Nigeria Restricts Fintech Onboarding, Target KYC-evading Crypto Investors

KEY FACT: Nigeria's Central Bank has halted the onboarding of new customers to four fintech firms Kuda Bank, Moniepoint, Opay, and Palmpay, in its stride to enforce 'Know Your Customer (KYC)" compliance in crypto and traditional investing.

Created on Corel Paint

The Central Bank of Nigeria (CBN) has issued a directive to four fintech companies to pause onboarding new customers, in a bid to strengthen the Apex bank's stride in enforcing Know Your Customer (KYC) compliance in crypto and traditional investing. The onboarding restriction is motivated by Nigeria's finance-related law enforcement agency, the Economic and Financial Crimes Commission (EFCC), which recently blocked 1,146 bank accounts allegedly involved in unauthorized forex dealings.

The affected fintech firms include Kuda Bank, Moniepoint, Opay, and Palmpay. The fintech firms have been linked to allegations of accounts being used for illicit foreign exchange transactions. A report from TechCabal quoted a person familiar with the situation thus:

“The CBN feels like a lot of crypto traders were leveraging the fintech platforms to disrupt the FX (Forex) market.”

On the flip side, an analysis of the 1,146 blocked bank accounts shows that 90% of the accounts implicated in the illicit forex transactions are with commercial banks, and only 10% are with fintechs. Meanwhile, existing customers' deposits and banking activities are not affected. One of the fintech startups posted a notice on their website:

“We’ve temporarily paused new signups on our platform. This means that you’ll be unable to open a new account at the moment. We apologize for any inconvenience this may cause.”

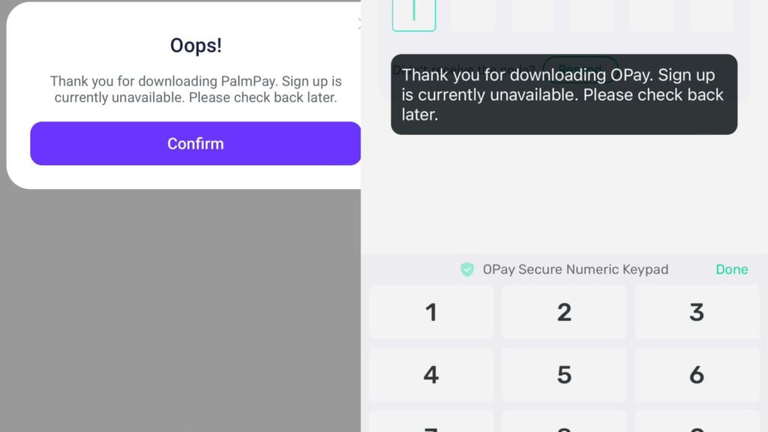

Screenshots from some of the affected fintechs. Source: Palmpay, Opay

Crypto enthusiasts have queried CBN labelling them to be partially targeting fintechs while ignoring the commercial banks. Commercial banks in Nigeria have indeed lost customers to the fintech startups. Reasons for this range from fast and hitch-free transactions to no or insignificant fees as compared to layers of related issues with commercial banks.

It is obvious that commercial banks also have a better relationship with the nation's financial regulator while fintechs are yet to build that type of relationship and help their perception with the CBN.

It is rather worrisome that Nigeria, after becoming the first African country to launch its central bank digital currency in October 2021, and catapulting itself to the top of the list of countries across the world with a pro-crypto outlook, is now all out to crush the bloom of cypto and related investment in its economy.

On the whole, industry experts believe that this Central Bank’s new KYC rules may not solve what is now described as a “fraud pandemic”.

This turn of events is raising questions such as:

- Will this effort by the government successfully end fraud or is it targeted at scrapping out crypto from the Nigerian economy?

- Will this make the fintech startups stronger or would they bow to pressure to give way to commercial banks?

- Will this effort by the CBN help to recover the value of the Naira?

Let's see what happens in the days ahead.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha

Our Rep is low due to wrongful #Downvotes

USE #BILPCOIIN OR #BPC TO EARN BPC TOKENS

Via Tenor

Credit: rickonthemoun10

Earn Crypto for your Memes @ HiveMe.me!

lolztoken.com

ERROR: Joke failed.

@bpcvoter1, You need more $LOLZ to use this command. The minimum requirement is 0.0 LOLZ.

You can get more $LOLZ on HE.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Sir, KYC rules is worth paying attention to. I guess this rules is to favours commercial banks and nothing less.

This is worth reading sir!