Ether and Bitcoin Are Not the Same, ETH is Better

I've seen this Exponential Investments weekly investor letter making the rounds in the past week. It's an Ethereum FUD piece put together by a couple of Bitcoin maximalists - Steve McClurg and Leah Wald. It's almost like they found an old draft of a bearish Ethereum article on their Medium account that they started writing in 2018, attempted to polish it up, and then published it.

A friend of mine sent it to me who had just recently begun to buy ETH in earnest, a little bit worried about this kind of argumentation coming from a fund manager. I read it and it took me about 5 seconds to debunk it. My friend was pacified. For me, I can't believe that there are crypto investment professionals that still think this way. But I guess, therein lies the opportunity.

It's just a reminder that we are still so early in this space. So early!

There's a great thread on Twitter by Booth MBA grad Leo Morozovskii that goes point by point on some of the wide misses these Exponential guys made in their piece. My aim with this post is to just provide some general color on the three aspects of Ethereum that make the Exponential thesis wrong. It's no wonder they did not even mention any of these three features. If they had done the least bit of research, they might have flipped their entire thesis and come out of the exercise as ETH bulls rather than ETH bears. And I'm guessing that probably wouldn't look so good with how their portfolio is currently positioned. Best for them to just close their eyes, put their fingers in their ears and scream "La la la!"

If you're going to write a hit piece on Ethereum, you'd better address these three elements that make it a compelling investment opportunity going forward: (1) ETH2 (2) DeFi (3) EIP-1559. Allow me to explain.

ETH 2.0

In Exponential's hit piece, they show a clear misunderstanding of the nature of ETH 2.0. To wit, they mention that "the difference in the price of Ether 2.0 and Ether itself will lead to market confusion in the short-term."

Excuse me, guys. But please do some research before you post a hit piece. There are plenty of ways to legitimately FUD Ethereum, but this ain't one of 'em. The ETH asset will be the same on ETH 2.0 as it is on ETH 1.0. I am seriously doubting my decision to devote any time to this rebuttal piece at this point. These guys don't even know what ETH2 is! But I continue...

Their next point in this section is the old trope from 2019 that ETC will become the "apex predator" of the Ethash consensus algorithm once ETH moves over to Proof-of-Stake. This hypothesis lead to ETC hitting a peak of almost $10 during the mini-bull run of summer 2019 and $12.50 on February 6, 2020 in the last little pre-COVID bull market crypto run. But you'll notice that ETC is rangebound in the 6s for the time being, while ETH is within shouting distance of its pre-COVID high of $282.49 realized on February 15, 2020. That's because the "apex predator" thesis, while it sounds pretty catchy, was bunk. The ETC Cooperative isn't even sure it wants to stay on Ethash. They want to move ETC to the SHA-3 mining algorithm.

Honestly, it doesn't even matter. Nothing is built on ETC anyway. Seriously, go take a look at ETC tokens. There is only 150 in total and they have illustrious names like YOCOIN, WealthCoin and UniversalCoin. Even after ETH transitions to POS, who is going to go mine this crap? I mean, there are more profitable things you can do with your nVidia GeForce GTX 1070s.

Like Gertrude Stein said of Oakland, "There's no there there." It's a pretty easy bet to make that the Ethereans will stay in Berkeley, i.e. ETH, and never set foot in Oakland, which would be ETC in this analogy.

Decentralized Finance (DeFi)

While ETC and BTC have struggled to get back to their highs experienced from the previous two crypto rallies, Ethereum sits within spitting distance (about 20%) of that $280 mark thanks to nearly every ETH DeFi coin (LEND, REN, MKR, SNX, LRC, KNC) making fresh new highs during this, let's call it a prelude to a bull run. DeFi market cap is now $2 billion and DeFi total value locked (TVL) is now $1 billion again after reaching a pre-COVID high of $1.24 billion.

We haven't even gone Full Bull yet and this is happening. And do you know why? It's because people actually use these DeFi protocols every single day. I know it's hard for the old school crypto heads to understand this, because they were raised on bullshit memecoins, forced scarcity, and blatant P&D schemes. But in the long run the only thing which leads to value is use. If a chain is used, it has value. That's why if you're looking at this from an institutional investment perspective, you'd better fill your bags now with BTC... and ETH. Nothing else compares. Which is what makes Exponential's argument about the coming "Ethereum killers" sound so ridiculous. They specifically mention Cardano and EOS, which again makes me wonder, "Have these guys done any research since 2018?"

Cardano has yet to even launch their mainnet. It's been almost 3 years since their raise and still no mainnet. It's been so long it's become a kind of running joke in the industry. For other projects, "When mainnet?" is a point on the roadmap. For ADA, it's a legitimate question. CEO Charles Hoskinson gets so defensive about his project on social media that the only legitimate takeaway is that there must be something wrong.

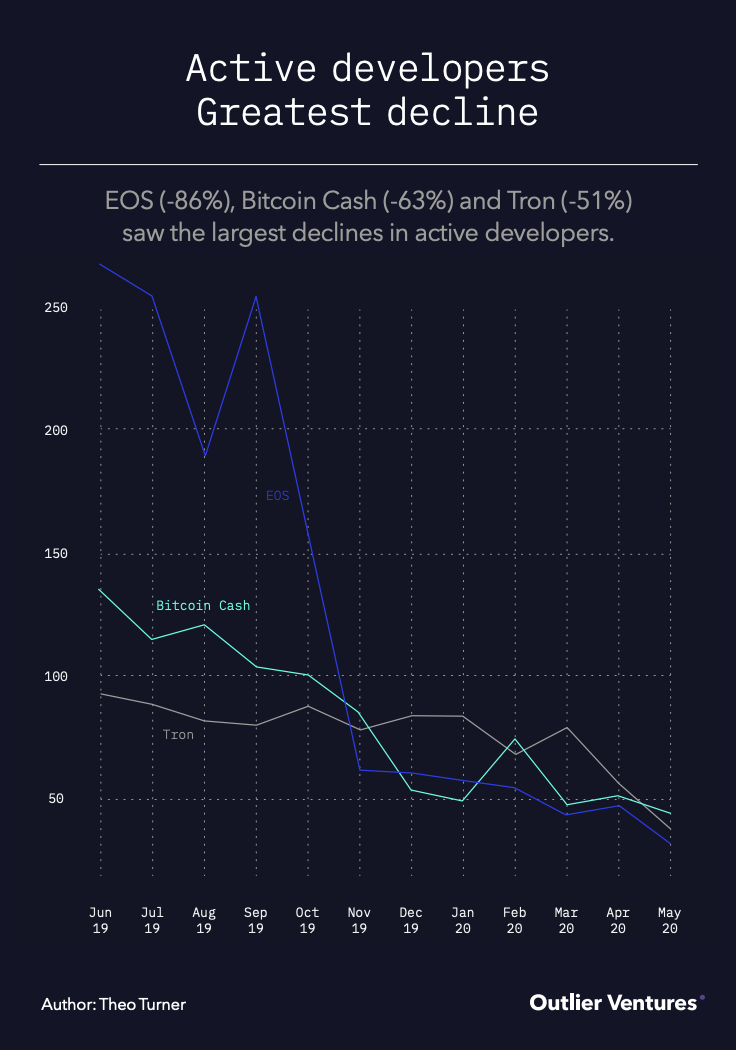

EOS is so fucked up that more than 80% of the projects that were being developed on it have abandoned ship. Take a look at this report.

The same report emphasizes that ETH has huge market share in smart contracts (79%) and dapps (82%). Those are Google numbers, folks. That leaves runners up Polkadot and Cosmos to be the Bing and Yahoo of the dapp world. Whoop de do! I love both of those projects by the way, because I'm not a narrow-minded maximalist. I'm trying to help change the world here and we're gonna need as much help as possible. But, again, if you're an institutional investor, the takeaway is pretty clear. If you want exposure to cryptoassets in your portfolio, you need both BTC and ETH.

Bitcoin is just a currency, a boring old store of value. Like gold, you can't do much with it besides let it sit there and store value for you. And while that is a fabulous use case that the world is desperately in need of in these "YOLO! Central banks just create at least $200 billion per week" times. It's just digital gold. It's not programmable money, which is what ETH is.

While Exponential quotes a 2016 article (seriously, this is crypto, a space where nearly everyone in it says a decade happens in a year and these guys are citing an article from 2016 in 2020, wtf?) from blind old-school maximalist Tuur Demester in their article, I want to highlight what I consider to be the best article written about ETH in the past year: David Hoffman's argument that ETH is a triple-point asset. Seriously, it doesn't appear as if the guys at Exponential have even read this article, which is a woeful disservice to their investors. The argument directly refutes their point that ETH fails as a store of value.

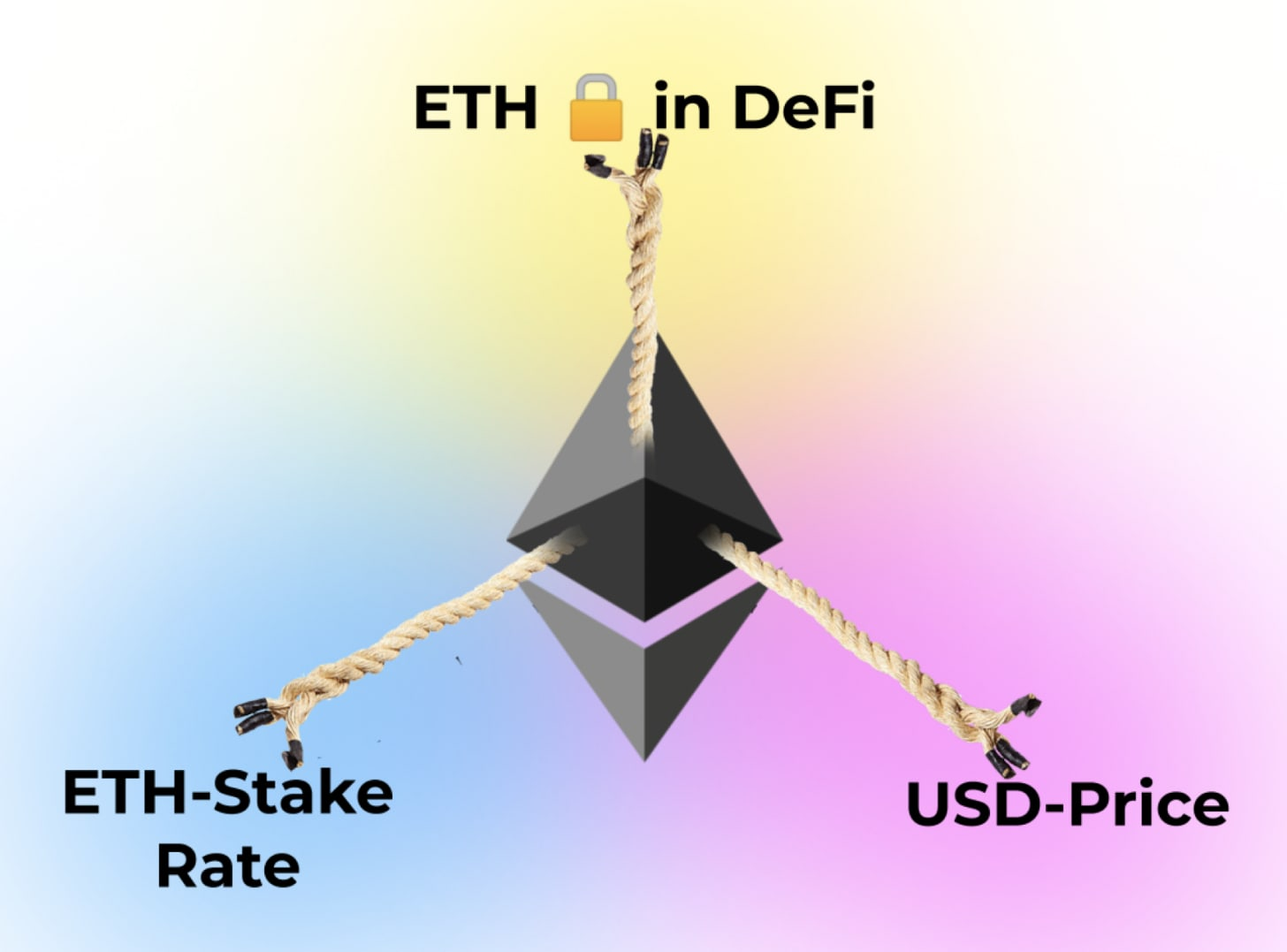

Hoffman argues that not only is ETH a great store of value, and all the ETH locked up in MakerDAO vaults and other DeFi protocols proves that, but it is also a great capital asset and consumable/transformable asset as well. Once ETH2 occurs, ETH will have the bond-like characteristics of a capital asset as people will be able to earn more ETH simply by HODLing it, which is a feature that BTC doesn't enjoy at the protocol level. The push-and-pull of these three characteristics will mean that ETH in an ETH2 regime will constantly be being forced upward to find a price equilibrium.

You don't really have that with too many investment opportunities. Of course, RUNE has some of these same characteristics and even stronger tokenomics, but if these guys don't even get that ETH is a fantastic investment, I doubt I'm going to be able to get them to understand RUNE. 😂

Let's wrap up this section by saying that DeFi is a movement that is only going to get stronger. The past few months have made explicit that it is a movement that is in the best interests of most people in the world. And ETH is where most of that development seems to be taking place. The Exponential article did not even mention DeFi at all in their text. That is an unforgivable oversight.

EIP-1559

Now here's where things get a little technical. If you haven't heard of Ethereum Improvement Proposal 1559, you can be forgiven. But it's a game changer. Although it was first written about by Eric Conner in March 2019, its complexity has meant that it is only now getting put on the Ethereum roadmap.

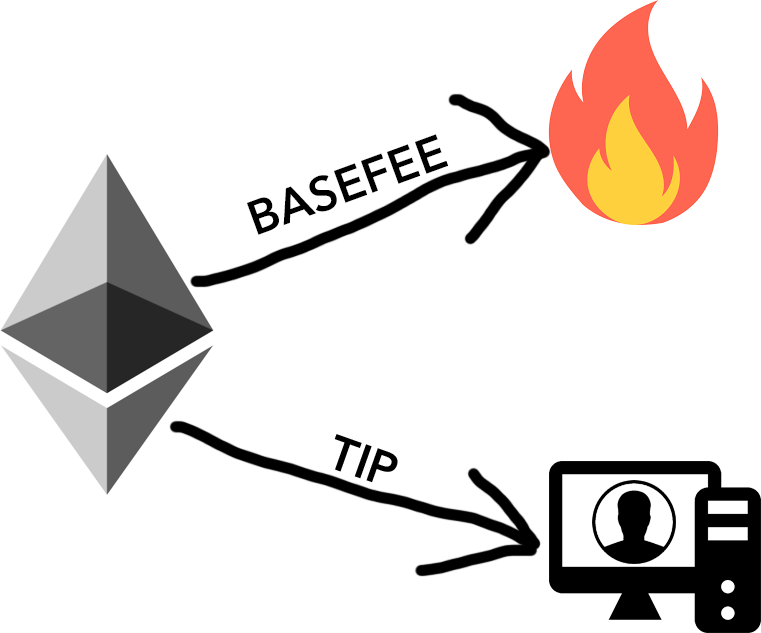

What does it do? Well, basically EIP-1559 proposes that an algorithm determine a "market rate for gas," setting a BASEFEE that would get included in the block and be subsequently burned. This burn mechanism would counteract the lion's share of the supply inflation attributed to POS block rewards. Tips can be added to this BASEFEE but it would solve the problem that ETH faces now where underfunded transactions can potentially sit in the mempool for days, even weeks, before getting processed or eventually discarded.

While Bitcoiners love to tout that BTC is "disinflationary" the fact is that even at current limited block rewards of 6.25 BTC per block, the inflation rate for BTC is still ~1.8% per year. For those of you counting at home, that's 6.25624*365 divided by the current ~18 million coin supply. The funny thing is, after ETH2 Phase 2 gets implemented (that's when EIP-1559 will get hardcoded to the Ethereum blockchain), it's highly probable that the ETH inflation rate reduces to somewhere between 1% and 1.5% per year, depending on the amount bonded to ETH validators in a PoS system. So, yeah, while these Exponential guys tout the "provable scarcity" of BTC, it is likely that the issuance rate of ETH will be lower than BTC within a year.

Another positive effect of EIP-1559 is that it likely solves some of the recent kerfuffle over inordinately high gas fees, which is another point highly articled in the article. As Vitalik Buterin recently stated, by having the protocol dynamically set a BASEFEE, EIP-1559 means that users will far less often have to set a gas fee manually. The point of EIP-1559 is to remove the complexities of ETH gas management from the user. That's good for UX, which is good for adoption, which is good for the value of ETH. Deribit recently released an in-depth report on the impact of EIP-1559 touting that "EIP-1559 largely holds what it promises."

Conclusion

I can't believe anyone would try to talk shit about ETH without at least trying to adequately refute the potential power of ETH2, DeFi and EIP-1559. While Exponential used some outdated arguments against ETH2, which I hope to have adequately refuted above, they don't even mention DeFi or EIP-1559. That oversight, to me, indicates that either a) they don't know what they're talking about or b) failed to do any opposition research.

Oh well, in the long run, it's probably better for all of us that there are people out there that manage large sums of money that do not believe in ETH. I mean Grayscale has already bought $110 million worth of ETH this year. Its ETHE pink sheets product is trading at such a high price compared to its net asset value (NAV) that it implies that ETH is massively undervalued by 8-10X.

Us plebs don't need any more competition than that driving up the price of ETH before we can get it ourselves.

Posted Using LeoFinance

Please join the conversation on Twitter, #posh

Thanks for the detailed explanation about ETH and some of the updates that are taking place.

Arguing with Bitcoin maximilists is like arguing with trollers on Facebook. As you clearly pointed out, this was a hit piece without detailing any of the major events with Ethereum.

Posted Using LeoFinance

Ha ha. I suppose you're right! However, if those maximalists are managing OPM, rather than just being a dog or warlock on Twitter, then I think they owe it to the folks whose money they manage to do a little bit better research. The piece I was reacting to in this post trotted out all the best hits from the past couple years, while completely ignoring the present status of ETH.

Posted Using LeoFinance

Hi there, this post has been manually curated by @defi.campus.

Sometimes I find these "ETH killers" quite laughable. During the ICO fever in 2017/18, they were boasting about how they are a better "tokenization" platforms. After the bubble burst, nothing new came from them. Now they are boasting how they are a better DeFi platform.

What is really interesting is that these use cases, be it tokens, tokenized assets or DeFi are discovered by the community. Ethereum has never changed its vision of becoming the world's computer/programmable blockchain. I am sure these "ETH killers" will continue to boast that they are better in whatever future use cases on Ethereum but Ethereum will continue to be the trendsetter.

By the way, do consider sparing a tag for #defi so that I can find your DeFi related post easier in the future 😅. If you are interested in DeFi related posts, do consider subscribing to DeFi Campus community.

p.s. I love how you slide in a Rune shill in the middle of the post 😁

RUNE is too good for these Bitcoin Maxis living in 2016.

It's a whole new world!

@tipu curate

Upvoted 👌 (Mana: 0/10)