Grievance for grievance with the Income Tax Department

Helpless citizen - the taxpayers deserve a resolution, isn't it ?

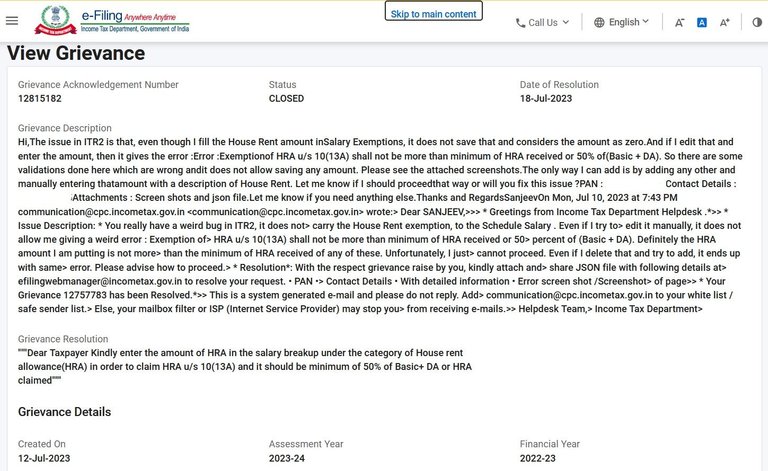

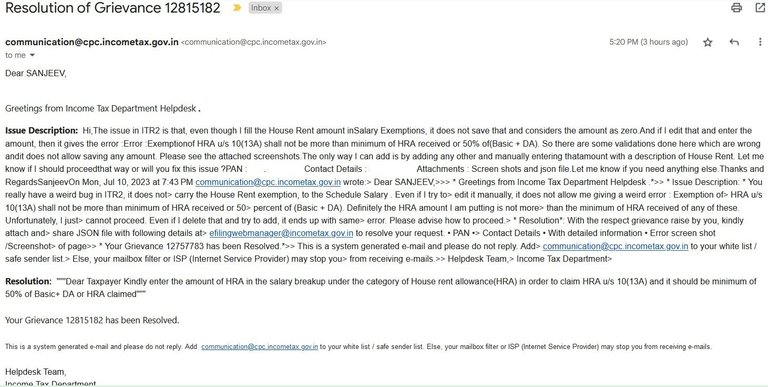

As I wrote in my last post, I had been waiting for a solution from the Income Tax department on the issue I have been facing. And to my surprise they resolved the query saying "Dear Taxpayer Kindly enter the amount of HRA in the salary breakup under the category of House rent allowance(HRA) in order to claim HRA u/s 10(13A) and it should be minimum of 50% of Basic+ DA or HRA claimed". The mail version is this, identical to what I see on their portal.

Did you even read my grievance ? I already mentioned this : even though I fill the House Rent amount in Salary Exemptions, it does not save that and considers the amount as zero.And if I edit that and enter the amount, then it gives that error..... And even I attached screenshot of that. Don't you understand plain English ? Even a lay man would would figured out that what they advised has already been tried out. And unfortunately it just blocks me to move forward. There is one workaround about which also I put in the ticket : The only way I can add is by adding any other and manually entering that amount with a description of House Rent. Let me know if I should proceed that way or will you fix this issue ? But it seems they have not looked at it in details and given a very very disappointing and unprofessional response. You have my number , did you even bother to call me once ? This is why I told in my last post : we are helpless citizen who is accountable to fill this in time (and also ensure to make sure you have no tax due) which is July 31st, barely couple of weeks left.

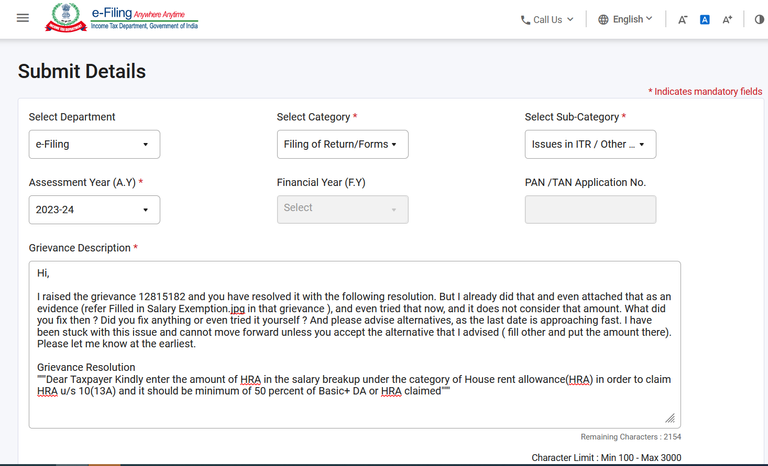

So with much disappointment I filled another grievance today, and now I will try to explore ways to bypass their validation based on my knowledge of how things work. They have a way to generate the final json file, so may be edit that and try to upload. Worst to worst, I will go ahead with the workaround. I know they may come back later to justify why I did so, but these posts will be a testimony to the fact that you should have fixed the issue at the first place making the process easy and smooth. They asked for a feedback on the resolution and I have given a 1 star rating with similar comments - this is absolutely an evidence of very poor quality measures in the software that you developed. We often talk about accountability in various metrics in Software development and it feels like they lack it.

Did any of you use the ITR-2 FORM to fill your income tax with a House Rent component ? If yes, can you help me please ?

And by the way I learned about a new thing on tax on leave encashment coming under Sec 10(10AA)-Earned leave encashment, will write about it in my next post.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.

AI free content - do not loose your natural intelligence.

Posted Using LeoFinance Alpha

I liked how you stated your case and your arguments, and how you showed the evidence and documents to support your claim. I found it very outrageous to see how the tax department ignored you and charged you a penalty for no reason.

It is impressive how governments complicate everything when the easiest thing always gives good results and thus the easier the time is saved and everything would be easier

I really wish you all the best and I believe all will be resolved.

I don't have to face this problem but your problem as you described is very distracting for you. Hope your problem solved.

Don't think so, they took six days to give a pathetic response, let's see.

I'm sorry you're having this problem. I have no idea what you should do. But this is happening more and more to all of us. When the sites are not functioning properly it is very difficult to fix. I'll bet many of us pay much more than we should (of course we should all be paying ZERO taxes, but...) because fixing overpayments is simply too onerous. We give up, as if we have no choice. We are slaves to paperwork.

Well, that is why I am putting it here on my blog, as an evidence. Later I would not hesitate to go to court if they come back after me.

Best of luck to you. My brother in law does my taxes so I have zero advice. I also own my home, so I don't deal with that particular field I think.

I wonder how the department even responds like this - very unprofessional. Lucky you....Here most people give it to external agencies, but then they charge for it. I help many people to fill on their own because it saves them some amount and also help them understand their tax obligations.

It's nice to have my brother in law help me. I just give him a handshake and a bottle of whisky as payment. He is also invested in crypto, so he knows more about that stuff than your average tax preparer.

😐😒😠 typical BS response. I hate when people give me some scripted answer to any question..

Hope u get some real answers..

They probably have some people sitting there and resolving cases without even looking at the details. I will go ahead with some workaround in 2-3 days, if I do not hear back.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

It should not be like this at all, a person gets upset when he sees these things and he has to give them in every situation.

There should be policy that will regulate these taxes in some countries

That must be stressful. Employees of the tax department should be better in handling those.

They have outsourced it to a Software Services company, which is why this kind of issues happening.

I'm sorry to hear that you're having trouble with the ITR-2 form. It's frustrating when you're trying to file your taxes and the system isn't working properly.

I have been thinking to start my filling but could not start so far but after going through your post I am a little worried. I will try to start it today if possible. Sad to see that we are not getting proper support from govt dept but they expect proper taxes to go into their treasury.

If you have to fill the ITR2 with House Rent, then this is definitely a pain, I have even tagged the department on twitter. I am planning to find out some alternatives, may be hijack that produced json and upload again - need to check, if that works. But overall pathetic response from the department.

I hope it will be resolved the soonest. They made things difficult.

https://leofinance.io/threads/alokkumar121/re-alokkumar121-8hfjbhrq

The rewards earned on this comment will go directly to the people ( alokkumar121 ) sharing the post on LeoThreads,LikeTu,dBuzz.

That's really disgruntling. Here in the Philippines, my sister is working as bookkeeper, and does the tax works for other people.

All these procedures must be easier to avoid users wasting their time. They (Government) have to find a way to make the process less complicated

Congratulations @sanjeevm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 35000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

https://twitter.com/lee19389/status/1681607290376404993

#hive #posh

https://twitter.com/LovingGirlHive/status/1682292111637618688

@tipu curate

Upvoted 👌 (Mana: 38/48) Liquid rewards.

Why don't you go to their office directly and meet the desired authorities?

haha. does it work this way?

This looks like a tough situation, sorry you have to go through it. Hope it gets resolved in your favor soon!