Math With Sales Taxes & Sale Discounts

Hi there. This math education post is on dealing with sales taxes and sales discounts. This particular topic is one of the more practical math topics as we do shop for stuff very often.

(As usual, math text rendered with QuickLaTeX.com)

Topics

- Review Of Percents

- Finding The After Tax Sale Price

- Final Price After Sale Discounts

- Combining Sales Tax & Sales Discounts

- Finding The Original Price

- Practice Problems

- Answers To Practice Problems

Review Of Percents

Before getting right into finding the after tax/sale price, let's review the concept of percents. Percents refer to a part of the whole (assuming from 0 to 100 percent). Five percent (5%) refers to take 5 for each 100 for example. With this in mind 5% of 200 is 10 as there is two hundred and we take five for each 100 (2 x 5 = 10).

As another example, 8% tax on a $300 watch results in having a $24 tax on top of the $300. A tax rate of 5% on a $39.99 item results in a added tax of $1.99 (0.05 x 39.99).

Finding The After Tax Sale Price

In the percents section, you might have noticed that the after tax price was obtained by determining the added tax value first and then adding this to the price of the item. There is a way to find the after tax sale price in one step instead of two.

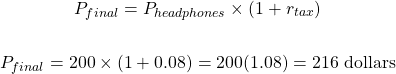

Given the price of the good or service and a tax rate, the after tax price can be obtained by multiplying the price of the good or service by one plus the tax rate. This tax rate is in decimal form where 1 percent is 0.01.

It makes sense that the one plus the tax rate is there as the final price should be higher than the original price. Higher taxes makes the cost of goods and services more expensive.

Example

Justin wants to buy a pair of noise-cancelling headphones for $200. The sales tax rate is 8% in his area. What would the final price of these headphones be?

Answer

Final Price After Sale Discounts

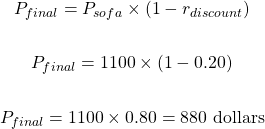

While taxes makes goods and services more expensive, sales discounts do the opposite. A sales discount reduces the price of goods and services. Discounts are used to attract buyers into buying goods and services.

The final price after sales discounts is the original price multiplied by 1 minus the discount rate. This discount rate in the formula is a decimal where 1% is 0.01 in the equation below.

Example

During an IKEA summer sale, a sofa that has a regular price of $1100 now has a sales discount of 20 percent. What is discount price of this sofa (before taxes)?

Answer

Combining Sales Tax & Sales Discounts

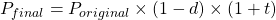

When it comes to sales at a store both discounts and taxes are applied (unless you live in a no sales tax area). Both the discount rates and tax rates can be applied on the regular price in order to obtain the final price.

Denote t as the tax rate and d as the discount rate.

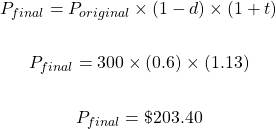

Example

Millie sees a big sale for cosmetics and wants to jump on it. What Millie wants costs $300 dollars with a 40% sales discount and her area has a 13% tax rate. How much would Millie pay after discounts and taxes?

Answer

The discount applied is $120 off (60 percent of $300). Added tax is 13% on the discounted price of $180 which is $23.40 of tax.

Finding The Original Price

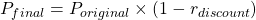

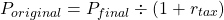

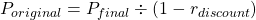

There are times when you are given the final price and want to find the original price before a sales discount and/or before taxes.

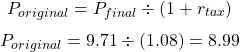

To find the original price if there is just a sales tax, use this rearranged formula:

When given the discount rate, use this rearranged formula:

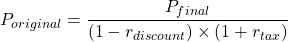

And for finding the original price when given both a discount sales rate and a sales tax, use this combined rearranged formula. The final price is divided by the product of 1 minus the discount rate and 1 plus the tax rate.

Example One

A 12 pack of toilet paper rolls costs $9.71 after tax (and rounding). The sales tax rate is 8%. What is the original price?

Answer

Example Two

A pair of pants has a discount price of $42 which was 70% off the original price. What was the original price?

Answer

Practice Problems

An energy drink costs $2.99 at the grocery store. With a sales tax of 5%, what is the final price?

A used book store does not charge tax on book purchases. A Harry Potter book is on sale with a 15% discount from $18. What is the discounted price of this book?

A TV at the store Better Buy has a regular price of $1200. With a sale of 20% off and a sales tax of 13%, what is the final price of this TV?

Consider a $2000 laptop with a sales tax of 13% in one area. What would the tax savings be if this same $2000 laptop was purchased in a different area with a 5% sales tax?

The local hairdresser was charging $20 for a discounted haircut. She says that this is a "good deal" as she gave 20% off. What is the price of the regularly priced haircut?

The bill from a restaurant dinner came to $97.42 (rounded to nearest cent). This is after a 10% tax, a 10% paid in cash discount and an added tip of 20%. What was the bill cost before price adjustments?

Answers To Practice Problems

$3.14

$15.30

$1084.80 ($115.20 off)

$160 savings

$25

$82