking at the chart, things are only getting worse for them.

So what is the real cause of this? Why my dear friends, it is technology.

I will not go through all the numbers here but the simple fact that technology is extremely deflationary. This means, as it expands as the percentage of the overall economy, massive inflation becomes impossible (at least for the USD). This situation, in my opinion, was only enhanced due to COVID-19. We are seeing corporations accelerating their plans of implementing robotics and AI, thus pushing even more of the economy under "IT".

The next 15 years will see massive deflation as technology accounts for even more of the global economy. One of the areas of greatest impact is AI. This is taking something that was at a 17% deflationary rate and likely jacking it up to around 40%. This will severely ratchet up the overall impact.

The major impact up GDP is the fact that this does a poor job accounting for technological advancement. When the price of things get cheaper, they tend to offset increases in GDP through replacement. For example, think of how many industries were eliminated due to the smartphone. Those who sold encyclopedias, physical maps, recorded music, and long distance phone service all saw their revenues vanish due to this one technology along with the different applications.

Amazon is another example of something that kills GDP. Think of all that is saved by simply ordering online: gas, electricity in the mall, maintenance on the car, wear and tear on roads, impulse buys at the food court, etc. All of these are eliminated by simply ordering online and allowing the company, which is likely on your street anyway, to simply make an additional stop.

Technology is akin to spreading wealth. Because it deflates, over time, things get less expensive. This is great for users. As prices drop, more can afford what was previously out of their reach. Of course, over time, things move towards a price of zero (or near zero), making those items abundant. Once again, look at road maps that use to be purchased at service stations. Today, you can get a detailed street map to most any city on the planet for free.

The United States economy is already over 5% of the total being under Informational Technology. This provides serious downward pressure on the rest of the economy as its tentacles spread. Just think about the automobile industry. Not only is a greater percentage of each car now computerized but look at the production process. How much of it is automated compared to a couple decades ago?

Get ready for these stats to keep accelerating. By the middle of this decade, it will become evident how the downward pressure is crushing all the Fed and other central banks are trying to do.

Be sure to plan accordingly.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.May be the lesson learned here is the revising the very idea of GDP and creating new indicators to measure your economy. There have always been criticism over how the use of GDP is biased and incomplete. Experts loved it coz it allowed them to demonstrate how and why the indicators (inflation, deflation and others) are behaving the way they are supposed to. The wall-street experts and governments were controlling the indicators.

Allowing to measure economy in new terms and indicators that properly measures new invention and new environment may allow effective gazing of the new economic order.

There certainly is a need for new indicators in both economics and accounting. Neither has adapted very well to the new era of technology.

Take intellectual property which expanded greatly in the tech age. Accounting doesnt have a great way for valuing that and it, in the end, just turns into a guessing game.

The same holds true for many economic indicators.

Posted Using LeoFinance Beta

Yeah. And may be that's the reason BTC is becoming a mainstream asset and not a cypher punk coin. The metrics are changing and being modified to accommodate this new asset.

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPI appreciate the counter-narrative, but I'm not sure you really explained it at all. Just a bunch of hand-waving. How does technology provide inflation resistance?

I think there's a more fundamental reason that excess dollar printing hasn't impacted prices as predicted. The dollars just don't enter the economy the same way that ordinary cash (or cash equivalence) does.

And technology could be a factor, but it's not the only sector. As a given sector expands, this leads to more perceived investment opportunities. We see this all the time. It's called malinvestment when there's excess printing as compared to true opportunity. When there's enough malinvestment in a concentrated sector or sub-sector, we see it as an asset bubble.

Essentially, asset bubbles help mask the effects of inflation or at least delay the direct, obvious effects of rising prices.