U.S. Rep. Byron Donalds Introduces Legislation to Solidify Trump’s Bitcoin Reserve Plan

KEY FACTS: Today March 14, 2025, U.S. Representative Byron Donalds (R-Fla.) is introducing a bill to codify President Donald Trump’s executive order from March 7, establishing a U.S. Strategic Bitcoin Reserve, which consolidates approximately 200,000 Bitcoin—worth $17 billion—and $400 million in other digital assets seized through forfeiture into a federal stockpile. The legislation aims to make the reserve a permanent fixture, protecting it from reversal by future administrations, and aligns with Trump’s vision to position the U.S. as the “Crypto Capital of the World,” supported by figures like Senator Cynthia Lummis (R-Wyo.). Despite backing from 23 states exploring similar measures, the bill faces opposition from Democrats like Representative Gerald E. Connolly (D-Mich.).

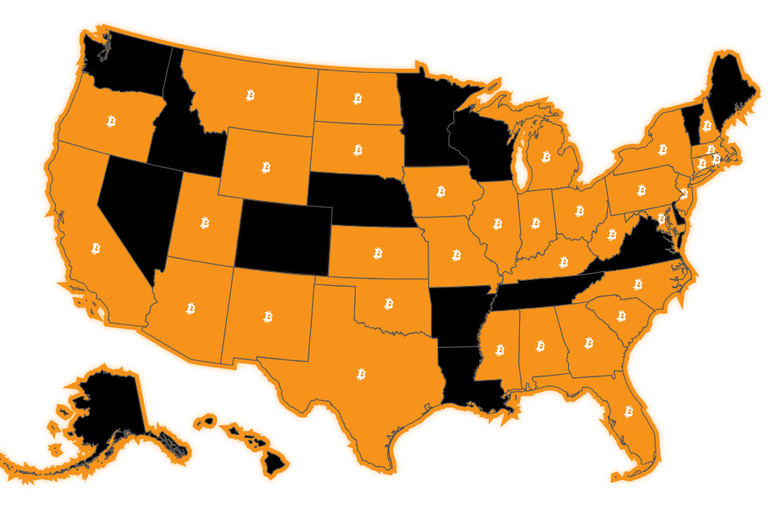

US states with Bitcoin reserve bill propositions. Source: Bitcoinlaws

U.S. Rep. Byron Donalds Introduces Legislation to Solidify Trump’s Bitcoin Reserve Plan

U.S. Representative Byron Donalds (R-Fla.) is set to introduce a groundbreaking bill in Congress today aimed at codifying President Donald Trump’s executive order establishing a U.S. Strategic Bitcoin Reserve. This legislative move, which comes just one week after Trump’s high-profile executive action, seeks to cement the reserve as a permanent fixture in the nation’s financial strategy, potentially shielding it from reversal by future administrations and further integrating Bitcoin into the fabric of American fiscal policy.

The bill, which has yet to be formally titled, builds on Trump’s March 7 executive order that created both the Strategic Bitcoin Reserve and a broader National Digital Asset Stockpile. That order directed the U.S. government to consolidate Bitcoin and other cryptocurrencies seized through criminal and civil forfeiture proceedings into a federal reserve, rather than selling them off as had been the practice in previous years. Currently, the U.S. government holds approximately 200,000 Bitcoin—valued at roughly $17 billion—making it one of the largest institutional holders of the cryptocurrency globally. The reserve also includes an additional $400 million in various other digital tokens, accumulated largely through law enforcement actions like the Silk Road seizures and the Bitfinex hack investigation.

Donalds' legislation aims to provide a statutory backbone to Trump’s initiative, ensuring its longevity beyond the current administration. Donald in a statement to Bloomberg said:

“For years, the Democrats waged war on crypto,”...“Now is the time for Congressional Republicans to decisively end this war.”

The Florida Republican emphasized that the bill would prevent future presidents from dismantling the reserve through executive action alone, a vulnerability inherent in Trump’s original order. By embedding the policy in federal law, the legislation could lock in Bitcoin’s role as a strategic asset for the U.S. government, signaling a long-term commitment to cryptocurrency as part of the nation’s economic framework.

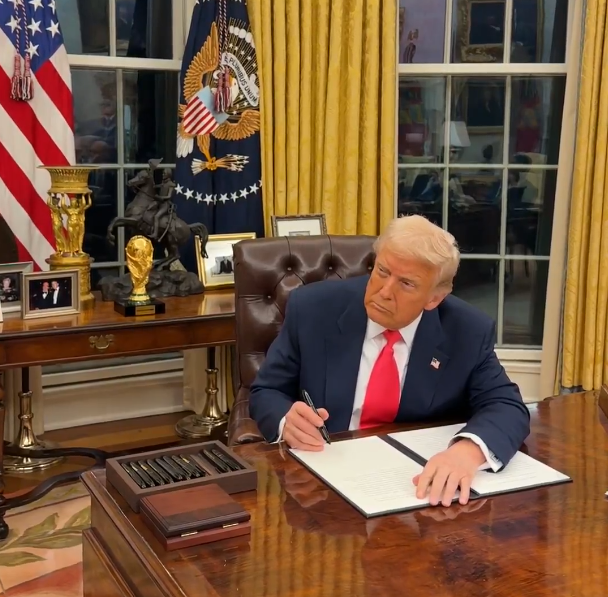

Source: Margo Martin

Blockchain regulatory experts are supporting the potential implications of the bill. Anndy Lian, an intergovernmental blockchain expert and author has said that the bill, if passed, could mark a turning point in how the U.S. approaches cryptocurrency, moving it from a peripheral concern to a “centerpiece” of national financial strategy.

“The legislation aims to cement the reserve as a permanent fixture, shielding it from reversal by future administrations,”..." the bill builds on Trump’s earlier executive action by providing a statutory backbone, potentially clarifying the government’s stance on digital assets.”

The introduction of the bill comes amid a flurry of state-level activity supporting Bitcoin reserves. According to data from Bitcoinlaws, at least 23 U.S. states have introduced legislation to integrate Bitcoin into their fiscal policies, showing a growing grassroots momentum for cryptocurrency adoption. States like Texas and Utah have already passed or are debating their own Bitcoin reserve bills, with Texas’ SB-21 passing the state Senate on March 6 and Utah’s HB230 advancing after amendments. This state-level enthusiasm mirrors the federal push, suggesting a broader shift in American governance toward embracing digital assets.

However, the bill is not without its critics. On March 13, Representative Gerald E. Connolly (D-Mich.) sent a letter to Treasury Secretary Scott Bessent, urging the administration to halt all efforts to establish the Strategic Bitcoin Reserve. Connolly argued that the plan offers “no discernible benefit to the American people” and accused Trump of pushing a policy that would enrich himself and his donors, calling it “unsound fiscal policy” and “the most lucrative get-rich scheme yet” for the president. Connolly’s letter also criticized Trump for failing to consult Congress before issuing the executive order, asserting that such a significant shift in financial strategy requires legislative authorization. Representative Maxine Waters (D-Calif.), a prominent member of the House Financial Services Committee, echoed these concerns, pointing to Trump’s personal cryptocurrency ventures—such as his World Liberty meme coin as evidence of potential conflicts of interest.

Despite the opposition, the bill has garnered support from key figures in the crypto-friendly wing of the Republican Party. Senator Cynthia Lummis (R-Wyo.), a vocal advocate for Bitcoin, reintroduced her own BITCOIN Act earlier this week, which would authorize the U.S. government to acquire up to 1 million Bitcoin—approximately 5% of the total supply—over five years. Lummis’ legislation, first proposed in July 2024, complements Donald’s efforts by outlining a concrete acquisition strategy, potentially funded by revaluing the Federal Reserve’s gold holdings. Senator Tedd Justice in a statement supporting the reintroduced BITCOIN Act, said:

“I’m proud to join Senator Lummis on this common-sense bill to create a strategic Bitcoin reserve and codify President Trump’s executive order.”

If Donalds' bill passes the House and Senate, a process that could face significant hurdles given the partisan divide over cryptocurrency, it would represent a historic step toward legitimizing Bitcoin as a mainstream financial instrument in the U.S. The legislation would also align with Trump’s vision, articulated during a White House Crypto Summit on March 7, to make the U.S. the “Crypto Capital of the World.”

For now, the bill’s fate remains uncertain. It will need to navigate a Congress still grappling with regulatory uncertainty around digital assets, as evidenced by two pending bills, the Stablecoin bill, and the Market Structure bill, aimed at defining the legal scope for cryptocurrency.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO