FED has spoken! Market will face QT [EN/DE]

The inflation is not slowing down as expected by FED. The non-tightening of the interest rates in the last months facilitated the bullish sentiment of the markets, equity as well as crypto. The FED seems to have realized the market is not take them seriously about higher interest rate. FED is pretty likely to start quantitative tightening (QT) again. Check out FED's Powell Testimony in-detail view.

Here is the interest chart using TradingView. It is likely that FED will try to raise above 5.25% and maintain between the yellow lines (5.25%-6.50%).

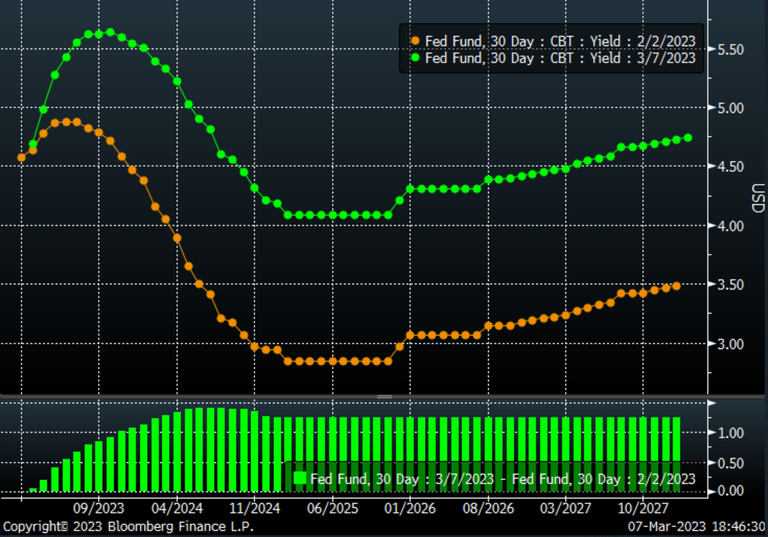

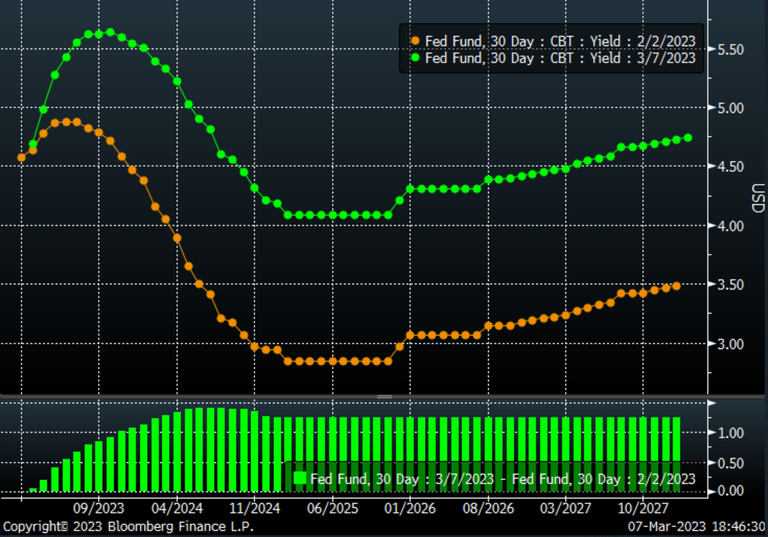

Twitter sources show that market expects rates to above 5.5% for the rest of the year!

Not sure if raising interest rates will bring the inflation down, but it will surely move the markets significantly in the coming days. If S&P moves, crypto moves too!

Hang tight for the roller coaster in the coming days and the rest of March.

@cryptopi314

Deutsch Übersetzt mit www.DeepL.com/Translator (kostenlose Version)

Die Inflation verlangsamt sich nicht wie von der FED erwartet. Die Tatsache, dass die Zinssätze in den letzten Monaten nicht angehoben wurden, hat die Aufwärtsstimmung an den Märkten, sowohl bei Aktien als auch bei Kryptowährungen, begünstigt. Die FED scheint erkannt zu haben, dass der Markt sie in Bezug auf höhere Zinssätze nicht ernst nimmt. Es ist sehr wahrscheinlich, dass die FED wieder mit der quantitativen Straffung beginnen wird. Sehen Sie sich FED's Powell Testimony im Detail an.

Hier ist der Zinschart mit TradingView. Es ist wahrscheinlich, dass die FED versuchen wird, die Zinsen über 5,25% anzuheben und zwischen den gelben Linien (5,25%-6,50%) zu halten.

Twitter Quellen zeigen, dass der Markt für den Rest des Jahres Zinssätze über 5,5% erwartet!

Ich bin mir nicht sicher, ob die Anhebung der Zinssätze die Inflation senken wird, aber sie wird die Märkte in den kommenden Tagen sicherlich erheblich bewegen. Wenn sich der S&P bewegt, bewegt sich auch die Kryptowährung!

Bleiben Sie dran für die Achterbahnfahrt in den kommenden Tagen und den Rest des März.

@cryptopi314

The above content is for educational purposes only. It is not a financial advice.

Der obige Inhalt ist nur für Bildungszwecke. Es handelt sich nicht um eine Finanzberatung.

Source: Images

Additional reference:

- Trading: HIVE/BTC vs HIVE/USDT vs HIVE/ETH

- FRED Economic Research: Macro is driven here!

- Inflation: Bitcoin, Hive, Dollar

- Look Into Bitcoin: Bitcoin know-how for everyone

- Tools & Resources: TradingView

If you find the content useful, kindly consider to follow and re-blog! It is a great motivation 🤗

Wenn Sie den Inhalt nützlich finden, denken Sie bitte daran, zu folgen und zu rebloggen! Es ist eine große Motivation 🤗.

A good analysis, good enough for a person to understand a lot.

thank you! 😇

You are welcome

Congratulations @cryptopi314! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 40 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Isn´t a rate increase leading to more dollar stacking and less investments because loans become more expensive? So wouldn´t rate increases not rather suffocate the economy? Less investments -> less new jobs.

So why are they doing this? Fear of inflation? But wouldn´t it be more prudent to make less debts to counter inflation?

@stayoutoftherz They see economy is pretty strong and will be able to handle higher interest rates. The unemployment rate is nearing all time lows, which strengthens their ground to increase the rates. As we know high inflation is not good for a country's debt, pensioners, and strength of the currency, the FED is adamant about bringing it down to 2%. In my understanding, they will continue on this path until something breaks such as housing market, unemployment rate, or the stock market, or all together!

I'll compare some of the macro metrics to shed some light on interest rates, recession, and unemployment rate in the next blog post. 😊

They're under reporting inflation. And what do you expect when they create more than 50% of the entire money supply in less than a couple of years.

Something's gonna break, and they'll announce their solution. Thankfully we already have ours.

#Bitcoin #crypto

The under reporting was rectified in the last months report. But surely, they can say in the next speech about updating the inflation numbers.

Looking forward to FOMC speech and CPI numbers! The market is likely to react quite strongly.