Attention on the Small

One of the things that I have always found interesting is the attention on Bitcoin, where unless it is hitting an all time high, there is very little mainstream news - unless it is in a hard dip. Being up 80% since the start of the year and no one bats an eyelid. However, another thing I find interesting is the government attention that crypto gets in general, where there is constant pressure looking to somehow punish it in order to bring it into line with centralized practices. And, while I am a crypto currency enthusiast for sure, I think it is good to think about how much energy is being put into the campaign, relative to its actual size.

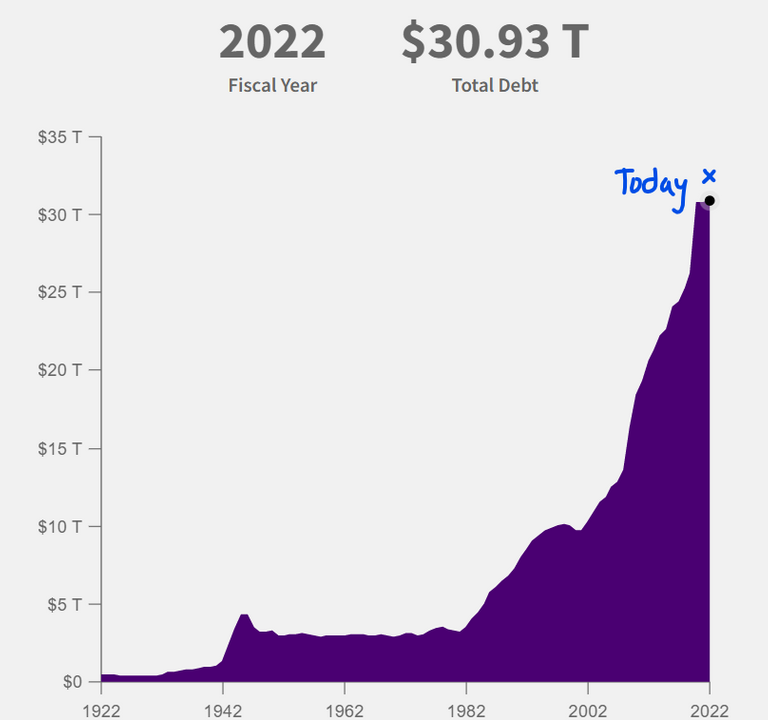

For instance, the entire crypto market is sitting at a total cap of under 1.2 trillion dollars and after all the challenges through 2022, at the start of the year it had dipped to below 800 billion. Yes, that is a fair amount of money by any measure, but it needs to be put into relation in order to understand what it means. Apple for example, is valued at 2.5 trillion - that is a single company. But perhaps more importantly, the global national debt is around 100 trillion and the total global debt is around 300 trillion.

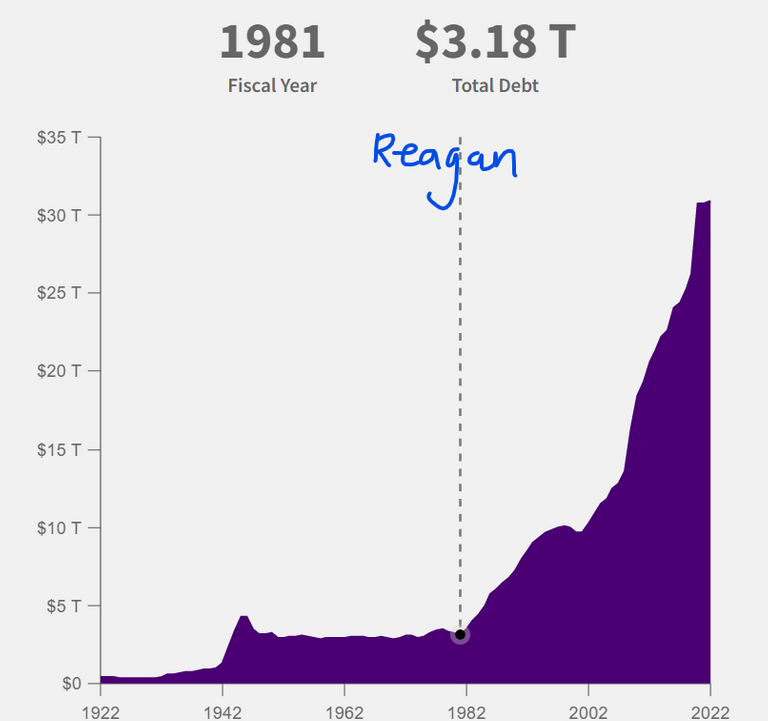

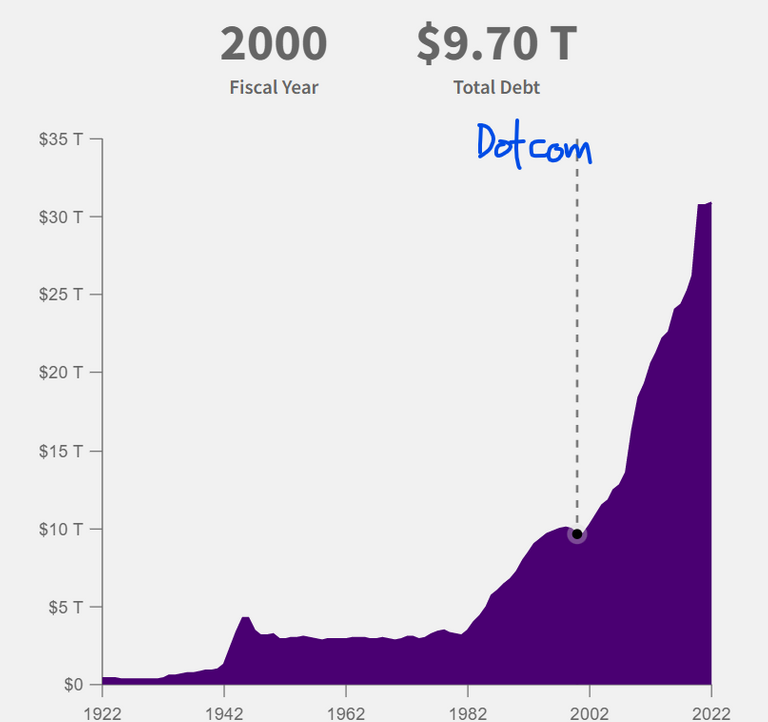

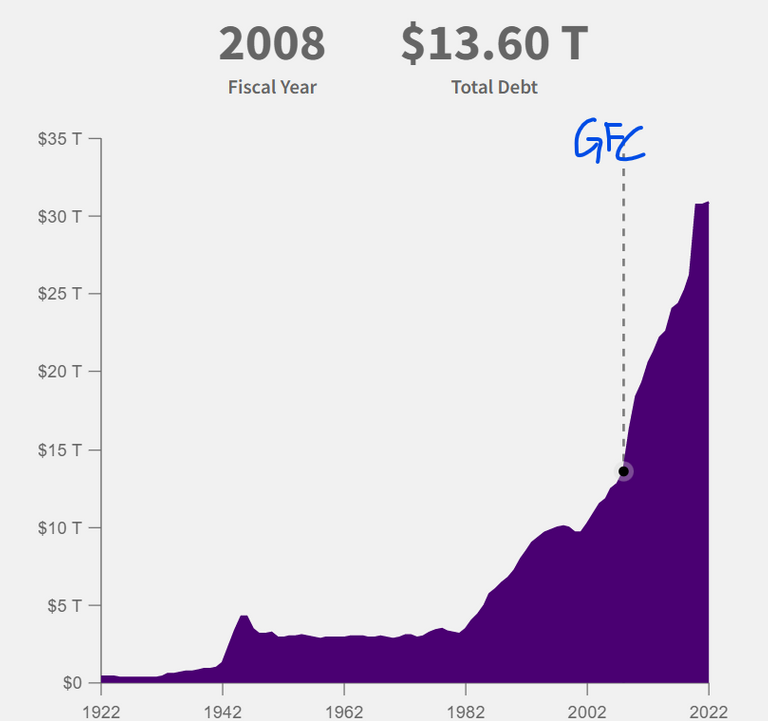

Looking at just the US debt for a moment,

Even if the US could get their hands on all of the crypto cap, it would still fall 400 billion short of getting the national debt below 30 trillion. Isn't that incredible? But then, they can't actually get their hands on all of that delicious digital value, because not only is it decentralized, but it is also spread globally.

What I mean by this is that there are millions of crypto owners spread around the world and spread across multiple tokens, and still the value is only 1.2 trillion. Yet, globally, the attention and pressure it is getting from the governments is immense, which is a good indicator that they are indeed threatened by the potential of crypto, even if not by the current state of the crypto industry.

But, why be threatened when it is a tiny, tiny drop in value in comparison to all that they have going on elsewhere? Well, in some way it is like the Coke-a-Cola company, where they will fill the marketplace with every conceivable product variation in order to not let anyone have a chance to get a foothold and perhaps threaten market share - Caffeine-free, diet Coke. That is just brown water. Yet, they didn't see Redbull coming and it left them scrambling for a little while, giving Redbull a chance to find a niche.

Crypto threatens market share of fiats currencies, which are ultimately owned by the state and with the US being a large part of the global reserve as well as the international trade currency, they have a lot to lose if they get usurped. And, not only this, it also threatens fiat culturally, where people have been conditioned to back a centralized currency, even if it is not in their best interest to do so. A decentralized currency is a direct threat to the way of life for many people, especially the wealthy.

The reason is that a lot of the markets that the wealthy use, are legislated so that only the wealthy have access to them and anyone else that tries, is going to be penalized more heavily through tax systems, so in order to make gains the same volume, they have to make more than the licensed traders, which also means that the licensed traders can get out with a profit ahead of the retail traders. And if the retail get out early, the volume isn't significant enough to make much of a dent.

However, this is changing too, as retail trading apps have opened up a more convenient gateway for average people to get involved, and once they get a taste of responsibility, consequence and gains, they will be more literate in finance in general and will start looking for alternatives that offer a better return. Crypto is a solid alternative. And, as crypto is developing the technology and mechanisms of trade available, as well as offering a very wide range of ROI potential, there is the risk that it will gain enough momentum to start widening the cracks in the already shattered fiat economy.

And, maybe this ROI range is something to touch upon too, because I don't think I have seen it mentioned before in comparison to traditional investments, but is part of the threat. When for example someone invests into barrels of oil, they get an ROI in dollars, not more barrels of oil. This provides liquidity usecase for fiat currencies, but also shows that the ROI is disconnected from the product itself. However, crypto offers a return potential in more crypto, which could be a direct product of a blockchain. - for instance, earning HIVE, through curation based on staked HIVE. Splinterlands also encourages investments through a return of more product, not necessarily the currency. This gives a potential for different kinds of trading configurations, which can create unforseen values based on future demand. While a lot of the emissions of this kind are shit tokens and useless, it doesn't mean they always will be and with more innovation and greater uptake, the demand could shift based on the changing perception of value.

And, this is a big threat, because the only thing that gives money any value, is the perception it has value. If the faith in a currency is lost, the currency is devalued to zero, because it is no longer tradeable, because no one wants it. For those who have got into crypto deeply enough, they will likely have already started shifting their own perceptions and beliefs about what is valuable and if this continues, there is a critical mass point that will mean there is no going back, and the centralized currencies fail, because people start trading their value elsewhere.

So, while the crypto industry might be small, it is a very large threat in terms of potential to centralized currencies and therefore the organizations that control them, because it puts control back in the hands of the people, encourages fiscal responsibility, decentralizes the value to make it harder to capture and most importantly perhaps, reminds people that they have power as a consumer and the conditioned usage of fiat currencies is a consumer behavior.

Centralization is all about gaining the power to control others and crypto undermines the power structures of the economy, which is the tool of choice. It is also the Achilles heel, as if it gets severed, the entire system collapses. Eventually, all of these cuts from every direction, will slice the correct point and bring it to its knees, and replace it entirely, without skipping a beat.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

Bitcoin gets so much attention because some big players are in there and because many cryptocurrencies depend on BTC standing in markets. I don't think that shitcoin meltdowns are bad, while on one end there is a leak on another there is a huge increase. About centralization, it is only one thing, control. That's it.

There is something to the quote of, while panic sellers are selling, someone is buying.

Too much hype around bitcoin, still. Not enough focus on what it can actually do and what kind of problems it solves. That's why the mainstream news only follows price.

I am always really hesitant to put too much faith in crypto because it's easy to be on one side or the other, it's a lot harder to be nuanced. Still, it's getting harder and harder to see a situation where national currencies are preferable to bitcoin (+hive), other than coercion, where they just make life difficult for those of us who use crypto.

I hope that in a world of abundance, exchange is less of a thing, and gifting and sharing and relationships becomes more of the norm when it comes to energy transfer. Obviously exchange isn't going to disappear, but in the old days, tradeable currencies were often just something used between different tribes, not inside of a tribe. I think 100 years from now, that will be the norm again.

Perhaps this is intentional, because the problems it solves make governments and media even less powerful.

At some point, do you think it will end up in the "can't kill us all" category? How long can we be held captive by guards we can overpower?

I don't think gifting and sharing will gain too much popularity, but I do think there will be a redefinition of what is valuable and as such, what gets traded shifts too.

Hopefully! I think that's what we are working towards here

Do you think all the attention that Bitcoin and other cryptos are receiving because policy makers understand the true potential? I am of the opinion that they do not truly understand what the benefits are. They cannot even fix the inflation and properly use the economic tools they have been using for so many years. Look at the interest rates and inflation.The Crypto attention so far is because of the waves it makes due to pump and dump. The goverments would be more serious than what they are if they realized the true potential of the decentralized, limited cap global moneyary system or the new global store of value to evade inflation.

Policy makers directly, no. But, it is foolish to think that no one understands the potential in it and giving them advice, or directing their hands in legislation. Look at what they did in regards of Eth - where one government agency sued an exchange because it was a security. Another sued it as a commodity.

Usually, it is us who are not aware of the war against us, not the other way around. Sadly, spreading the righteous narrative relies on intelligence, while the dominance of emotion is overwhelming. But short-term.

The Sands of Time spare no one. Equally.

Ah, there was this tune from the soundtrack of Fallen...

Whose?

This is a war between us, ordinary people, and the goverments. Thanks to cryptocurrencies, we have proved that another financial world is possible, but this does not serve their purposes. They don't want some of the cash flow in the world to be out of control. We should embrace cryptocurrencies because we sew the clothes.

This is the case, especially when they have already lost control of most of the corporations through globalization. Tax is no longer paid where the revenue is earned, which is a massive gaping hole in national economies.

I have seen many people get concern about Bitcoin when it started to rise up and pump. In my opinion they are manipulated by the other word. Then they come to manipulate others saying " Investing money in Bitcoin is the best investment. Once it was at price 65k and come down again in 15k. Now it started to rise up again and this time I am sure that it will rise up to 100k. Buy Bitcoin now and thanks me later 😅. "

But if they knew a lot about it then why they didn't gave us the suggestion while BTC was in 15 k. I think in the current time they are things that they are Pro in the crypto world and their pro mind will disappear with a hard dump 🤣 ..

15 seems like such a long time ago now, doesn't it? ;)

People will learn, even if they miss the opportunity - making it a tough lesson.

I saw a statistic the other day that the US Government now holds more BTC that all of the big commercial investors combined. That should tell us something as well. I was in the southern part of the state this past weekend and when I was looking at my map application for a place to eat I noticed that a BTC ATM popped up on my screen. It was in the middle of nowhere and so random, but it made me realize this is proliferating more than I thought. I can't wait until we see businesses accepting payment in stable coins. That makes more sense than the current ones who accept BTC. We still have a ways to go though!

That proliferation is pretty incredible, considering the small size of the industry in a global sense.

And, even if they sold it all at the next ATH, their practices would mean that there would still be no changes to the economy.

centralization is failing time and time again. how many more banks need to drown in the sea of ignorance before people accept the liberating power of crypto?

I am guessing that the majority will only move when it is either too painful to stay still, or the gains being made by people they know are so large, they have to follow.

If Ethereum crosses 5K and onwards, I feel they too would be getting the same treatment like the Bitcoin. In fact I have noticed that the Silicon Valley and the other tech communities around the world are kind of friendly towards the Ethereum. I feel it would not get too big and not too small either but it would be one of those assets which all would be taking advantage of in market. I am surprised govt who punish crypto don't have made moves towards the owner of the Ethereum yet.

They have made moves against exchanges with Eth already and have for a while. But it seems to go a bit more under the radar than BTC for sure.

I am very sure that very soon, banks and government will fully accept the usage of cryptocurrency.

Countries like El Salvador will benefit so much from it because they have made cryptocurrency their legal tender.

I don't think they will do it soon, unless it is the CBDCs.

blockchain and btc are the future

https://twitter.com/1415155663131402240/status/1641075634742108167

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

mmmm we'll see, oor now the attack has already begun against the industry, in some parts crypto-investors are already persecuted and I can say that it will get worse, the good thing is that we have a history here in hive to document how we have obtained every penny earned on the site so when the kyc comes you know what to do. And regarding value, well, as the rich uncle Mc Duck said, if we have value in something, it can be a bottle cap that serves as currency or a pack of cigarettes, as in some prisons where a cigarette was used as currency, apart from being smoked, it was highly coveted , so we will see the value of money as currency. good day.

My father during WWII in Malaysia, used to trade empty packets of cigarettes as a token. Anything works.

Yeah I think it's same with my friends. When BTC was going up every month, they were interested in learning how to buy and trade. These days, no one talks about BTC outside of the crypto community. I was joking with my friends that the day that they start to buy again, it's time for me to sell. Lol!

THey will be interested again and start buying, somewhere near the highs :)

If the government wanted people to accept CDBC, and people accept the idea of cashless and CDBC, the moment government start restricting and cancelling and expiring CBDC for whatever reason, crypto will look very attractive to the masses that have already accepted digital-only.

This is a game of chess, what’s the next move? Mandating won’t do it as it will just create workarounds and black market. It is a double edged sword.

Big threat to CDBC as a tool for totalitarian control.

It is definitely a game of chess and I am not a very good player! However, I feel more secure in the decentralized governance than centralized governments - So I know which field I am playing on at least :)

Crypto is truly a mess in their heads. Something they don't want to see grows to allow the average man into their centralized wealthy world.

It will be the poorer countries that drive adoption and will also be the nail, because they will no longer work for pennies.

Yes, that's very right.

I've been in the crypto realm for only 17 months or so, and I'm already hooked and hopeful. Nowadays I'd rather make transfers in stable coins, and avoid the basic cash transfers apps or banks. The "crypto way" is way faster and cheaper, and that's just one of the many perks crypto offers.

There's still a long way to go though, a lot of untapped potential and adoption. Yet, no matter what, bear-bull, red-green, hopefully I'll be able to stick around.

A massively long way to go and it won't be smooth sailing, but there is a huge amount of value to capture.

Just when you start to think that 2022 was the worst, and is 2023 things are gonna be better lol. Who knows how much more drama we'll be seeing this year.

People always like get rich quick schemes. That's human nature. So when something pumps, it always makes the news and more people FOMO in and get burnt when prices finally corrects themselves. That said, people fear what they don't understand. And politicians are frankly just playing to their userbase.

The average person and below are well, average and below - but they are the majority.

This latest round of crypto crackdowns in the US is getting out of hand. They are reaching at this point because they have dragged their feet too long coming up with responsible regulations. Instead of passing laws, they are regulating by enforcement, which is an awful precedent to set. I'm quite scared for the future of crypto here in the US.

It is going to get pretty rough and the thing that people will have to realize is, the laws don't have to be followed. It will be painful however.

We choose to follow them for the good of the people/society. I'm convinced that the IRS wouldn't rightly know about the crypto I've been paid for the work that I do, but I'm going to claim it on my taxes anyway because that's the fair and proper thing to do - even if I don't quite agree with how my taxes are spent here.

The governments and banks don't want to give up any power and anything that moves outside the system is a threat. As it is, BTC is a huge threat to them and there isn't any real way for them to stop BTC as it is decentralized. BTC is the king of crypto and it affects everything so it is the target that the news media will attack more often than not.

Posted Using LeoFinance Beta

It is a target, but what might have an effect on it is if businesses start supporting it, rather than the legacy economy. They have a high incentive to control their funds too.

It is in the nature of government to take power from others for itself. I imagine the same can be said for crypto. They see it is giving others power, so the governments must have it. If they can;t have it, then neither can us peasants.

Yep - governments in theory are not bad - however, human nature is what dictates the reality of them.

Love the different perspective on this, you don’t normally think of it in those terms. If every coin was sold at current market price it wouldn’t even make a 10% dent in the debt. That’s pretty insane to think about!

I think with crypto and the future, it’s definitely the cracks are expanding at an increasing rate and it only gets worse the more governments of the world freak out and try to ban this and that and harass people. It shows their weakness and fear then the sharks start to circle. I don’t plan on selling any to fiat to cash out at this point! It only goes up from here I think, and the utility of the digital assets increases quite a bit!

Posted Using LeoFinance Beta

I don't understand why people don't wake up, but I also figure this is human nature too. It is like prisoners in Auschwitz, that far outnumbered the guards and could have overpowered them through force, but individuals wanted to survive. The "can't kill us all" approach rarely is going to be put into practice.