Pickpockets of the Future

Borrow when borrowing is cheap.

But make sure what you borrow generates more value than you will have to pay back, especially if interest rates are going to increase. And this is where the governments have failed, as they have expanded their borrowing over the last 15 years on what were record-low interest rates, but they haven't generated wealth for the average person or built the platforms required to stabilize, they have distributed it through various mechanisms and into the pockets of the micro percent.

But, as anyone with a mortgage knows, repayments need to be made on borrowed money and that is affected by interest. This is the same for governments too, which means if they aren't generating more than that, they are going to have to borrow more at increasing rates, where borrowing isn't as cheap.

And, when the governments choose to bailout financial institutions, which tend to happen when the economy is collapsing, they are borrowing very large sums at increasingly poor rates. And that borrowing is coming from the taxpayers in the future, who will also have to cover the interest amounts incurred on top.

Pickpocketed in the Future.

But imagine, you are going to get on a train tomorrow and know that someone is going to reach into your pocket or bag and take your wallet. What are you going to do? Will you try to prevent the theft? Will you risk mitigate by ensuring that your wallet is secure or perhaps, making sure that your wallet has nothing of value in it? Take a taxi instead?

Would you change nothing and just let it happen?

What could happen if there is another Financial Crisis?

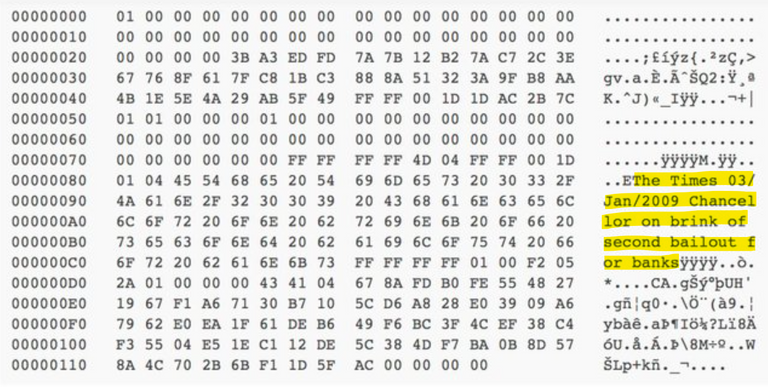

It is an interesting thing to consider, because the Bitcoin network was created as a direct response to the events that led up and the response to the crash in 2008. Essentially, it was created to build a decentralized cash system, with no central authority, or a single point of attack. Since then, it has obviously snowballed into other domains and the base technology has been reiterated and reimagined in many forms, that are used for different purposes.

Will the response be new innovations? After all, necessity is the mother of invention, and we need a robust financial system that we can rely on, as the current iteration just isn't cutting it. Okay, it was doing the job for a long time, where it was making some people insanely rich and the vast majority increasingly poor, but that isn't the case anymore. There is too much volatility.

And on that note,

What does 0.5 + 0.5 equal?

What does 0.01 + 0.99 equal?

Equality.

Wealth always adds up to one, no matter the distribution.

But as we can see, distribution matters. The reason the financial markets are becoming more volatile, is that they are increasingly centralized, so that one mistake has massive repercussions throughout the entire network. In a decentralized economy where there is more distribution and less aligned activities, failure is more isolated and absorbed into the network, without it becoming cataclysmic. Even if a large entity on the framework collapses, the rest of the network will distribute that value to others within quickly and largely effortlessly, without centralized interaction, but decentralized cooperation.

A decentralized framework is less efficient, but far more stable that a centralized. However, when it comes to "efficiency", there is a point that it becomes a liability, where adjustments made to meet incentive return, will eventually lead to error and that becomes highly volatile, due to the efficiency practices employed. And this is where we are in the current economy, where profits are the driving force for efficiency, and therefore expensive redundancy systems are not in place.

For instance, Hive would be more efficient if there were fewer servers and they were all running on the same server system, but if that system goes down, there is no backup to keep it running. Now, Hive as a blockchain is relatively efficient, so running a Hive node is very cheap, but there is a multiplied cost still.

When centralization is applied to the entire economy without any fail-safes in place, failure becomes very costly indeed and the only redundancy system that can be called on, is the "pickpocket fallback", taking from our future wallets. And, they have set the system up to be able to spend our future money without us being able to protect the contents of our future wallet, because if we could protect it, we wouldn't pay. In the same way, that if your government asked nicely for another 10K this year from every single person in tax, people *couldn't afford and wouldn't give.

For reference, that would be 3.5 trillion dollars in the US.

But, taking it from our future wallet where we don't have so much as even a wallet chain in place to protect us from the theft, those amounts can be taken out whenever they want to take it out. For example, in 2018, the US debt went up by 5 trillion, which is around $15,000 for every person in the country.

This system is broken in so many ways and what needs to be realized is that in order to replace it, this one is going to have to break. That isn't a comfortable thought, because like it or not, our daily lives are tied to and intimately affected by the meta and when that changes, we get changed. However, like any change in history, some time down the path, things are okay again. But in this case, the "okay" has to start factoring in the entire population, rather than having only a miniscule amount of decision makers driving a maximization policy that promotes efficiency, at the expense of the majority.

The world economy is currently imploding, and it isn't a controlled demolition. The cost of rebuild is going to be on us, so we may as well ensure that what is built serves our needs, rather than it becoming another ghetto system, where we are renting from the middlemen, with no control over what we own within their building. They can take it at any time.

Every loan that a government takes is a pickpocket of our future wealth and, there is not even an IOU left in return. There is an expectation that we will be okay with the theft.

So far, we have been. What about tomorrow?

The current system is on borrowed time.

The wallets are getting protected, the pockets sewn shut.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

This is what most people fails to understand before they borrow.

I'm always sad seeing people borrow from sources where they will have to pay twice of what they borrowed and yet couldn't even make profit from what they borrowed... It's really sad I must say.

There have always been actually.

Well, all the same , I understand the angle you are coming from about the decentralisation of cryptocurrencies in general, it is an approach to solve a problem and I will be optimistic it solves if completely

I really enjoyed reading you, thanks for sharing

Volatility is good, for those who are able to use it to profit. I like volatility. However, the volatility the markets are seeing now is outside the range of instruments that they are using and, the yare using our money, not theirs. Their loss is our loss, their gain is their gain.

Ouch... really didn't get that part.

You mean invariably that it's a win-win situation for them whereas we are left to suffer... Ouch

the bank situation is a very precarious one. another collapse could prove to be absolutely detrimental to us all, as a society.

More are likely I suspect and yes, detrimental, at least in the short term.

Borrow only when it will generate more value than what you will pay back.

This is a good read

Also borrow when there is inflation because you would pay less in value. Those who got mortgage during the pandemic, while the interest rates were very low, are now in a very good profit as their debts have been devalued due to the hyper inflation for two years here in my country.

This is true, so long as they are earning more money. most are getting less here, so they are struggling more.

I really dislike loans. I took them in one year, 10 years ago. Short-term for 14-21 days. Less than 0.7% per day. This is very depressing.

0.7% a day! :D

Yeah - it is all very depressing, yet we keep up the game.

That's pretty scary to think that they have to borrow the money to do the bailouts. I guess it doesn't really surprise me though. They have been doing the same thing for decades. I'm just glad I am here on Hive and invested in other crypto assets. I feel it is a good hedge.

They will also sell government bonds of course, but it is essentially the same thing.

Yeah, for sure.

Intriguing essay. Timely. So happy to see someone discussing it openly, instead of pretending nothing is wrong at all. Maybe nothing is wrong though. Maybe this is the demolition we need to build a monetary system, or lack thereof, that will benefit the likes of you and me, instead of enslaving us to debt and taxes.

I counsel my "kids" to never borrow money. Luckily, so far, they haven't. I feel they are much safer, considering what is coming at us fast right now.

Many of us think everything is fine. Anyone who reads the NYTimes religiously thinks everything is fine. Anyone who listens to NPR thinks everything is fine. Theft can no longer be recognized as such.

It's going to be an interesting week! I'm so glad I have crypto!

At least, this is how I am trying to come to terms with this collapse. Time to "adult up" and take responsibility, right?

Time to adult up and stop just following instructions from your government, brought to you via MSM, yes indeed. It's the 11th hour for that.

That is equivalent to "being divergent" and government systems are uncomfortable with such ways of thinking...

A great many of us in the US, supposedly the land of the free, were recently categorized as "domestic terrorists" and "public enemies" for not following a particular governmental command.

It is a truism that necessity is the mother of invention. Our needs drive us to innovate, but that requires effort. We need to build strong financial systems that we can confidently depend on.

Prevention they say is better than cure. There is no way I will go out with my wallet knowing someone will pick it.

Now that banks are collapsing and real estate is harder to main, what do you think would be the course for the govt and the people who depend on the investment associated with govt backed assets? Do you think we would have new form of instruments to invest into other than crypto?

I am unsure. But, would you trust something the banks or governments come up with?

My first payment for paid work was many years ago, when I was just 16 years old and preparing to start university. My dad always instilled in us the motto: “… never spend what you haven't earned yet…”, wise words from my father. That advice has stuck with me ever since.

My mother also influenced us with her way of thinking, she used to tell us: “if you don't work, you don't eat…”, “if you don't study and prepare for the future, you will be a failure”. Today, these teachings ring in my ears and I communicate them to those young people thirsty for success that I have met along the way.

But what does all these have to do with the topic raised by our virtual friend @tarazkp, it's simple… My mathematical studies related to the world economy are based on the perspective of a quantum model. A single particle, whether positively charged or negatively charged, will unequivocally alter the equilibrium state of the model/system, as it suits them best.

The idea that has been around since time immemorial is that “all investment must generate profit”, and of course that is the goal of the investor, isn't it? You are not going to deposit a certain amount of money in the hands of anyone, no matter how friendly it may be, without a minimum guarantee, unless it is ill-gotten money that you have left over, he, he, he…

Parasitism is taking over the whole world; people now want to have the basics without any effort... That parasitic model must be changed to one where work is valued. Values that are instilled in producing for a living and giving back to the system, whatever it may be; so that it is strengthened. In blockchain, for example, the majority publishes with the intention of earning and earning; that's fine, but it is the minority who reinvest profits from their portfolios to strengthen the platform. Any system that dries up and takes it out and doesn't put it in, ends up emptying itself…. Then we wonder what happened?

And this is exactly what governments do. Except they don't earn it, we earn it for them.

And it changes everything else, depending on what movements it makes.

However, what bout changing the paradigm and instead have, "investments need to generate wellbeing" ? A parent for example would invest into their child for wellbeing, not profit. If it doesn't help us develop wellbeing, why are we doing it?

And more. I call it "workless wealth"

Yet, most seem to think that strengthening the platform is not their job, and simultaneously complain that the whales don't vote them :)

Exactly.

I don't know but there's probably being too conservative at some point. Not decided if it's time to invest into another business attempt, yet. It would be moving away from producing needs and into providing wants. But that's in a small town where young folks are kind of bored and moving away from. It could be just that I myself miss some of the entertainment I'd like to share.

Done on the right scale, though, it could be a good way to hunt for and support talent.

The problem is, I might want to have it as a policy but as a profit generating endeavor...that would be questionable. So I need more income to be able to spend some before getting to a good ROI phase, perhaps many months or a few years from now, if ever. Things are being made ever more complicated. Fixed expenses are too high for a small scale operation.

...

And the choice is...should I just start and burn through the fund that was otherwise designated as my 6-months emergency reserve. Which depreciates while sitting there as a liquid reserve.

I am moving towards saving into not cash but precious metals, next, I guess.

...

That said, it seems that the way to start anything without burning through emergency funds/investment opportunities/savings is through a solid plan backed by...borrowing...and then more borrowing when you need to adjust. Not mentally ready to do that. The solid plan needs to come first.

...

Another personal example: About 18 more monthly installments left to pay off the car but I am not in a hurry there. I could do it right now and get rid of that debt but in an inflationary environment I am kind of giving less when postponing. Not more than the initially agreed upon is asked of me, anyway. Not yet, at least. It's fixed in Euro.

But will there be any Euro or USD this time next year? Some say the BRICS alternative commodities-backed new world reserve currency plan looms on the horizon. That's why I think it's time for gold and silver to...wait for it...shine.

Get debs for paid debs Is a nada idea AND people AND entities do it un this moments, AND this Is dad for people, who losses their assets,

Well hive Is our jewerly of kingdom AND se hope the withnesses never stop their server AND this continúes for Every Time in the future.

Well Is Time to stay prepared yo get food from the mountain AND save a Little money, remember the cost of food Is a Little expensive right now.

Best regard.

And be carefully with the debs.

Hopefully there are more servers and then crosschain servers that tie more aspects together and build a very robust platform for millions of people to enjoy for years to come :)

I never borrow money but if i can borrow it of government & get away, it's ok!😅🙊

All kidding aside: money must make money, otherwise it won't do any good and you'll be in trouble in the future.

So I'm in the market for a new country to pay taxes to that won't go and bail out the first big business to put their hands out... you have any bright ideas mate?

Not sure. I still say Northern Europe!

There are countries that don't do bailouts - but they might be the ones that steal the money for themselves :D

My girl though, she needs warm, sunny beaches or she will not be happy.

Normally I only carry about 50 euros so the thief might feel sorry and return the money... Probably not.

If I could I would reschedule and travel next day. If not I would probably travel with a previous train and try to avoid the theft.

But you would do something. These days, stealing a wallet is pretty risky I think - most people don't have cash.

I did borrow some money from my family and invested in the 2021 bull run its not safe but I make 8x from my investment and pay them back

but if I would borrow from the bank I would never invest in crypto cause it's very easy to lose money

it depends on personal position, as in all things. I think I would rather lose to the bank than family :)

Here is the issue, asset price is inverse of interest rate.

When rates were dirt cheap like what we have seen since the Great Financial Crisis, we went through over a decade long irrational asset bubble, the ones that get hurt are the people who bought during the last two years thinking rates would never go higher.

The top 1% benefited the most seeing all their assets appreciated so much and many took advantage selling into the buying frenzy. Or just held onto generation HODL and collect higher and higher rents.

What’s next? The rich will pick up distressed assets as high interest rate make the principle value cheap again. Their cash flow continues unabated.

The masses continue without fail trapping in debt slavery and mortgage their productive life away, they always FOMO the top.

It is one of those things many did. When I collared my mortgage (bought just before Covid made any impact on the world), people said I was crazy, as I would be paying more than the already super low interest rates.

Absolutely. A couple years of pain for the 99% - buying opportunity for the rest.

The government has been always spending money irresponsibly and they waste a lot of money. At the same time, our politicians have been spending money like water for things that don't even benefit us. As people usually say, they just try to kick the can down the road and they will continue to do so.

Posted Using LeoFinance Beta