Circle and Intercontinental Exchange Partner to Integrate Stablecoin in TradFi

KEY FACTS: Circle and Intercontinental Exchange (ICE) announced a memorandum of understanding to integrate USDC and Circle’s tokenized yield product, USYC, into ICE’s financial ecosystem, including its derivatives exchanges and clearinghouses. This partnership aims to bridge cryptocurrency and traditional finance, leveraging stablecoins to enhance capital market efficiency. Amid a supportive US regulatory climate under the Trump administration, the collaboration could redefine financial operations by combining Circle’s blockchain expertise with ICE’s global infrastructure.

Source: Circle/ X

Circle and Intercontinental Exchange Partner to Integrate Stablecoin in TradFi

Stablecoin issuer Circle has teamed up with Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), to explore the integration of digital currencies into ICE’s vast financial ecosystem. The collaboration, formalized through a memorandum of understanding (MoU) announced on March 27, 2025, aims to leverage Circle’s US dollar-pegged stablecoin, USDC, and its tokenized yield product, US Yield Coin (USYC), to enhance ICE’s operations across its derivatives exchanges, clearinghouses, data services, and other systems.

One of the most influential institutions in global finance and parent of the NYSE, @ICE_Markets, announced an agreement with us to explore product innovation using USDC and USYC.

Stablecoins are officially entering the next chapter in TradFi.

Source

Circle, the company behind the world’s second-largest stablecoin, USDC, has been at the forefront of the stablecoin revolution, offering a digital asset pegged 1:1 to the US dollar and backed by highly liquid cash and cash-equivalent reserves. As of March 26, 2025, USDC boasted a circulating supply exceeding $60 billion, confirming its widespread adoption in cryptocurrency trading and real-world financial applications. Meanwhile, ICE, a global economic powerhouse, operates a network of exchanges—including the iconic NYSE - alongside clearinghouses and data services that underpin much of the world’s traditional financial system. The decision to collaborate reflects a shared vision of bridging the gap between decentralized digital currencies and established financial markets.

Under the terms of the MoU, the two companies will explore how USDC and USYC can be integrated into ICE’s platforms. This could include applications in derivatives trading, settlement processes, and data analytics to transform how financial instruments are exchanged and managed. Lynn Martin, President of the NYSE, emphasized the growing trust in stablecoins as a reliable alternative to traditional fiat currencies and the potential for stablecoins to evolve beyond their origins in crypto trading and become a cornerstone of mainstream finance. In her words:

“We believe Circle’s stablecoins and tokenized digital currencies can play a larger role in capital markets as digital currencies become more trusted by market participants as an acceptable equivalent to the US Dollar. We are excited to explore the potential use cases for USDC and USYC across ICE’s markets.”

Stablecoins have undergone a remarkable transformation in recent years. Initially designed as tools for cryptocurrency traders to hedge against volatility, they have emerged as a powerful mechanism for fast, cost-effective cross-border payments and a bridge between traditional finance and the decentralized world of blockchain. According to industry data from platforms like Dune and Artemis, stablecoins processed an astonishing $35 trillion in annual transfers by early 2025 — double the throughput of payment giant Visa — while their combined market value reached $214 billion. Circle’s USDC, with its reputation for regulatory compliance and transparency, has been a key player in this shift, distinguishing itself from competitors like Tether’s USDT, which has faced scrutiny over its reserve backing.

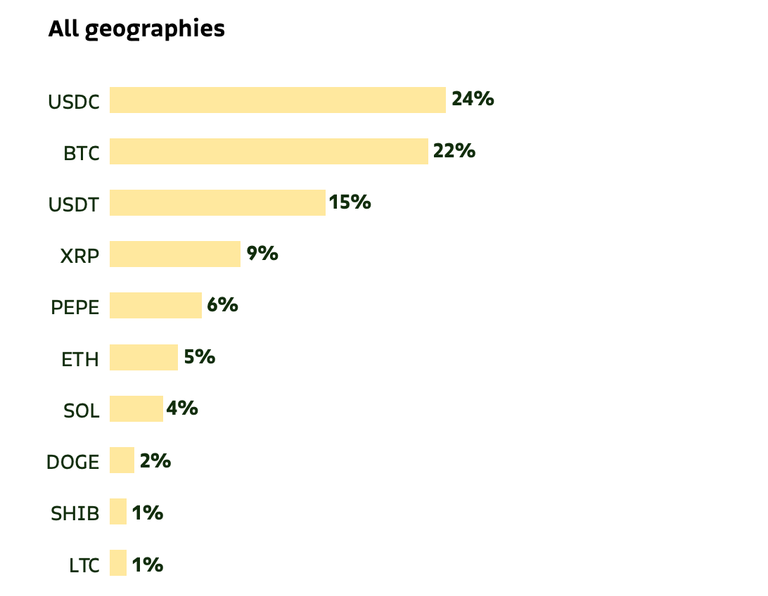

As reported by Bitso’s “Crypto Landscape in Latin America 2024,” stablecoins accounted for 39% of crypto purchases in the region, with USDC alone comprising 24% of the total stablecoin volume. This growing adoption highlights their utility in regions with unstable local currencies, where they offer a stable alternative for savings and transactions. The integration of USDC and USYC into ICE’s systems could further accelerate this trend, bringing stablecoin functionality to institutional investors and traditional financial players on a global scale.

USDC was the most widely held and transferred crypto in Latin America. Source: Bitso

In addition to USDC, the MoU includes plans to explore the use of USYC, Circle’s tokenized money market fund. Launched as a yield-bearing digital asset, USYC allows holders to earn returns while maintaining the stability of a dollar-pegged instrument. This product represents an evolution of the stablecoin concept, blending the reliability of fiat-backed tokens with the income-generating potential of traditional financial investments. For ICE, incorporating USYC could open new avenues for product development, such as tokenized derivatives or settlement mechanisms that offer both liquidity and yield.

The inclusion of USYC in the partnership is another addition to the growing trend of the tokenization of real-world assets (RWAs). From money market funds to real estate, financial institutions are increasingly experimenting with blockchain-based representations of traditional assets, which promise greater efficiency, transparency, and accessibility. Circle’s recent acquisition of Hashnote, a firm managing a $1.3 billion tokenized RWA portfolio, further illustrates its commitment to this space. The pairing of USYC with ICE’s infrastructure could set a precedent for how tokenized assets are integrated into mainstream markets.

For ICE, the partnership with Circle offers a strategic opportunity to stay ahead of the curve as digital assets gain traction. While the MoU marks an exciting development, it remains a preliminary step. The companies have not yet detailed specific timelines or products, indicating that the integration process will involve extensive testing and coordination. Together, Circle and ICE are poised to explore uncharted territory where the stability of the US dollar meets the innovation of decentralized systems to reshape the future of capital markets.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

https://www.reddit.com/r/CryptoMarkets/comments/1jlper3/circle_and_intercontinental_exchange_partner_to/

The rewards earned on this comment will go directly to the people( @uwelang ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

https://bsky.app/profile/did:plc:sss5rm3g6562nyn7azrncgam/post/3llgbwzng2s2d

https://bsky.app/profile/did:plc:sss5rm3g6562nyn7azrncgam/post/3llgbwzng2s2d

The rewards earned on this comment will go to the author of the blog post.

Congratulations @uyobong! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 3100 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: