Decentralized Exchanges Hit Record $462 Billion Monthly Volume

KEY FACT: In December 2024, decentralized exchanges (DEXs) hit an all-time high with monthly trading volumes reaching $462 billion, driven by optimism surrounding favorable U.S. regulatory prospects following Donald Trump's presidential election victory. Leading the surge, Uniswap recorded $106.41 billion in trading volume, followed by PancakeSwap at $96.42 billion and Solana's Raydium at $58 billion, boosted by increased activity on Solana's decentralized applications (DApps). Memecoins contributed significantly, though the memecoin market faced a sharp $45 billion correction later in the month, with its market capitalization dropping from $137 billion to $92 billion by December 23.

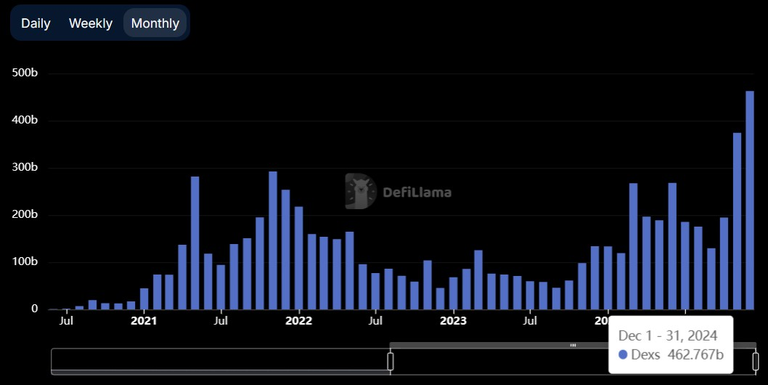

Monthly decentralized exchange volume. Source: DefiLlama

Decentralized Exchanges Hit Record $462 Billion Monthly Volume

In December 2024, decentralized exchanges (DEXs) achieved a significant milestone, with monthly trading volumes reaching an unprecedented $462 billion, as reported by decentralized finance (DeFi) data platform [DefiLlama.

This record-breaking volume continues the upward trend observed in November, which recorded a monthly volume of $374 billion. The surge is attributed to the anticipation of a more favorable regulatory environment in the United States following Donald Trump's victory in the presidential election.

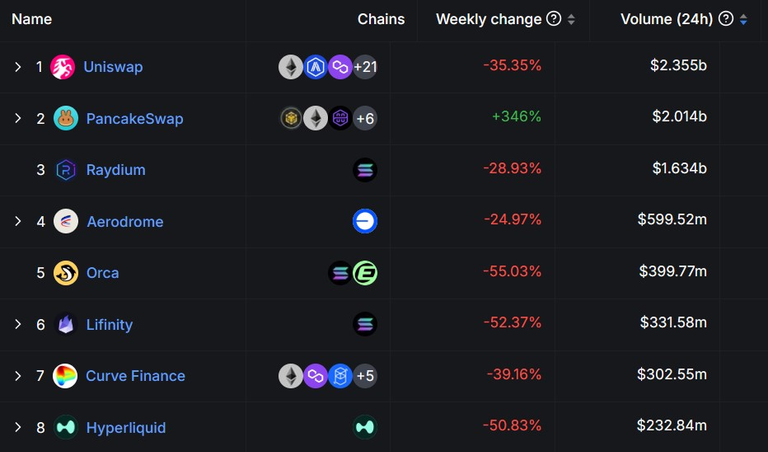

Uniswap maintained its position as the leading DEX, recording $106.41 billion in trading volume over the past 30 days. PancakeSwap followed closely, securing second place with a $96.42 billion monthly volume. Solana's largest DEX, Raydium, ranked third with a trading volume of $58 billion during the same period. This increase aligns with a revenue boost in Solana's decentralized applications (DApps) during November.

Top decentralized exchanges by monthly trading volume. Source: DefiLlama

Other notable DEXs include Aerodrome and Orca, occupying the fourth and fifth spots respectively. Aerodrome reached $31 billion, while Orca reached $22 billion. Additionally, Lifinity, Curve Finance, and Hyperliquid collectively recorded a volume of $43.6 billion.

On December 17, research platform Syndica reported that Solana-based DApps generated $365 million in revenue in November, largely driven by meme coins created on the Solana meme coin launchpad. Despite the overall growth in DeFi trading volumes, the memecoin market experienced a sharp correction in December.

According to CoinMarketCap data, the total market capitalization for meme coins peaked at $137 billion on December 9 but declined by $45 billion to $92 billion by December 23. Currently, the market cap stands at $95 billion, reflecting a 20% decrease from its value on December 1. The initial surge in meme coin market capitalization earlier in the month was likely driven by increased interest from U.S.-based trading platforms listing meme coins and Pepe (PEPE) reaching a new all-time high.

These developments highlight the dynamic nature of the cryptocurrency market, with significant fluctuations in trading volumes and market capitalizations across different sectors. The DeFi ecosystem has continued to evolve significantly and is likely to influence trading activities and asset valuations.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha