Do the math

A little advice on getting ahead financially

This week in the Hive Learners the topic is to give one piece of financial advice. Unfortunately asking about only one piece of advice is a bit like asking what is the one important part of a car. Pretty tough to answer. Without an engine it won't run. Without a transmission it will have no power. Without tires it can't move. There just isn't one piece of the car that is important. The important thing is that everything works together as a whole!

The same is true of finances. If there is no income then it is truly impossible to get ahead. If expenses are greater than income than poverty will come sooner or later. If there is income but no planning then expenses will balloon to become higher than income and it seems to happen every time.

However, the post prompt is to give ONE piece of financial advice, so here it is:

Do the math!

It is something I have drilled into my sons over and over again. Doing the math on finances is so important yet so many people just don't take the time to bother. Even worse, the math really isn't that difficult! Plus the math trickles down to every part of financial planning.

Here are a few examples:

Budgeting

People hear budgeting and they cringe. I don't want to be constrained in how I spent my money. I want freedom! However at its core a budget is very simple. Just two questions really :

- How much do I make?

- How much do I spend?

If you can answer those questions and if you make more than you spend then great you are on the right track!

While it is pretty easy to figure out how much you make figuring out your spending is a little tougher. It actually requires adding up what you actually buy. Do a little adding and now you know how much you spent. Put those expenses into categories and now you have a budget. Done. You did the math. Of course if you are spending more than you make you have to make some tough decisions on where to cut....but at least by doing the math you know you have to make those cuts rather than get deeper into debt every month!

Buy or Rent a house

Ask a lot of parents and you will get the financial advice "Buy a house for financial security". My children ask me that question and what do I do? I tell them "Do the math". Sometimes it makes sense and sometimes it doesn't.

Just a few days ago my oldest son asked that very question. Here's what I told him. (paraphrased).

Son, look at that house for sale across the street. It is selling for $1.5 Million dollars and on average any house in this city sells for at least $1 Million. Right now mortgage interest is about 5% if you get a good deal. Property taxes are another $5000/year. Let's do a little math.If you bought that house for 1.5 Million your interest to the bank at 5%?

- $1,500,000 * 0.05 = $75,000 (Interest on loan)

- $5000 (Property tax)

$80,000 / year lost every year if you own that house or roughly $7,000/month.

Now if you rent for $3,000/month (typical rent here) you are losing $3,000/month to the landlord.

Would you rather lost $7,000/month to the bank or $3,000 to the landlord? Either way you lose. Personally I'd choose to lose less!

A little math and the question of buying or renting becomes very easy.

Lost money

When I was talking to my younger son recently we did his taxes together. In a year he made $16,000 at is part time job and he was surprised he made so much. I asked him a simple question. Where did the $16,000 dollars go?

He thought about it for a bit and said "Well, I saved $8,000 to buy a new car". I congratulated him on saving that much but then asked where did the other $8,000 go? He thought about it a bit and didn't really know...but I had a pretty good idea.

Again, I'll paraphrase the conversation.

Let's do a little math. How often do you eat out with your friends at Mcdonalds or Wendy's? My son thought and said 3-4 times a week. Usually after a long shift at work when everything else is closed and your asleep plus on the weekends when I'm out with my friends. Then I asked: And how much do you spend when you go there? He replied "usually about $20-$30".Then we did the math:

- 4 meals/week * $25/meal = $100/week

- 52 weeks/year * $100/week = $5,200

Son. You spend about $5,000 on food, then gas money for your car, a few pieces of clothing and things you like and guess what...that's $8,000.

Then I had to ask a question as a little dig:

Could you have bought something you enjoyed more than food for $5,000?

Little things add up

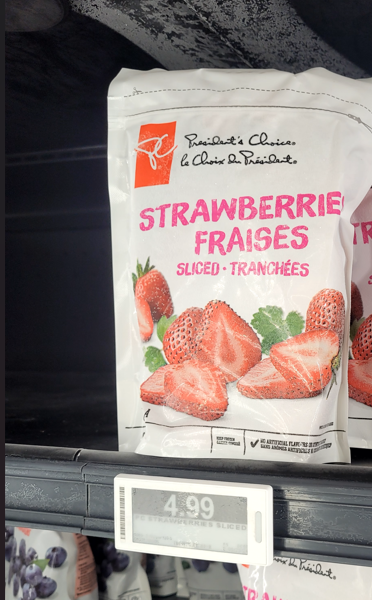

Overall though little things add up. I'll show a few images from my last trip to the grocery store. If you have been reading my posts on food costs over in the #earnspendgive community you will already know I look hard at math but here is a simple example: Strawberries

Fresh Strawberries $3.99/lb on sale

Frozen Strawberries $4.99/600g

Frozen Strawberries $3.00/400g

A seemingly insignificant purchase to be sure

Most people just pick up the fresh strawberries because fresh is better. They are happy they are on sale for $3.99 (regular price $6.99/lb) and off they go.

But let's do the math:

$3.99/lb Sounds good. But there are the stems that need to be cut off and usually there is a bad one or two in there. How do we compare lb to grams? Well 1lb = 454g but usually lose 15% or so when cutting off stems.

- One lb of fresh strawberries usually means about 454 * 0.85 = 385g (lets round to 400g)

So $4.00 for 400g of strawberries (fresh)

Compare to $5.99 for 600g of strawberries (frozen).

Which is the better deal?

$4.00 for 400g ==> $1.00 for 100g (fresh)

$5.99 for 600g ==> $1.00 for 100g (frozen)Hmm... same price fresh of frozen.

But how about the smaller pack?

$3.00 for 400g ==> $0.75 per 100g (frozen)

The winner of the price battle is the smallest package! Go figure, it is usually the larger package but the only way to know for sure is (you guessed it)

Do the math!

In the end its about making informed choices

Now I'm not saying my son shouldn't eat out at McDonalds. I'm not saying that everyone should buy frozen strawberries. I'm also not saying that it would never make sense to buy a house. There are often very good reasons to pay more for something!

However, if you do the math you can know for sure how much more you are paying. Then you can make an informed decision on whether it is worth the extra money!

Now my second financial rule (I know I'm only allowed one) is to :

Always read the fine print!

When it comes to financial documents, loan terms, credit cards and other financial stuff I always recommend reading all the details. Why should you read the fine print?

Hehehe....

So you can do the math

There are so many details in the fine print that can change the overall amount paid on anything. If you don't look at those details it is quite possible to pay a lot more than expected.

So, remember, when it comes to finances math is just a way to quantify what you have, what you are spending, or what is the best deal. If you don't do the math you are making an uninformed choice.

Personally I always find it better to make choices when I know the details rather than just going with my gut.

Just my take on finances but hope it was helpful.

Either way I love to get feedback.

Feel free to send along a message on your thoughts.

Thanks for reading!

A beautiful life can be built through a beautiful plan. A good financial system can save money to build a good life. All in all a beautiful blog you have created. So much fun reading your blog in its entirety.

Thank you. I think few people read my blog in full because I write a lot :)

I started with nothing, picking garbage from trash cans when I was young and now I have enough to support myself and my family well. Overall a good life with solid plan and a vision for the future.

Of course my wife hates that I always look at every purchase logically balancing every pro and con and always doing the math.

But it has worked out in the end :)

Thanks for reading, really appreciate it :)

Thank you very much. You have expressed your opinion in a very nice way. I am very happy that you also answered my opinion

But in the fresh fruits there are much more vitamins and less chemistry. On the long run by eating more fresh food and less industry stuff you will spend less on healthcare and physician bills. Do the math!

Hmm....

I'll disagree a little on that one.

Foods that are highly processed do indeed lose a lot of their value over time. Processing, additives, and all that other stuff are certainly not good for you.

Freezing, drying, and home preserving like jams, jellies and pickling can change the nutritional value but typically due to heat. Freezing rarely changes the vitamin content by much. Unfortunately freezing does rupture the cell walls of the berries making them mushy when they thaw.

Depending on the use could certainly make frozen less desirable.

Yes, I have done the math ;)