Trends for crypto 2020 - Watch out for the incoming Bitcoin January price dump and new lows

Happy New Year 2020 everyone, may your trade winds be fair and fine. Last year was a hectic ride for Bitcoin as it spent the first half going parabolic and the second half retracing furiously, and ending off the past months trading sideways in a particularly boring channel.

Source

But 2020 is going to be potentially even wilder guys, so “hodl” on to your Bitcoin as the bulls pull the sleigh across the snow of winter and onto the tropical beaches of the coming Crypto Summer.

Proof of Keys 3 January

First we have the Proof of Keys event on 3 January in just two days time as I write this, coinciding with the first ever launch or birth of Bitcoin. January 3 2009 was the day Satoshi Nakamoto, the godfather of Bitcoin, launched the Genesis Block. Proof of Keys is a great theme and meme to remind the crypto community that we are our own bankers and that we need to take all our crypto off the exchanges on that day to emphasize the fact that we have sovereign control over our holdings, we are are own bankers, and even if our crypto is ours, if it is still in an exchange wallet, then it’s “not your keys, not your crypto”. It crypto we trust no one, it is known as a “trustless” system. You trust the math and the code or smart contracts, but not the bank, broker or exchange.

Personal control needs to be in our own hands, and exchanges are not always safe, as we have seen over the years with numerous exchange hacks, like Mt Gox, where millions of dollars worth of crypto can be hacked and stolen in a flash. So we get to celebrate and honor Satoshi, and Bitcoin, on the 3rd of January by removing our crypto holdings from the exchanges – just to see if they really have the cold hard crypto and can give it to us. If we all pull out our crypto at once, we will know if the exchanges are legit in their holdings, like asking a bank at a bank run to pay us out in cash. Usually the bank will run out of fiat to actually repay everyone. Similarly we don’t want the exchanges to go the same way, at the loss of of our crypto, so we put them to the test this week.

January as traditional Bitcoin price dump month

Now you may or may not have heard of this statistic. If we look at the Bitcoin weekly chart we can see that in the past, January has by far been a month of significant bearish downside movement in price. January 2017 saw price fall almost 35%, 2018 obviously was the post-ATH crash in price, and even 2019 saw price make a second fall, back down to the local yearly low around $3200. This came as a 20% drop during the month itself. And if we go back further, the same significant price collapse occurs in previous years over January. So, whether to balance out tax returns, or celebrate Chinese New Year or whatever the theme of the month, it may well be due to recur in the coming four weeks, so be ready for a potential drop in price back down to test previous lows, possibly even as low as $3-5k support levels.

I have some buy orders ready waiting to be filled at these lower price ranges, in the low $6k region to begin with. If price drops even further into the $5k region, then I will certainly pick up some more. In this way by DCA, we can buy the dip at this re-accumulation zone before the next parabolic bull run. It’s coming guys.

Halving May 2020

Besides these January highlights to look forward to, 2020 is one of the big four years. Every four years or so Bitcoin has the “halving”, where the block reward rate is halved for miners. This is only 4 months away or 120 days or slightly more, so not long to go now. We traditionally see price dip somewhat before the day and even after, only to gradually rise after that. So we could see a bearish first half of this year and a bullish second half. Therefore patience is the key factor this year. The bull run is so close now, just a year or two left and we should be at new ATH. It seems long to wait, since we have already waited two years since the last ATH, but we simply need to take the long term bigger view and hodl for now.

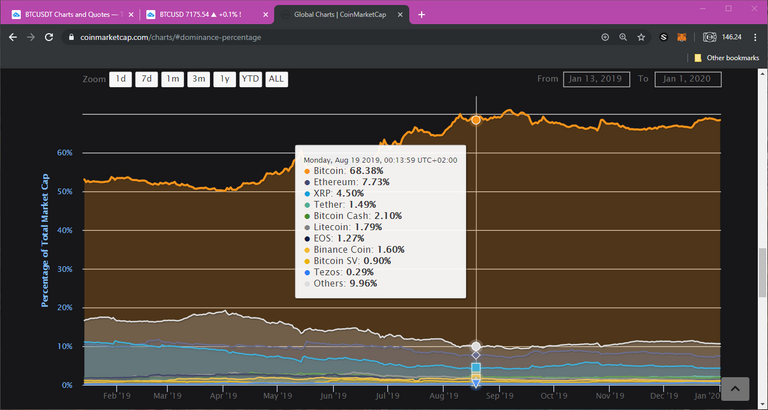

Bitcoin market cap

If we look at CoinMarket Cap we can see that Bitcoin dominance dropped to 50% in April last year. This means that the alts took up the other entire 50% of the market, which is significant, even if they all had to combine to match Bitcoin. ETH rose to a high of 10% and “other” or all the rest of the 3000 or whatever smaller alts claimed close to 20% of the market capitalization. Then the bigger alts took up the rest of the market cap. Since then however, Bitcoin dominance rose to a massive 71%, while the “other” category of minor alts fell by over half. So the majority of alts took a real dip in 2019 to say the least.

What ever happened to alt season? It never happened. So, as Bitcoin dominance again shows a gradual decline from 71% down to 65% a few months ago but now back up to 68%, will it drop once more, implying that an alt season can now kick in for 2020? Don’t hodl your breath just yet on this prediction, although it may still play out after all. So all you alt bag holders – perhaps this will be your year. I know my LTC bags are not looking as happy as they should be at present, so let’s see what 2020 will do for us all in that alternative token category.

China’s digital central bank coin

As China rises to world dominance, it also forges ahead of the pack in blockchain adoption and the digitalization of its national currency, the yuan. Along with some other countries, 2020 will see the rise of the sovereign or national central bank digital currency. Goodbye paper fiat bank notes, not worth the paper they’re printed on. Unfortunately the CBDC may be built on a blockchain or DLT but it will not be decentralized. It will be a crypto in name only, totally controlled by the dictatorship, in China’s case, and so more of a tool for further oppression and control than one of sovereign empowerment and liberation, as Satoshi Nakamoto wished. One thing is for sure, and that is the fact that China will outpace USA and the west by adopting blockchain tech sooner. They already do most of the Bitcoin mining globally, so the west may be in their shadow from here on.

Anyway, whatever happens, 2020 is going to be a very exciting year for you if you are a crypto enthusiast. And as the next parabolic bull run gets ever closer, the anticipation is mounting. Let’s hope banks still allow us to withdraw our money from our local exchanges when we want to cash out. Laws are already changing and we may need to find alternative ways to get our profits or spend our Bitcoin. Either way, I wish you all the best for 2020 and happy trading.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.