Finally the Income Tax people gave the solution

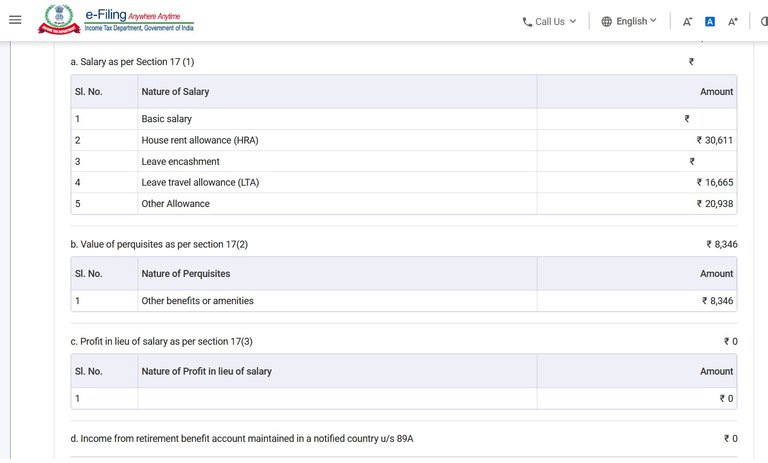

Apparently it's a problem with how the data is filled under section 17(1) under Schedule Salary, and you have to fix it.

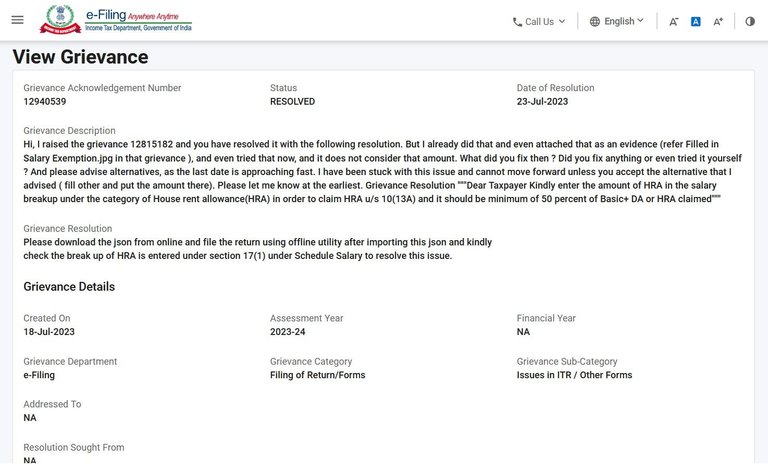

It has been a long follow-up, with the tax department and finally they gave the solution : Please download the json from online and file the return using offline utility after importing this json and kindly check the break up of HRA is entered under section 17(1) under Schedule Salary to resolve this issue. You can see the same in the attached screen shot. But wait, isn't that like admitting that its a fault in their system ? Why would I need to download the json from one source and upload in another ? But let's try that for a moment. So I downloaded the json and updated it and uploaded on the desktop utility.

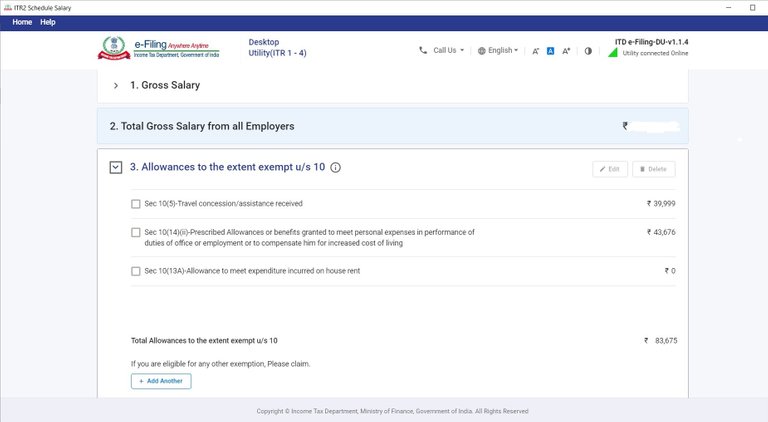

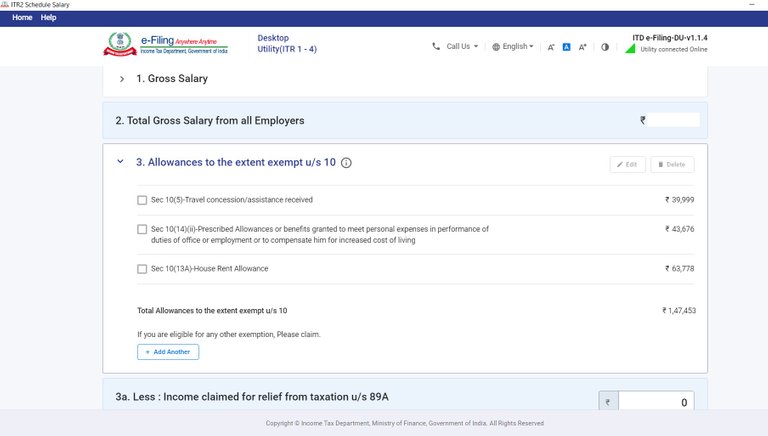

Went inside the Schedule Salary, and checked under section 10, the exemption for house rent was still showing up as zero.

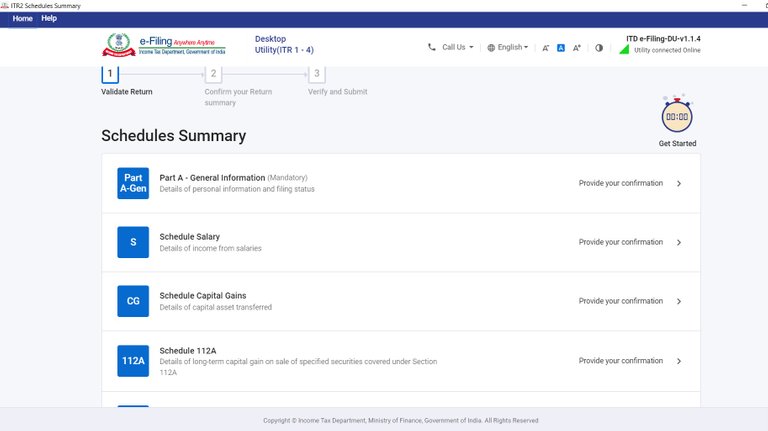

So I figured out what I did was not right. Searched the json that was exported from online tool and there was no section 17(1) , so searching by 17(1) was definitely not working. Then I assumed, it was only shown in UI, so navigated to the Schedules Salary and tried to find out a clue to do what they asked for : kindly check the break up of HRA is entered under section 17(1) under Schedule Salary.

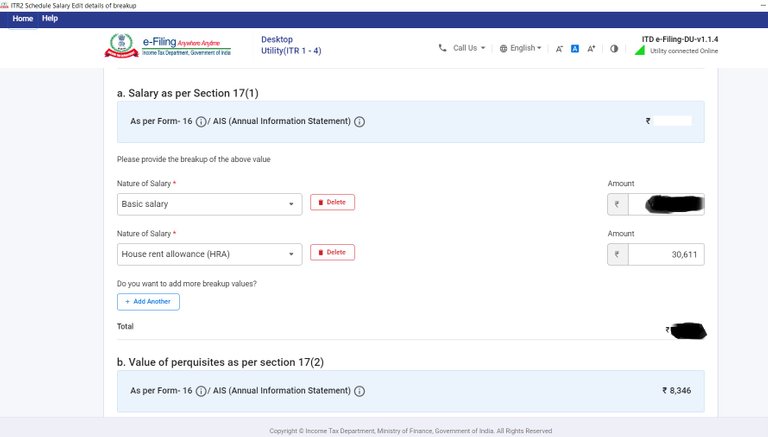

So the Salary is as per Form-16 / AIS, but then this had only the Basic Salary. There is an Edit button (on the top) and click on that and then click on Add Another and then add a component for HRA as shown above. But wait, the HRA amount is already been part of your Basic salary. So what you have to do is to calculate the Basic by deducting the amount of HRA and put that in Basic Salary and then put the HRA in the newly added component. The Form-16 already has the data and deducts the HRA from the basic salary to calculate tax. So ideally, the data should have been imported that way because its pretty standard process among all employers. And even if it has not been, it should allow me to enter the amount directly under the exemptions and consider that because that is how its in the Form-16. But behind the screen its looking out for the presence of the component under 17(1) Schedule Salary. SO after I entered in 17(1) and saving, the validation error does not come and I can see its considering that amount.

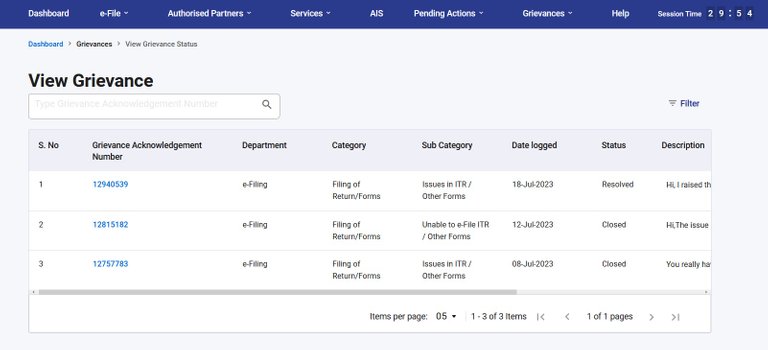

So finally they probably understood the problem after continuous follow up and figured out why the validation error was popping up ( may be did some code analysis). I did not give up and raised three grievances and patiently waited to understand the root cause and solution.

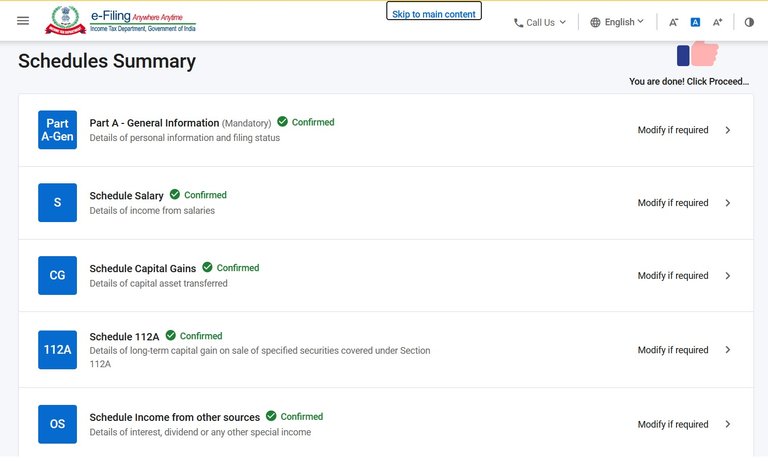

Now that the problem is solved, I have to go through each schedule in the offline utility and confirm before filling the return. So I thought, I should try in online mode because everything is already confirmed there.

And the changes did work well, so their point of uploading and doing it offline was not necessary at all. It's just a bug that exists in both and the solution works at both the places. However, the story did not end there. For every claim under exemptions, they need an entry in 17(1). And surprisingly it fails at the last step, which makes you go back and add them. They tell you to click on the link, but that does not work. So you can navigate back to Schedules , its auto saved, so no worries there.

So add every component under 17(1) and deduct the same amount from Basic Salary to ensure the final figure matches with your Form-16. There is no reason, why they want us to do all these manual work, where in they could have done it because the Form-16 clearly have them, so the AIS (Annual Information Statement) should have them as well. But since it blocks you to submit your return , you will have to figure out and make the change.

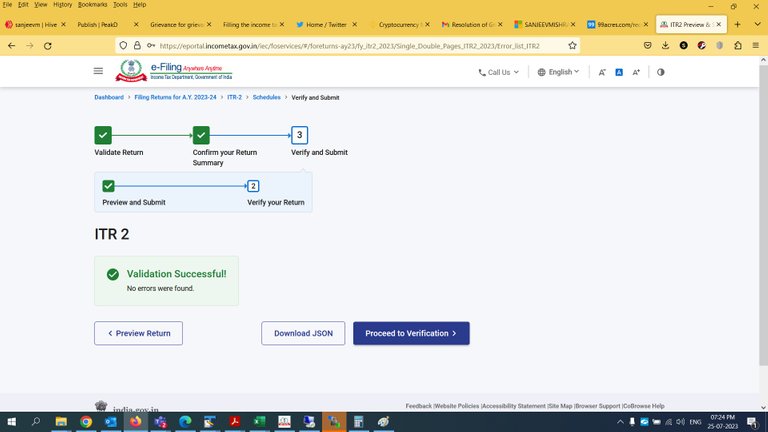

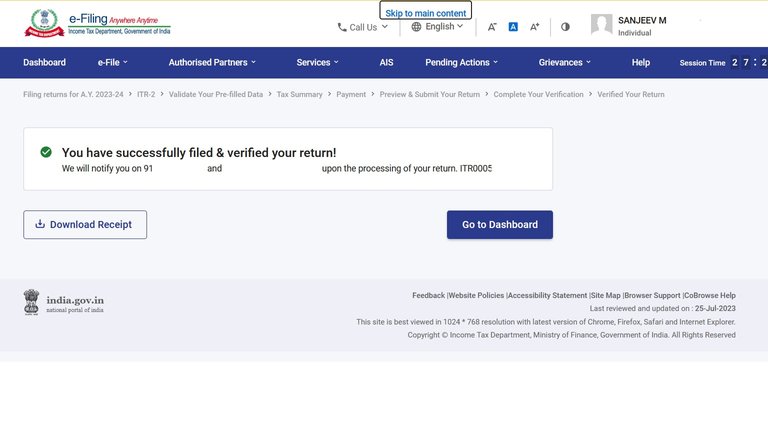

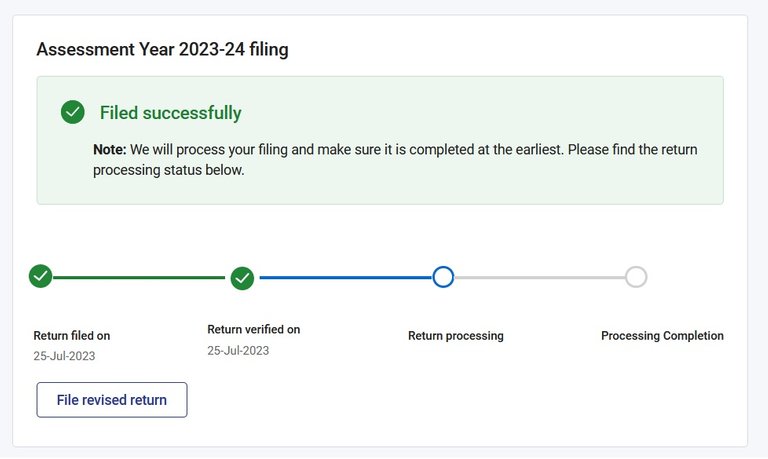

Once you come to a stage where Validation is successful, you can proceed for verification.

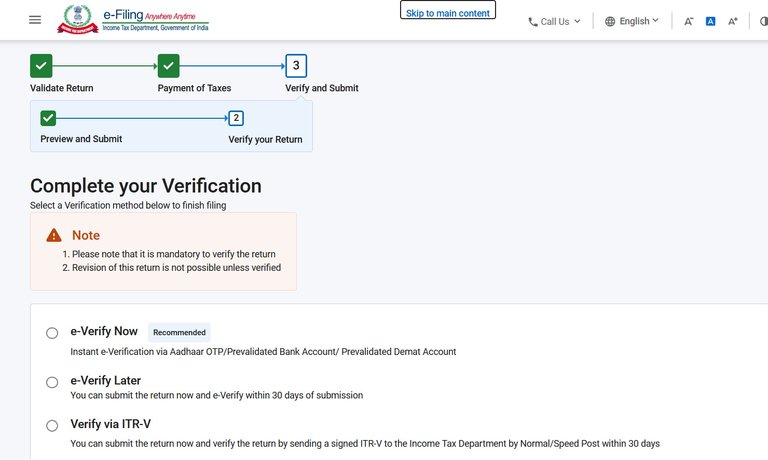

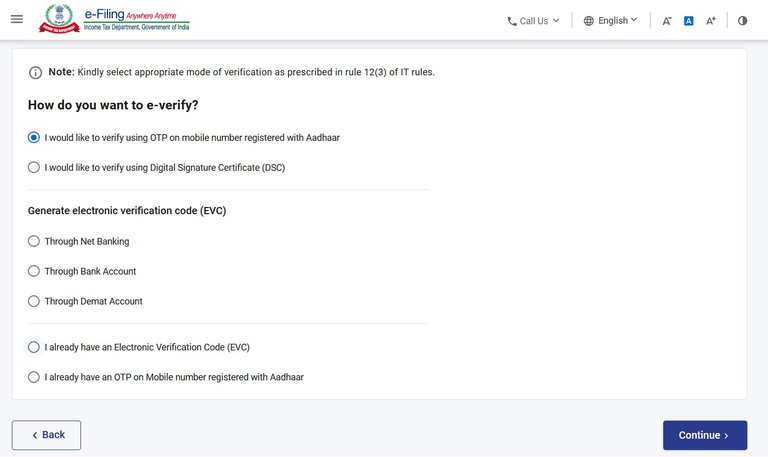

Select e-Verify Now as you can instantly verify, if your Mobile number is registered with Aadhar, which is most likely true for most of us.

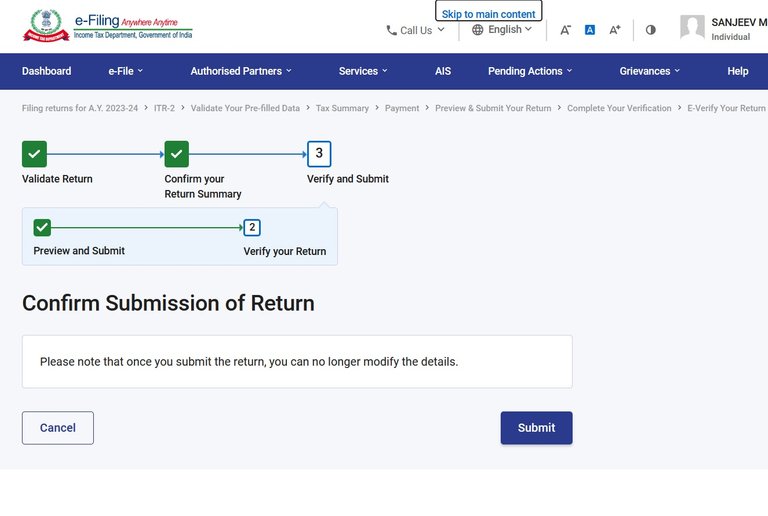

Please note, you cannot modify after you submit, but don't get scared, you can fill a revised return.

This completes a big task of submitting the return. As the due date is approaching, its better to do it now, as the site will definitely go through slowness because of spike in the no of users. You may also refer my old post apart from this post, to have all the information.

And let me know, if you need any help, I will try my best to fill your return. And by the way, I have chosen the new tax regime from this year, so no more headache of filling all these exemptions.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.

AI free content - do not loose your natural intelligence.

Posted Using LeoFinance Alpha

Do you suggest trying an offline utility to file instead of an online form? Good that you finished your filing.

Mine is still pending and hope I can finish it before this weekend.

One more thing- We can claim either HRA or the rent paid? One can be claimed right?

I think, online utility is better, because the offline utility connects online to retrieve your data. So if you fill online, it saves your draft automatically. For the HRA, you have to follow that HRA exemption rule :

The Income Tax Act Section 10 (13A) provides for HRA exemption of tax. The deduction will be the lowest among the following:

Salary here may include the basic salary, the dearness allowance, and the commissions.

src

If you are unable to do these calculations, then you can use a tax calculator like this : https://ynithya.com/taxcalc/

Usually the employer already takes care of calculating them and considers only the amount that is lowest of these four. So if you have it that way in your Form-16, you can just use that value.

This is great to hear that the solution has been solved and I am damn sure it will bring relieve to a lot of people

Yes, I think, its going to help a lot of people.

Finally there was solution. It gave you so much stress lately.

Finally......

Difficult terms as I don't know much about it.

There is very good news, now almost everyone's problem will be solved.

I have seenmy brothers worried for tax filing.

Such bugs are irritating and waste a lot of time. It is good to know that you are done with your task before time. Though it caused you the stress.

How are you dear friend @sanjeevm good day

finally the error has been corrected and you have been able to make the statement I appreciate that you have shared this experience.

enjoy the day

https://twitter.com/lee19389/status/1684169729001357312

#hive #posh

great man you finally did it. I still facing an issue and this time it is tied to u/s 80DD, I click hyperlinks and nothings happens and I haven't mentioned about 80DD not sure from where it is coming..pathetic experience..

I can help, if we want to look together. I know, they are giving some broken hyperlinks, which is indeed is pathetic. 80DD is a separate schedule all together, can you check, if it filled something by default. Did you declare anywhere that you have some dependent person with disability ? We can get into a video call and have a look.

thank you dear for the help. I have nothing in the 80DD and For now, I am trying to use the utility and will see if building json from the utility can help. As many people are suggesting this approach as opposed to doing it via the income tax department web portal. cheers

Let me know, if you still need any help.

It sounds like you had a few challenges along the way, but you were able to successfully file your return.

I understand that you were frustrated that you had to do some manual work to get your return to validate. I agree that it would be better if the tax department could automatically import the data from your Form-16. However, I am glad that you were able to figure out the solution and that you were able to file your return on time.

Ya finally, I figure out.

I hate how complicated they make it. Should be relatively straightforward for your average person but it ends up being shrouded in so many loopholes.

Exactly, if the employer has everything in Form-16, why the tax department would need the taxpayer to take all these burdens and be responsible.

Glad that you got it sorted!

Patience and continuously pinching them :) They would have ideally figured out in the first grievance itself.

😉😂😎🤜 It WAS an error in their system! but how rare of them to admit this..

glad u finally got it done. :)

And more ever closing the tickets without even giving proper answer, they would call us if they find out anything wrong in the tax payment, but not help when we need. Poor taxpayers..

It's good that you have found a solution otherwise one gets a lot of trouble especially when taxes come and one has to worry. We pray that this will solve all people's problems.

https://twitter.com/LovingGirlHive/status/1684519871923855360

I liked how you analyzed the different arguments for and against the solution, and how you showed the fallacies and contradictions on both sides. I think it is a very relevant and necessary topic to discuss, especially in these times of economic uncertainty.