Matera raises $100 million from Warburg Pincus to boost its US presence | Brazil leads in instant payments

Blake Wisz | Unsplash

Instant payments are revolutionizing many parts of the world. It is indeed a very efficient model for making payments that could take longer than expected. However, not all companies providing this technology are achieving the success expected of them. It is all about how users start to adopt it in a way that is useful in their daily lives.

In my country's case, I can testify that MercadoPago has been a company that has successfully navigated this situation. It started with the MercadoLibre platform, an online buying and selling platform, which later added a payments section that is now the most widely used. In this context, payments through QR codes or aliases greatly facilitate the payment process and save a significant amount of time.

What is interesting about all of this is that this system is designed to work with all kinds of banks, so one does not have to worry about it. It is likely that in every store or supermarket we may come across a sign indicating that this form of payment is accepted, representing enormous flexibility.

A similar situation is seen with Pix; a payment system created by the Central Bank of Brazil, which has gained such popularity that it is being considered for expansion beyond Brazilian territory. Over time, it has seen such adoption that it is estimated to be used by at least 153 million Brazilians and 15 million businesses.

In both cases, this technology enables anyone to progress in their goals or projects by receiving payments through this method, widely utilized not only by traditional merchants but also by street vendors. All that is needed is a wallet with an installed application to start making and receiving payments. It's as simple as that.

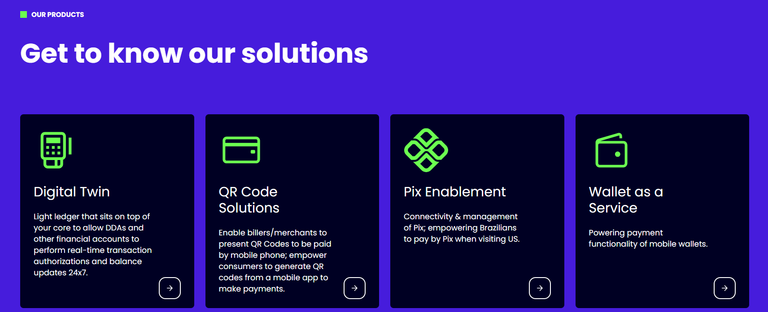

The company called Matera plays a crucial role in supporting this technology and provides software covering instant payments, QR payments, and the necessary connections to other financial institutions. In the case of Pix, it could be considered an ecosystem, as it not only serves as a network for transactions but also integrates all these functions.

One thing to consider is that this payment method is gradually being seen as a replacement for credit card payments. Although both could potentially coexist, and in fact, that is what is happening. Credit card payments are an option many people around the world consider to alleviate end-of-the-month concerns.

Matera also functions as a major service provider, and that is why it has seen significant growth in recent times. It has increased its revenues by 30% in 2023 and has grown at least four times since its establishment in 2020 when it entered the Brazilian market.

Recently, Matera has announced that the firm Warburg Pincus has made a $100 million investment. With this, Matera aims to boost the market in the United States and replicate the success seen in Brazil. While instant payments exist in the U.S., such as the FedNow service, they have not been widely adopted, or the adoption has been considerably slow, presenting a significant opportunity. Clearly, this suggests another means of market access.

As Matera's goal, it aims to reach the figure of one billion Pix transactions per month, with the current figure being 500 million Pix transactions. There are 280 customers who have placed their trust in this company, in addition to two globally renowned banks and 10 of the leading US banks.

Matera's relationship with Brazil is more than just impressive. In this case, Brazil has managed to lead the market with an adoption rate of 75% of its population, while Matera continues to build a functional infrastructure that has the potential to expand worldwide and be considered to bring a more widely used payment system to every corner, thus leading in providing technology.

- Main image edited in Canva.

- I have consulted information in techcrunch.com .

- Screenshots taken from the official Matera website.

- I have used Hive Translator to translate from Spanish to English.

Posted Using InLeo Alpha