CBDCs - A Cyberpunk Dystopian Nightmare

It all started 12 years ago with Bitcoin. There had been unsuccessful private attempts of creating a digital currency before as cypherpunks were planning the digital money revolution since the 80s.

Bitcoin was the first one that appeared to be working, and after a couple of years of test-phase it started rapidly rising to prominence, however, cryptocurrencies today are still at a young and uncertain state.

Governments are also entering the Digital Cash game with CBDCs. These will be digital currencies not under our control (unlike most cryptocurrencies) but will be centralized administered by banks and governments.

CBDCs are centralized digital currencies run by the Central Bank.

FED coin for the USA, or they will name it probably "Digital Dollar". Digital Euro for Europeans, minted by the European Central Bank, and of course the frontrunner in this race, the Digital Yuan (a.k.a. Digital Renminbi).

But, can we safely assume that CBDCs are an evolution in finance and that cryptocurrencies will not be required when the government digital currencies come into effect?

The CBDC Financial Dystopia

Image: Free Download from Pixabay

Central Bank Digital Currencies as the title suggest are a form of "fiat" currency, backed by our trust in governments.

Each "national" or "fiat" currency is closely associated with a worldwide trust of financial organizations on governments' ability to repay the federal debt.

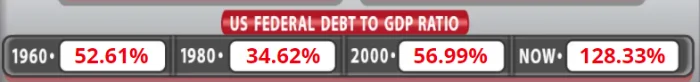

Debt to GDP

There used to be an alarm ringing on any economy when its debt was reaching the ceiling and measures had to be taken from governments to cut back spending.

Usually, this ceiling was reached when the debt/GDP ratio was reaching above 100%. This meant that the total debt amassed by one economy had reached the same level as the GDP it produces. Meaning that the whole economic procedures of the last year were not enough to cover the debt our government has amassed.

Image Source

Normally a counter-measure to reduce debt is for governments to cut back spending. And a means they have in their control is the flow of new money. Cut spending translates to reduced money liquidity in the financial markets.

Then a recession hits and all indicators turn bearish.

Control, Censorship & Financial Surveillance

Source of Image: Pixabay

A part of economists suggests that a CBDC would help create better conditions for organizing the economy and managing better in times of financial turmoil. We can agree that since everything will be digital, the time required to proceed with changes will be negligible, and perhaps this time spared could help alleviate the effects of negative economic events.

But besides that, there is nothing else that a CBDC could help with. Having elasticity in the money supply is of utmost importance to governments, but a CBDC will not change the fact that governments are still not going to be able to foresee an economic meltdown (like in 2008). A CBDC on its own is not a financial entity that could predict or defend core and challenging issues an economy is suffering from.

After examining the Central bank Covid response and the increase of fiat in circulation, it seems that inflation within the next two or three years will once again start rising dramatically. The printing of money from FED, ECB, and all central banks is not on par with economic activity. How is a CBDC going to help with that? It will just increase the rate of inflation faster since the newly printed money will be automatically received by the banking institutions.

We see a push towards a CBDC as a panacea, but instead, it will be a disappointment as CBDCs purpose is not about great leap forwards for the economy. It is about control, censorship, surveillance, and restriction of financial activity.

What changes will CBDCs bring?

Source of Image: Free Download from Pixabay

Have you ever wondered if governments would be ever rushing to create a CBDC if cryptocurrencies didn't exist? There were no plans and no research on a digital currency by banks or governments until just a few years ago.

CBDCs are created to counter the financial freedom Crypto is providing to the population.

Governments and Central Banks find a CBDC a necessity today, after watching the explosive rise of cryptocurrencies. The main reason CBDCs exist is for governments to keep control of finance.

The plan was diverse and the competition that started wasn't going to be a fair one.

There is also a strategy to stop progress in the crypto-flagship, Bitcoin. This started in 2013 and currently, we see a Bitcoin being crippled and not able to perform on-chain transactions without fees rising astronomically. BTC is not able to scale.

However, thousands of cryptocurrencies appeared. And there are plenty that still offers total control of our money, immutability, and financial freedom.

There is also the store of value characteristic that is derived from the fixed and low supply most cryptocurrencies have. This trait is also reinforcing demand and giving an option outside of traditional finance.

CBDCs will not be decentralized. There won't be miners around the world providing proof of work and securing the network from attacks. CBDCs will be a centralized database under the control of governments. One person, the president, or the chairman of the Central Bank will be under control.

Thus, a worse system than what we have now will be created. The only form of "fiat" money that we are in control of is paper cash. With a digital CBDC, the digits in our mobile wallets will not be under our control.

CBDCs are not Cryptocurrencies

Source of Image: Free Download from Pixabay

Some in the field suggest that CBDCs will help cryptocurrencies achieve more recognition and adoption. Somehow they fail to see the effects will be the exact opposite.

CBDCs with the enforcement by governments, will probably completely take over the digital currency market.

Cryptocurrency will remain a niche while CBDCs will keep getting adopted. This is a pessimistic thought but more than 90% of the population will adopt the CBDCs willingly or without major resistance.

Sadly most people are not financially educated enough to understand the risk is with fiat money and not with cryptocurrencies. Moreover, the risk increases when the government fiat evolves into a more centalized future.

Crypto adoption is lethargic

Ten years later, crypto has not been adopted by businesses. Most of the adoption comes from crypto-cards that are Visa/Mastercard and connected an exchange like Coinbase, Crypto.com, or Binance with a bank.

This is not progress, it just presents cryptocurrency as an extra step to the transactions sector. It makes Crypto the third (or fourth, fifth, and so on) function to the transactions mechanism. We don't own the crypto on an exchange.

The main reason for Bitcoin's creation was to cut down the middle man. It doesn't enable commerce and doesn't perform better when a system of third parties and second layers is involved.

In the terms of actual adoption without third parties involved, crypto has failed massively. There had been attempts by communities of projects like Bitcoin Cash and Dash to increase merchant adoption but are still at a very low level of what we were expecting three or four years ago.

While the population knows what cryptocurrencies are, they still don't want to use them. Speculation and price volatility are reasons that mostly characterized crypto being an asset class and not money.

Final Thoughts

Source of Image: Free Download from Pixabay

Besides some very small economies (i.e. Bahamas) China was the first one to promote this digital cash option, in a country where digital payments were already increased and used at a 70-80% rate within the recorded economy.

The meaning of a CBDC is clear in the case of China. An authoritarian government will gain more control in the financial sector with a centralized digital currency under its control.

The rest of the governments will also centralize completely the financial sector, although not in an attempt to counter the influence of the Chinese CBDC as they claim, but to strengthen their iron grip on national financial affairs.

Moreover, there are more implications CBDCs will bring to our privacy since every financial transaction we make will be recorded and supervised by government officials.

Financial transactions will be censorable and monitored.

Can we safely say that we trust our government? Even so, are we going to explain to future generations that our governments can be eternally trusted and have complete control over us?

Have the lessons of history not taught us anything yet? How often in history were governments overthrown or turned authoritarian? What will happen to the centralized digital "fiat" wallets when an event happens and the government just blocks access to our funds?

We will have to comply with anything then, wouldn't we?

We are fighting for the freedom to transact however we want without anyone censoring our transactions. This is a core human right that we shouldn't trade for anything.

Originally posted at Read Cash

Images:

Lead Image from: Pixabay (by geralt)

Writing on the following networks:

Noise Cash

Read Cash

Steemit

Hive

Medium

Vocal

Minds

Vocal.Media

Den.Social (inactive)

Publish0x (inactive)

I'm also active on the following media:

Congratulations @pantera1! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

You should post using https://leofinance.io Your content will do great there and you will earn extra LEO which could easily exceed what you earn in HIVE/HBD. #proofofbrain is another tag worth using.

Thanks for the recommendation. I am testing some features like ecency. So far leo has had better results. I will try using proofofbrain also. I've heard good words about it.