Introduction of TRON-based DeFi project and some notes

Hello, this is kimm. DeFi Yield Farming started with Ethereum, but it is felt that the recent trend has changed slightly toward Tron and EOS as GAS fees, which have clearly increased, begin to act as an entry barrier for small investors .

As new farming projects continue to be released on Tron and EOS, private chat rooms to share the information are being created, and it seems that the content of the Ile Farming participation review is starting to appear quite a bit. For those of you who may be curious, in today's post, I will summarize TRON-based DeFi farming projects and things to be aware of .

It is clear that the farming projects introduced below are "never recommended." Since there may be asset damage at any time due to contract errors, heavy losses, or dumping by the developer, it is recommended that you search for a lot of information before participating.

#One. DeFi = full responsibility

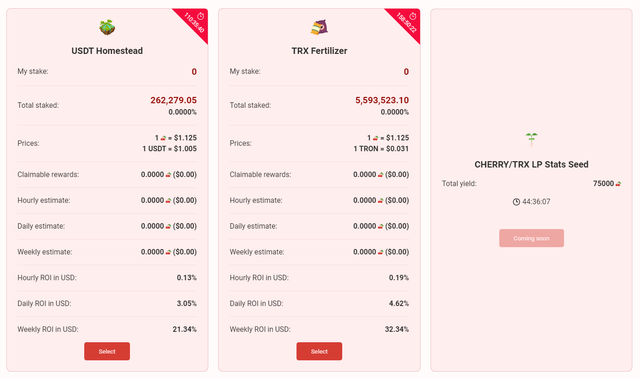

As some of you may have confirmed in the news of Coinness today, there was a notice in the Tron-based DeFi project called Cherry Pie that "the USDT related contract code has a problem and users cannot withdraw USDT staked".

The amount of USDT staked by users on Cherry Pie reaches a whopping 262,279, and this enormous amount of assets is actually tied up in a contract and burned. However, it is important that the situation in this problem is an issue that was reported in other DeFi projects before Cherry Pie's USDT Homestead farming began .

- Original link: Turnip.land Project is Closing

The Turnip.land project team, launched on September 4, has raised more than $200,000 in locksmith assets in one day after the launch date, but added USDT, a second mining pool after USDJ, the first mining pool. Later, we announced that we discovered an important problem with the smart contract library used by the DeFi project .

According to the report, there was a compatibility problem with the SafeERC-20 library of non-standard USDT contracts, and it was found that unstaking of staked USDTs did not work normally , and we tried to find various solutions to resolve the bug, but eventually 61,102 USDT was You have announced that you will be permanently locked into the smart contract.

Fortunately for the unfortunate, for problems caused by external library problems, the Turnip.land development team has announced that a full refund will be made at the development team's own expense, and more than 90% of the refund has been completed . Thanks to this, users who had staked USDT on Turnip Land could take a breath, but as of now, staking of Tron-based Tether (USDT) has a very high risk , and most DeFi projects are operated anonymously. Users need to keep in mind that if a similar case recurs, users risk losing all of their assets .

In DeFi, it is necessary to use liquidity supply (LP) or staking farming of tokens other than USDT, and we recommend that you use DeFi, keeping in mind that you need to be careful not to put too large assets into it.

#2. TRON-based DeFi project

Currently, TRON-based DeFi farming projects are also continuously appearing in the market, and contracts from the Cherry Pie, which have a problem above, and TronFi, Jackful (JFI), and Turnip, which are successful in a lot of popularity and success. There are various projects such as the newly launched Sriracha (SRI) by supplementing the problem.

Below, we will briefly introduce the site address and token.

Posted Using [LeoFinance](https://leofinance.io/@kimmyhime/introduction-of-tron-based-defi-project-and-some-notes)