Mynt raises $23 Million to invest in the creation of an artificial intelligence-based, SME-focused expense card!

Sufyan | Unsplash

If there is one thing we can assure, it is that as small and medium-sized enterprises tend to grow and multiply, a higher level of attention is focused on them with the intention of being able to in some way manage internal finances in each of them. Technology, as we have mentioned on more than one occasion, is the number one ally. And with it comes one of the standards that is adapting to these times; artificial intelligence.

In this particular case, Mynt could be a clear example of this. We are talking about a Swedish startup that has created a platform aimed at facilitating expense management in SMEs. It is based on artificial intelligence in order to offer corporate cards with which finances can be managed.

The corporate cards offered by Mynt have Visa as a partner, and it is unlikely that they would consider American Express as Baltsar Sahlin, CEO and co-founder of Mynt, stated that this is a direct competitor. In an interview, he mentioned that there is a certain difficulty when issuing cards and managing expenses, which presents a good opportunity to find a solution to the issue, that is the reason why the Mynt platform was founded. Furthermore, he emphasizes that there is a gap between banks and accounting systems, which directly impacts SMEs.

This was one of the reasons why it was a good idea to partner with Magnus Wideberg, a systems engineer with extensive experience in the financial sector. After founding Mynt, there was a significant expansion, so not only is there some type of activity with companies of Nordic origin, but it is also reaching countries like the United Kingdom, as well as the rest of the European markets.

Perhaps the creation of Mynt would not have been possible without Johan Obermayer, who was a colleague of Sahlin at Ericsson, where they both noticed the difficulty in managing expenses and the problems it brought to small companies, which I imagine were preventing them from growing within a reasonably considerable time.

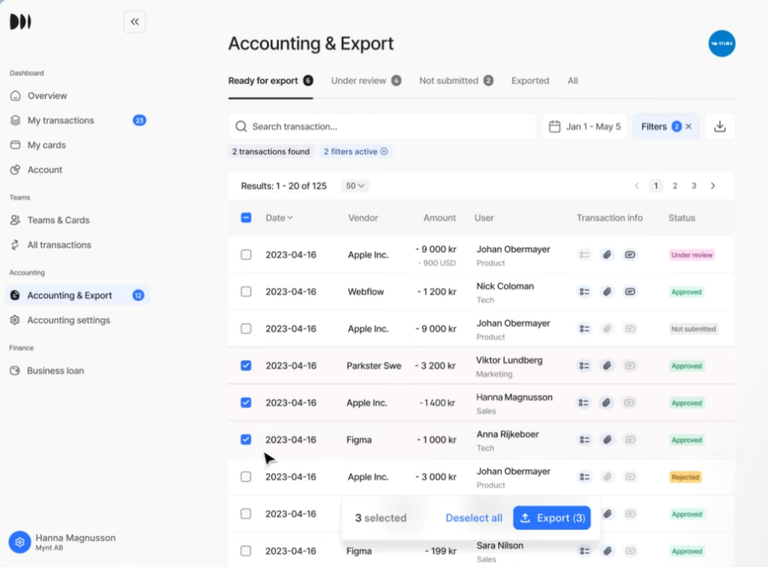

What may be surprising is the technology it possesses. Mynt has the ability to integrate into third-party systems through an API; with this in mind, it is possible to improve the way card issuance services are offered to enterprise resource planning companies, as well as banks and fleet and fuel providers.

It could be said that a strategic point that gains importance is that Mynt preferred to promote this project in a Nordic region because the payment and accounting systems are differently structured according to Sahlin. This is more about designing the products for a certain number of employees, making it much more flexible, with an ideal design for up to 500 employees.

At this point, it is worth mentioning that automation is key in these emerging companies. Especially considering that expense management still has some deficiencies and requires a lot of time and commitment. In these cases, the accounting departments fall short, where in many instances, their employees are not accountants, and in the SME sector, these departments may be very small or not enabled at all.

In this sense, it is worth noting that technology plays a significant role in expense management and administration, as it definitely speeds up processes so that the focus can shift towards other important areas, related to the company's growth and how customers begin to choose them.

It seems that Mynt is doing very well. They have recently managed to negotiate a funding round for $23 million, led by the Vor Capital firm. Other investors that have already been present like CNI and Incore have also participated, making the total amount raised reach at least $52 million. This leads us to assume that Mynt's current valuation has reached $210 million, which is truly remarkable and shows significant growth. We should also highlight the fact that the customer base has grown from 3,000 to an astonishing 12,000 SME customers within a year.

It remains to be seen how much more growth can be achieved in the medium term. The truth is that corporate cards are still not being widely used by SMEs as one might expect, although this represents an opportunity for market expansion and growth.

- Main image edited in Canva.

- Screenshots obtained from Mynt's official website.

- I have consulted information at techcrunch.com.

- Translated from Spanish to English with Hive Translator.

Posted Using InLeo Alpha