Significance of White Label Digital Banking Services on Customer Retention

The financial services company has undergone revolution in an era of rapid innovations and expanding customer tastes that is characterized by technical technologies. White Label digital Banking Services is an example of a new trend that challenges existing banking paradigms in terms of innovative, tech-driven solutions. In this post, we’ll examine white label digital banking services in detail, revealing what they entail, the advantages, and aspects worth considering as they continue redefining the banking landscape and creating possibilities for organizations to provide their clients with enhanced financial service in today’s digital age.

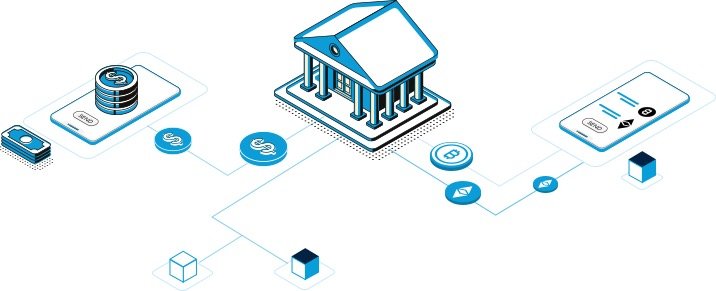

A strategic offering, white-label digital banking services enables banks, organizations and FinTech firms to supply comprehensive banking and financial solution via their brands but not having to establish a banking infrastructure from the beginning. This helps organizations to join or grow further in digital banking at a minimal cost, as it is not pricy. Businesses can acquire access to the experience of renowned fintech organizations and adapt the available alternatives. Mobile banking applications, online account management, payment processing and many more features customized for them are some of the services that they should supply in order to develop personalized experience for their users.

White label digital banking services have the advantage that they are promoted in business settings with attention to branding and user experience allowing each of the unique companies the chance to offer state of art solutions under their own labels. With more clients wanting on the go, user-friendly, and seamless banking experience, white label digital banking services are becoming vital when it comes to staying relevant in the financial Services marketplace. It is fast and affordable for the firms to adopt the digital age through better client experience and remaining on top of changing times.

The Impact of White Label Digital Banking on Customer Retention.

The idea of White Label Digital banks is one powerful tool for building client trust in this quickly changing world. The innovative banks offerings offered by diverse organizations under their name are altering how establishment connect, as well as maintain clientele. Here’s how White Label digital banks is a path towards consumer loyalty:

Personalized Customer Experiences: The advantage offered by white-label banks is that it allows the business freedom to change and tailor their bank services to satisfy the particular requirements and taste of their clients. These platforms supply configurable functionality as well as construct an easy to use interface for their clients hence boosting the consumer experience in general. It is also achievable to develop client loyalty by the perception of the bank understanding its customers individual financial needs and providing these requests.

Accessibility and Convenience: Customers enjoy round the clock digital banking services where they may access and conduct transactions on their accounts any place anytime all over the world. The degree of accessibility and ease offered develops client loyalty by enabling consumers to control their accounts at their own speed, therefore considerably decreasing the need for physical branch visits.

Streamlined Financial Management: Many white-label digital banking services contain things such as budgeting tools, financial data, and even cost monitoring services. They empower customers with power to be in command of their financial wellness. Bank’s customers will develop loyalty if they recognize that there are tangible benefits from the employment of specific bank tools aimed at enhancing their financial management.

Enhanced Security: When it comes to digital banking, security is of top priority, which is why white-label digital banks offer state of the art security processes. Such technologies provide stronger encryption, multi-factor authentication, and real-time fraud detection to convince clients that their financial information is secure. Customer loyalty depends on trust, this includes faith in the surroundings and the product itself.

Regular Updates and Innovations: White label banks are often driven by a fintech provider, who offers services on a regular basis and refreshes these services often. Therefore, there are always fresh features and technologies available for clients. Such regular improves and demonstrate a dedication to client pleasure which leads to customers loyalty.

Seamless Integration: Digital white-label banks should fit into their clients habit. They usually feature capabilities such as mobile check deposits, peer-to-peer payments as well as an account aggregation which aids in managing various transaction accounts inside a single platform. A bank should ensure that their users lead easy financial life through products and services.

Cost-Efficient Services: Offering cost-effective services like reduced charges, competitive interest rates and even in some conditions the fundamental free bank accounts is made practical by implementing white-label digital banking solutions in enterprises. The cost benefits in turn have a huge influence on customer loyalty since customers opinion of value is crucial.

Key Approaches for Cultivating Customer Loyalty Through White-Label Digital Banking

The building of client loyalty in white-label digial banking has to be systematic and aimed toward improving the customer experience, developing credibility, and offering constant value. This is how you can excel at this:

Seamless Onboarding: The first impression is essential. Make new customer’s onboarding simpler with fast and easy account setting. Make sure that you give clear instructions, simple interfaces, and modest documentation demands. This helps generate a good client experience in the earliest phases of the relationship.

Personalization: It is through data analytics where it should be conceivable for you to discover how your customers act and what they would prefer in a range of instances. Customize the online banking system in order to offer custom preferences, products, and material. Services that tailor themselves to satisfy distinct users are highly valued by the clientele.

User-Friendly Design: Make sure the user’s interface and experience is intuitive and friendly. A pleasant, user-friendly site that does not frustrate the user and is utilized often.

Educational Resources: Offer the content in the form of articles, videos, and lessons that may be available through the digital banking system. Financial empowerment of clients helps to develop their financial literacy and increase consumer loyalty by showing that you care about them financially.

Regular Communication: Inform clients of updates, new features, policy changes, and security measures. Continuous interaction enables customers to trust you as they keep appreciating your service.

Quick Customer service: Provide immediate customer service using many platforms including chat, e-mail and phone. Settling challenges and queries immediately displays dedication to clients.

Enhanced Security: Constantly put money into the platform’s safety. Keep updating security measures as well as advising customers on safe practices. Trustworthiness and loyalty result from a secure platform.

In conclusion

Developing and sustaining a loyal customer base is vital in the competitive world of white-label digital banking. Adopting these tactics will ensure that the clients stick to utilizing your digital banking services rather than exploring for alternative options.

https://inleo.io/threads/wealthwess/re-leo-curation-htkhhkm3

The rewards earned on this comment will go directly to the people ( wealthwess ) sharing the post on LeoThreads,LikeTu,dBuzz.

Congratulations @wealthwess! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: