Arizona’s Strategic Crypto Reserve Bills Cleared for Full Floor Vote

KEY FACTS: Arizona has become the first U.S. state to establish a state-sanctioned digital asset reserve, as two bills: SB 1373 (Strategic Digital Assets Reserve Bill) and SB 1025 (Arizona Strategic Bitcoin Reserve Act), were approved by the Arizona House Rules Committee for a full House vote. SB 1373 aims to create a reserve of digital assets, like Bitcoin, seized from criminal activities. SB 1025 authorizes a Bitcoin reserve funded by public resources from the state treasury and retirement system. With a Republican majority in the Arizona House (33-27), the bills that originated in the Senate have a strong chance of passing.

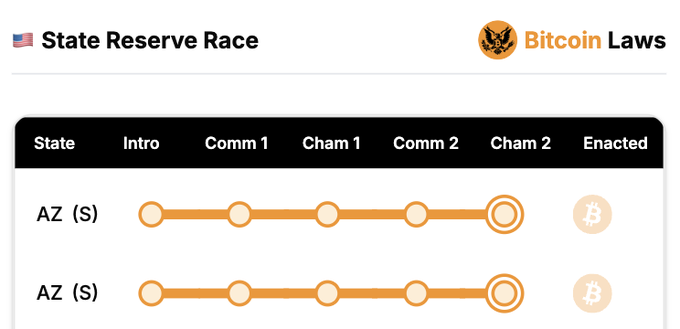

Source: Bitcoin Laws/ X

Arizona’s Strategic Crypto Reserve Bills Cleared for Full Floor Vote

Arizona is on the cusp of making history as it inches closer to becoming the first U.S. state to establish a state-sanctioned digital asset reserve. On March 24, 2025, two pioneering bills cleared a significant legislative hurdle when they were approved by the Arizona House Rules Committee, paving the way for a full vote on the House floor. These bills, known as the Strategic Digital Assets Reserve Bill (SB 1373) and the Arizona Strategic Bitcoin Reserve Act (SB 1025), represent a bold step toward integrating cryptocurrencies like Bitcoin into the state’s financial framework.

🇺🇸 State Reserve Race Update:

Arizona's House Rules Committee passed both Bitcoin Reserve Bills (SB1373 and SB1025), ruling them "constitutional and in proper form."

The bills have now passed their assigned committees, meaning they should be headed for a full floor vote.

Source

The development comes amid a national conversation about the role of cryptocurrencies in government policy, spurred in part by President Donald Trump’s recent executive order on March 7, 2025, which established a federal Strategic Bitcoin Reserve and Digital Asset Stockpile. The two bills, while complementary, address distinct aspects of Arizona’s proposed digital asset strategy. The Strategic Digital Assets Reserve Bill (SB 1373) focuses on creating a reserve composed of digital assets seized through criminal proceedings. Under this legislation, the Arizona state treasurer would be tasked with managing these assets, which could include tokens confiscated in cases ranging from drug trafficking to cybercrime. The bill aims to transform what was once considered a liability into a financial resource for the state.

Meanwhile, the Arizona Strategic Bitcoin Reserve Act (SB 1025) takes a more proactive approach, authorizing the creation of a specific Bitcoin reserve funded by public resources. This reserve would draw from the state’s treasury and retirement system, as a significant investment in Bitcoin as a long-term asset. If passed, this legislation would position Arizona as a leader in recognizing Bitcoin not just as a speculative investment, but as a strategic component of its fiscal policy.

Source: Arizona State Legistature Proceedings

Together, these bills could establish a robust framework for Arizona to hold and manage digital assets, blending assets seized from criminal activities with newly allocated public funds. The dual approach reflects a growing acknowledgment of cryptocurrencies’ staying power and their potential to diversify state reserves, much like gold or

The bills’ advancement through the House Rules Committee on March 24 came as welcome news to their supporters. The committee’s approval is a critical step in Arizona’s legislative process, ensuring that the bills meet procedural and constitutional standards before reaching the full House. With the Republican Party holding a 33-27 majority in the Arizona House of Representatives, proponents are optimistic about the bills’ chances of passage. The GOP’s dominance could provide the necessary votes to push the legislation through, though bipartisan support will likely be key to ensuring a smooth journey to the governor’s desk. However, it could encounter minimal opposition.

The bills originated in the Arizona Senate, where they garnered enough support to move to the House earlier this year. Their progression reflects a growing appetite among state lawmakers to explore innovative financial strategies, particularly in the wake of federal moves to embrace digital currencies. While the exact timeline for the House floor vote remains unclear as of March 25, the momentum behind the bills suggests that a decision could come soon, potentially within weeks.

Arizona’s push to establish digital asset reserves comes at a time when other states are also eyeing similar initiatives. On March 6, 2025, the Texas Senate passed its own Strategic Bitcoin Reserve Bill (SB-21) with a decisive 25-5 vote, though it still awaits approval from the Texas House and the signature of Governor Greg Abbott. Meanwhile, at least 23 U.S. states have introduced legislation supporting Bitcoin reserves, according to data from Bitcoinlaws, underscoring a nationwide trend toward integrating cryptocurrencies into fiscal policy.

However, Arizona appears to be leading the pack. If both SB 1373 and SB 1025 pass the House and are signed into law by Governor Katie Hobbs, the state could claim the title of the first in the nation to formally establish a digital asset reserve. This distinction would not only bolster Arizona’s reputation as a forward-thinking state but also potentially attract blockchain businesses and crypto investors looking for a supportive regulatory environment.

Crypto advocates argue that Arizona’s House moves will legitimize Bitcoin and other digital assets, reducing the likelihood of future bans and encouraging institutional adoption. Matt Hougan, chief investment officer at Bitwise, recently:

“A strategic Bitcoin reserve in the United States reduces the possibility that the government will ever ‘ban’ the cryptocurrency and could encourage many more nations to adopt Bitcoin...”

Despite the enthusiasm, some lawmakers and financial experts have raised concerns about the volatility of cryptocurrencies, questioning whether they are suitable for inclusion in state reserves. Bitcoin’s price, while soaring in recent years, has historically been subject to dramatic swings, prompting skepticism about its reliability as a long-term asset. Critics also worry about the logistical challenges of securely storing and managing digital assets, as well as the potential for conflicts of interest if state officials have personal stakes in the crypto market.

On the flip side, supporters counter that Bitcoin’s scarcity, capped at 21 million coins, makes it an attractive hedge against inflation and a modern equivalent to gold. White House crypto czar David Sacks recently described Bitcoin as a “scarce” and “valuable” resource, a sentiment echoed by Arizona lawmakers backing the bills. They argue that the state’s willingness to embrace digital assets could yield significant returns over time, especially as adoption grows globally. The passage of SB 1373 and SB 1025 would mark a watershed moment for the state and the broader U.S. crypto ecosystem.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO