HDFC Credit Card - my experience and some exciting offer for you, BUT......

An Exclusive HDFC Bank Credit Card Offer, Just for You - Rs 1500/- Amazon Voucher gift.

The offer sounds exciting, isn't it ? Just apply and get a Credit Card and you will receive 1500 Amazon voucher as a welcome gift. But that's not entirely true. There are terms and conditions and barely very few read that and jump in instead.

They keep reminding me in a continuous basis to refer my friends via mail or whatsapp. Once I click on that mail link, it creates a mail with this content :

Hi, I wanted to share some exciting news with you. I have been using an

HDFC Bank Credit Card for some time and my overall experience has been amazing! The best part is, if you get a new HDFC Bank Credit Card using this special Link, you'll receive a Rs. 1500 Amazon voucher as a welcome gift. Trust me, It's an offer you don't want to miss! Check this Link to Avail the Offer: hdfcbk.io/k/DUvfEek3HLy

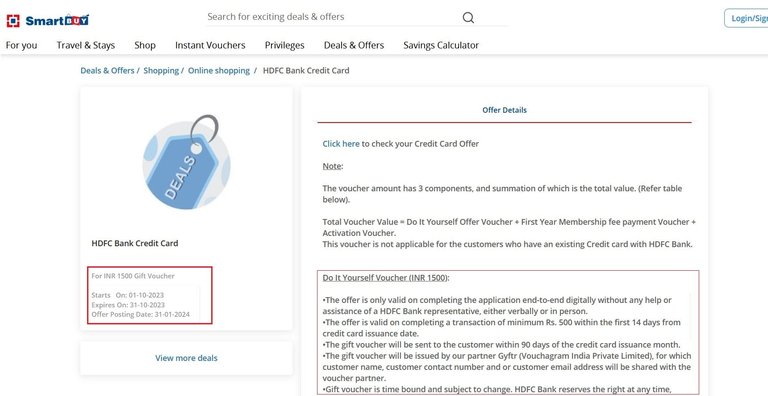

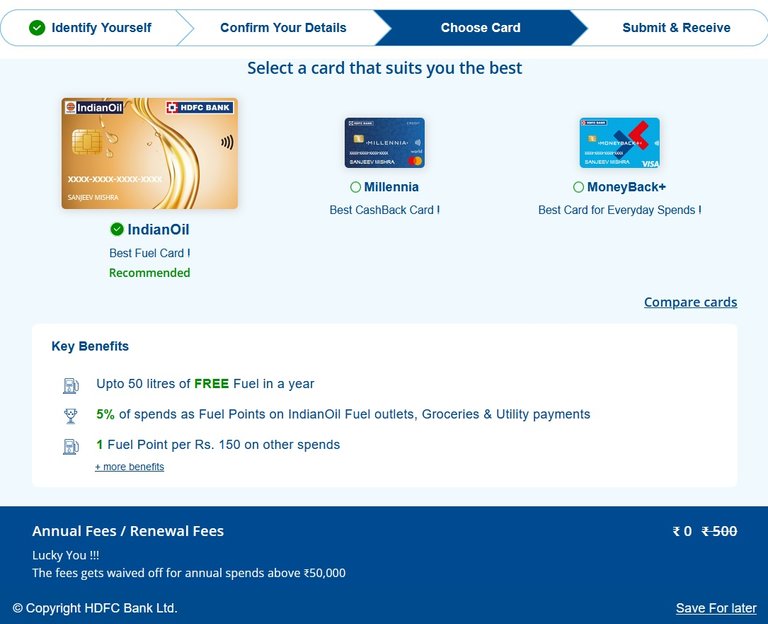

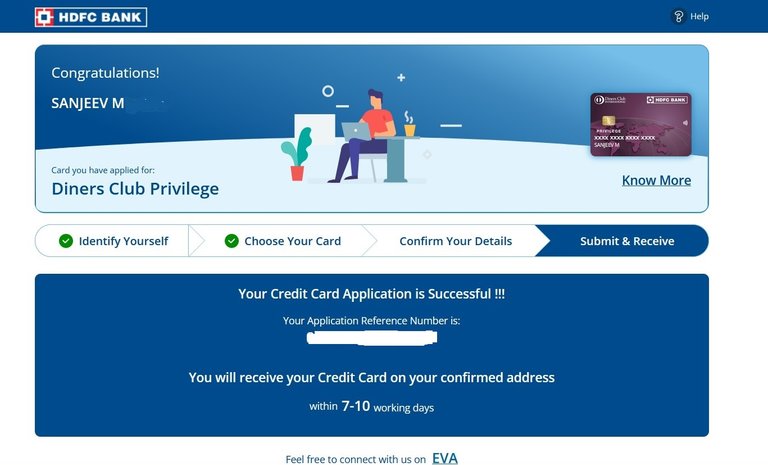

The link seems to be very generic, and you can use it. Once you click it, it lands you on the above page, where you need to enter and confirm your details with the OTP and it will take you to a page where you can select the card of your choice. But before that, spare a moment to read that Terms and Conditions.

They call it a "Do It Yourself Voucher" - you must complete the application end-to-end digitally without any help from a HDFC Bank representative, and you must complete a transaction of minimum Rs. 500 within the first 14 days from credit card issue date. There are many other conditions in that page which you should read, but the point is that apparently they run this offer forever, but tell you in such a way that you will feel like you are going to miss it, if you do not apply now. And they actually don't give you a 1500/- voucher at one shot, the voucher amount has got 3 components, and "Do It Yourself" gives you only 500/- . Then there is a "First Year Membership fee" Voucher which is equal to the annual fees. And there is a Activation Voucher, which gives only 250/- if you perform 1 transaction within the first 37 days from card issuance date. So now you may realize how they cleverly tease you for the offer.

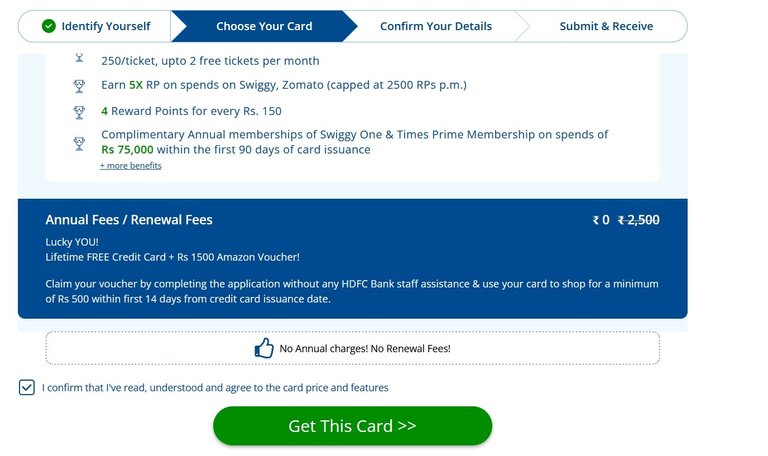

Going back to the parent page, you can select the card of your choice, and it's very important to understand the Annual fees waiver clause. The Annual fees gets waived only if you spend above a certain limit applicable for each card - else you will be Unlucky you. And the other important piece in deciding your card is what key benefits you are looking at. So choose the one that is best suitable for you. I went for the Diners Club Privilege because of these offers :

If you carefully see there is no Annual Fees, saying its a Lifetime Free Credit Card. But then I don't trust them entirely. The Annual minimum spend for this is 300000/- for the annual fee weaver, so I will have to make sure I spend that much. I already did a transaction of 500/- on the very first day, so hopefully I should get that voucher, but it may come within 90 days, ya, that is how they play around. I have still kept these screen shots. to show them later, if needed.

Credit Cards are very good as long as you manage them well. You get almost more than 45 days to pay back for your spends. But if you are not very good on your financial management, then I would strongly discourage you to go for it. The reason is that they earn most from your faults - if you do not pay in time, they charge you very hefty amounts in forms of penalties and interest. For that reason, I always put a standing instruction to auto debit the full amount by their due date. If you pay only Minimum amount due, then they still charge you interest. But then you are responsible to make sure your account has that much money. And you can do that only when you manage your finance well. So it's all connected. You should never spend just because you have got the credit card, its you who has to pay later. So spend only if you need to spend - instead of giving cash, use the credit card, and you can save the amount for 45 days earning you a little interest.

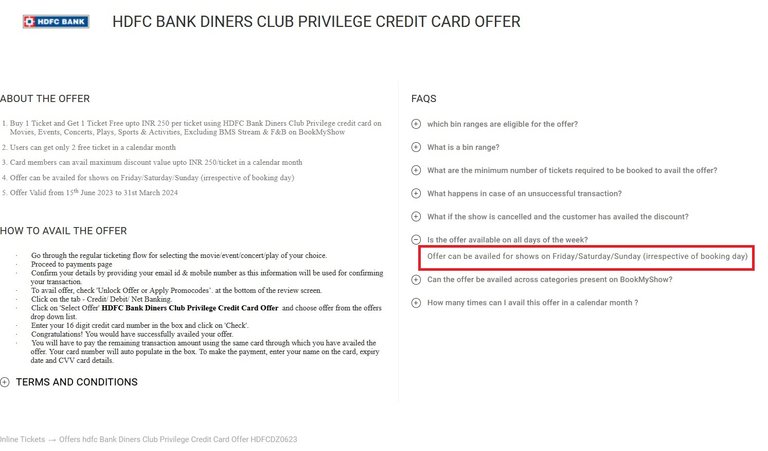

As I wrote in this post this card has got a nice offer for movies - I can get 250 off per ticket, up to 2 free tickets per month. So its like buy 4 tickets ( for my entire family) and get a 500/- discount. Or the father and son duo can go twice 😀.

And that is also not simple - the offer is applicable only for shows on Friday and Week ends, irrespective of when you book. That seems to be ok, because usually we won't go on week days anyways. The other benefit of the Diners Club Privilege card that attracted me was Free Airport Lounge access. So far I did not have this in any of my other cards, so this will be useful when we travel.

It's already been a month, and there are couple of times when the Card did not work for online payments, because its neither a VISA nor a MasterCard affiliate card. I had to use my other cards, so it also depends on the payment provider that is processing the payment. However, it works fine on POS (Point of Sales) terminals. That will help me to meet my annual spend of 300000/-, because I know they will charge even though they promised that it's free for life.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.

AI free content - do not loose your natural intelligence.

Posted Using LeoFinance Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Many times we only read what interests us and only then can we make mistakes. The small print must be analyzed very well and if it suits us after all, we must take advantage of all the opportunities that may arise.

Most of the time whenever I hear Amazon cards, I don't usually believe so much in it like that because I have my doubt that there is always challenges in redeeming it

This seems to be authentic but then as per the terms and conditions.

You are very right in what you say, we almost never read the terms and conditions, and therein lies a large part of the problems that are not being able to achieve the bonuses offered

Thank you very much dear friend @sanjeevm for sharing all this information

I take this opportunity to wish you a happy start to the week.

Most people are always attracted to the amazing offer they see but fail to go through details and understand it more.

Honestly speaking I never trusted a credit card and never owned ever...nothing is free that comes true when it comes credit card..

If you play well with credit cards then you can earn good by by using the bank's money.

Exactly and the merchant offers now a days, gets us pretty good amount.

Bhai I had a pretty worst experience with my dad's case...since then....it's no no.

I agree and its true that experiences can vary from person to person. Sad that you had to go through this so your decision may be right.

I prefer using credit cards and wherever its available but again things vary for different people.

i think it make people more extravagant.....but rightly said preferences matters.

No, it does come free, but you have to carefully manage. They usually give 45-50 days free time, so its always good to have one and utilize effectively. More ever, there are lot of merchant offers, that benefits us.

I know like the current online shopping festival....but it is tricky , and need to look after now and then....I experince a rigorous procedure during my Dad's time and since them it was no no

The benefits you highlighted, like the movie ticket discounts and airport lounge access, seem enticing, but as you pointed out, careful management of expenditures is necessary to truly benefit from these offers.

How do you evaluate and compare different credit card offers before making a decision?

Based on what I need, and which cards give most offers. For example, HDFC has several types of cards, but then I choose this one because of movie tickets and airport lounge access. If one wants to use for fuel, then he should go for a specific card that does not charge fuel surcharge.

Good idea!

Here too some banks and some digital banking systems sometimes offer this.

I have been using an HDFC card since 2011 and the one I use if free for life card. I use a different card but this also looks good as it offers many benefits. HDFC cards are good but I prefer using AMEX as a reward program is so good.

Free for life card is best. I am not sure, if they will really make it free, but if I spent the amount quoted, they will give a voucher of equivalent amount. Next year, I will know.

That's great.

Hi @sanjeevm

I use the same HDFC card and it has been about 2 years. These are nice benefits but it's only for the new users and I was not given anything when I got this card. Btw this is also my first-ever credit card.

May be, they try to lure customers. But then you get some extra offers from these cards during sale period.

SNEAKY SNEAKY SNEAKY.. 😎😉

There is always some 'catch', but glad to see u got it all figured out.

Things can be good, as long as they are used right and everything is clear about it..

This kind of offers which seem to be very good for the users, a person can also get many necessities of life as gifts if the person will act in the same way on top of all the things you have done.

Seems you need to go through everything with a fine toothcomb. They are crafty, tell you to have a credit card for emergencies then they fine you for not using it!

Good luck with yours.

Not really into Amazon stuff, but this one sounds good.

This seems an interesting offer from Amazon. Wondering about why others doesn't trust Amazon.

https://twitter.com/lee19389/status/1711439882932150438

#hive #posh

https://twitter.com/LovingGirlHive/status/1711492054432514483