Why Algebra Matters - Balancing a Portfolio

The Problem

After Bitcoin stops going up every year, it will assume a kind of yo-yo pattern where it goes up and down around a value rather than continuously going up like a space rocket.

We don't know when this will happen or whether it already has. Some say they do. If you think Bitcoin's price will double every year forever, you have another thing coming.

On Vaultoro, you can trade Bitcoin, Dash, Ether and Gold and Silver. To capture gains that happen in Bitcoin and save them to silver or gold you can create an equation as follows:

Definitions

Let ABTC,i represent the initial amount of BTC in the account.

Let ABTC,f represent thefinal amount of BTC in the account.

Let AAu,i represent the initial amount of gold in the account.

Let AAu,f represent thefinal amount of gold in the account.

Let a be the amount of bitcoin to spend on the metal

Let p be the price.

Initial Equations

ABTC, f = AAu, f * p

This will be true if there is an equal amount of value of both the comodities.

To get to ABTC,i to ABTC,f as follows.

ABTC,f = ABTC,i - a

AAu,f = AAu,i + a/p * 0.995

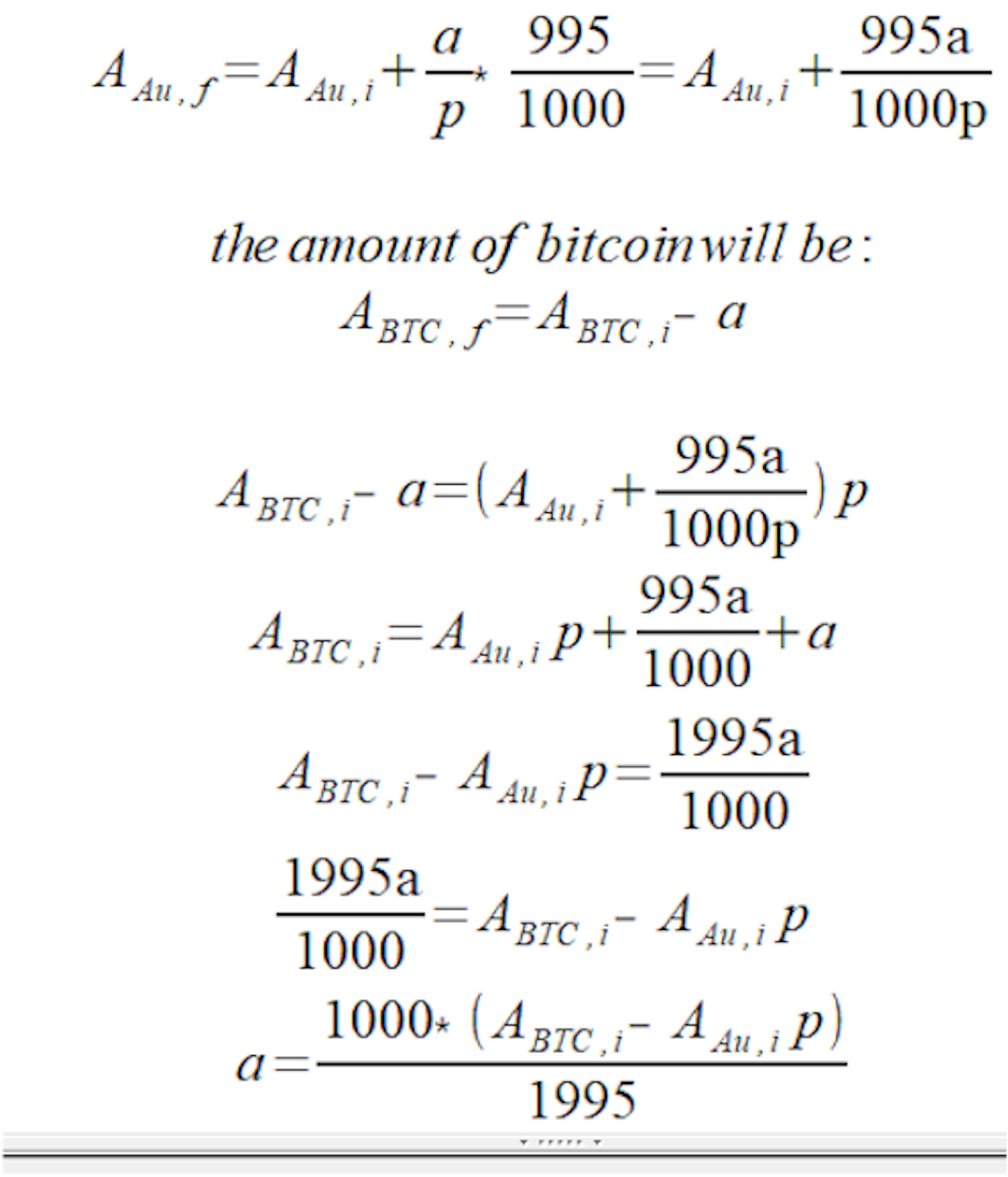

The front-ends do not handle MathML so here is a JPG of the rest.

Equation Solution

The same equations work when balancing Bitcoin and Silver or Bitcoin and Ethereum on the same exchange.

An Example

Now we plug in values for Gold or we can apply it to silver instead:

Suppose we have $10,000 of silver and bitcoin on the Vaultoro exchange. And we have $3000 of silver and $7,000 of bitcoin. Now these prices are not in dollars in Vaultoro, they are in BTC. You cannot even have dollars on Vaultoro.

So instead we are talking about 0.123,7 BTC and 3571 g of silver.

The amount to buy is

1000 * ( 0.123,7 - 3571 g * 0.000,0161 BTC/g) / 1995

Sell 0.0338 BTC for silver at 0.000,016 BTC/g. But you will have to wait, maybe you wont sell because nobody is buying at that rate. You have to buy at

This leaves you with 0.090 BTC and 5656 g of silver.

Now, if silver should go up in value, your BTC bags will increase, and yes, you will lose in Bitcoin terms should the Bitcoin price keep climbing but suppose the price of silver takes a random walk and ends up back to where it is now?

| grams of silver | total bitcoin | amount of BTC to spend on silver | price of silver g/BTC | Total value in BTC |

|---|---|---|---|---|

| 3 571 | 0.123 7 | 0.033 37 | 0.000 016 | 0.180 8 |

| 5 656 | 0.090 3 | -0.011 42 | 0.000 02 | 0.203 5 |

| 5 085 | 0.101 8 | 0.010 22 | 0.000 016 | 0.183 1 |

| 5 724 | 0.091 5 | 0.005 71 | 0.000 014 | 0.171 7 |

| 6 132 | 0.085 8 | -0.012 31 | 0.000 018 | 0.196 2 |

| 5 448 | 0.098 1 | 0.013 69 | 0.000 013 | 0.169 0 |

| 6 501 | 0.084 4 | -0.009 81 | 0.000 016 | 0.188 5 |

| 5 888 | 0.094 3 | -0.011 78 | 0.000 02 | 0.212 0 |

| 5 299 | 0.106 0 | 0.010 65 | 0.000 016 | 0.190 8 |

As you see when the Bitcoin price finally becomes stable or duringtemporary bear market, a balanced portfolio can pay off.

Other Posts by @leprechaun

Twenty Video Sites to Upload Content To

See How Videos Embed on this site

See How Videos Embed on Steemfiles

See How Videos Embed on hive.blog, on peakd, on steemit, on LeoFinance, or on Ecency

Donations (Tips)

| Tron: TPicBhbwp1GtG9xGoUY6gzoTp6ssRQoxgP |

| SLP simpleledger: qqtes6cafexr00tzv9r360rd3g9l3zssuu72smhxl7 |

| bitcoincash: qqtes6cafexr00tzv9r360rd3g9l3zssuuj3mqzxpq |

| bitcoin:1LT2zLt4uooLfnTFfBJGzpTY4EY1SWZxoJ |

I agree that no one knows how long BTC will continue to rise, but I think the growth will continue for a long time considering it's scarcity and popularity. I think the price growth and volatility would slowly taper to a much more stable scenario over time, but when that stability will be reached is hard to say. Over time as we continue to watch the S2F model continue to play out, maybe we will begin to be able to make some accurate predictions at some point.

The problem with S2F is if you apply it to say NXT token, nXT should be worth infinity because it was an instamine and then there was no more coins issued. You probably never heard of NXT token and why would you have when its been horizontal in price for the last three years after a huge spike.

I think due to the recognition around the world, its acceptance, and a that it is the easiest crypto to trade into, creates a real use case for transferring, trading and payments. Then the limiting supply doesn't hurt.

Then there is all of the standard features such as they cannot be confiscated, cannot be frozen, you don't need a government id.

There is real adoption of Ethereum and Dash. Bitcoin Cash is getting spread out more than Bitcoin and now has more transaction volume than Bitcoin. Ether has marketcap because its a casino blockchain. Bitcoin's value against fiat is partly due to how much the fiat usecase has been hurt by financial institutions. With every confiscation (bailins), or excessive money printing Bitcoin goes up. With new financial controls, bitcoin goes up.

Could we get Proof of Brain to become something people actively use to buy services? I want to make a 10,000 POB pizza.

I remember NXT. Yeah I agree, I don't think you can apply S2F unless you have the popularity that BTC has had. I think POB will definitely be actively used with no fees and 3 second transactions. One thing I'm considering is reaching out to @thelogicaldude to set up a POB store.

You will soon have options for that! Hit me up!