5 Days Till Litecoin Halving - What is This And Why Should You Care? rewards will be "cut" in half

Litecoin is expected to gradually become scarcer in the market due to the halving that will take place on the 5th.

A rule incorporated into the litecoin code (LTC) is set to reduce rewards soon for miners who today guarantee transaction processing on the world's fourth largest blockchain in full value.

5 Days Till Litecoin Halving - What is This And Why Should You Care? rewards will be "cut" in half

In about five days, litecoin will undergo a scheduled change to halve its reward - a process aimed at preserving the purchasing power of cryptocurrency. The mining reward is currently 25 litecoins ($ 2,500) per block and will fall to 12.5 litecoins ($ 1,200) per block on August 5.

With this transition, the protocol will be adding significantly less litecoins to the market after August 5th.

A reduction in inflation is great in any market. Restricting the supply of an asset really does change the dynamics of the market over a longer period of time and this will be the same case for Litecoin when the block reward halves again in 9 days time.

What Is A Halving?

No, the Litecoin network is not splitting in half! What is actually happening is the reward that the miners receive for securing the network, currently set at 25 LTC per block, will reduce by a drastic 50% - hence the use of the halvening. This means that the influx of LTC currently entering the ecosystem will see a 50% reduction - 50% fewer coins are now entering the supply of the market as before.

The Litecoin block halving is scheduled for block number 1,680,000 which is expected to be mined on August 5 2019. The block reward is set to be halved every 840,000 blocks and this is coded into the software from launch.

So What Happens During The Halving?

Well, opinions are greatly mixed on this topic. Many people believe that this should help the price rocket in the run up to the halving. However, other experienced players within the market actually believe that the value derived from the halving is actually already priced into the market. Why would it not be? We all knew about the halving ages ago as the block number has always been set.

The first block reward halving for Litecoin took place way back in 2015 at block 840,000 when the reward was cut from 50 LTC to 25 BTC. In the month before the halving was expected, Litecoin saw an epic price surge totalling 400% as it increased from around $1.70 to around $8.00. However, in the two months following the halving, the price of Litecion dumped by a total of 75%.

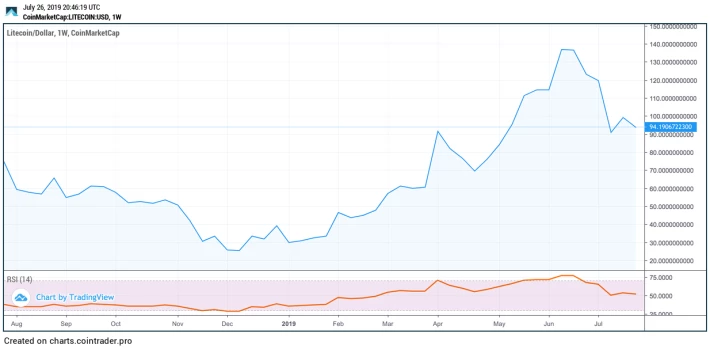

IF we are to take a look at the LTCUSD market beneath, we can see why many Litecoin HODLers believe that the block halvening is already priced in.

Since the start of February this year, Litecoin has surged by a total of 194% from $46 to a high of $138 which is a very significant increase that can largely be attributed to early traders anticipating the block halving to have a positive effect on the price - even before the halving.

What Does Charlie Think About It All?

No not Charlie Chaplin! I'm talking about LTC founder and creator Charlie Lee.

Lee has aired some interesting concerns about the upcoming halvening as he believes that this may have a “shocking” impact on miners. In a recent interview, Lee had stated that he thinks that some miners will become unprofitable after the block halvening leading to these miners to shut off their machines. The blocks will start to slow down as a result of a number of miners turning off their machines as the network has less power. However, after the difficulty has readjusted (every 3.5 days) the block time should return back to its normal speed as equilibrium is reached again.

Regarding the price, Lee believes that the halving is already priced in as investors have always known about the halving. However, he also believes there may be some short term increases due to traders believing that the halving will still allow the price to increase causing them to buy, which causes the price to increase - a self-fulfilling prophecy.

Litecoin this year

The cut in half, therefore, seems similar to interest rate hikes and other measures initiated by central banks around the world in tackling high inflation, so investors may be tempted to buy litecoins as they head to the event.

However, while cryptocurrency is a gamble for the next few days, big gains seem unlikely with price action over the past six months, suggesting that an impending supply cut has already been priced by experienced traders.

Litecoin doubled in value in Q1

Litecoin, which traded at $ 30 on Jan. 1, ended the first quarter at $ 61, representing a 100% gain. This was LTC's best-ever first quarter performance, as reported by CoinDesk on March 31.

Most importantly, cryptocurrency made stellar gains in the first three months of this year, despite the flat action on bitcoin, the main cryptocurrency.

Essentially, LTC entered a bullish market before bitcoin confirmed a downtrend change, with a large move above key resistance at $ 4,236 on April 2. Prices peaked above $ 140 in June before dropping to $ 80 that month.

Litecoin's non-price metrics have also risen sharply since mid-December, reaching new highs several times over the past two months. For example, hashrate or computing power devoted to mining rose to 523.81 TH / s on July 14, up 258% from the low of 146.21 TH / s seen in December 2018, according to with bitinfocharts - https://bitinfocharts.com/comparison/litecoin-hashrate.html.

Miners' share may drop after litecoin halving

Mining profitability is likely to fall by 50%, along with block rewards, as mining difficulty - a measure of how difficult it is to maintain and increase the blockchain - rarely adjusts immediately. Thus, some miners may switch to other blockchains, leading to a drop in the hashate.

Computing power, however, may increase in the coming months, as falling inflation rates to 4% from the current 8.4% per year are likely to bode well for LTC prices. This would offset the drop in mining profitability.

It is worth noting that the hashate fell 15% near its previous halving before recovering over the next two weeks, according to Binance Research.

Conclusion

At the end of the day, the 50% reduction in inflation will be a strong positive for all LTC holders. As the influx of LTC starts to become restricted on the market, this should lead to increased prices due to the new constraints. However, this is to be seen as a long term effect as the majority of traders will agree that LTC will dump after the halvening.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

The #steemace tag is only for gaming related content. Please only use the tag if it fits this category. If you think you have been downvoted on accident you can contact us on Discord or answer to this comment. Thanks for your understanding. (Our downvote will not affect any other rewards other than GG on SteemAce)