Filling the income tax return yourself

A weird bug in ITR-2 that prevents to complete the filling

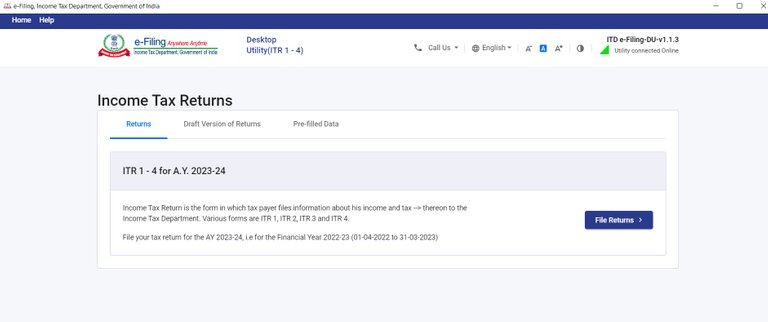

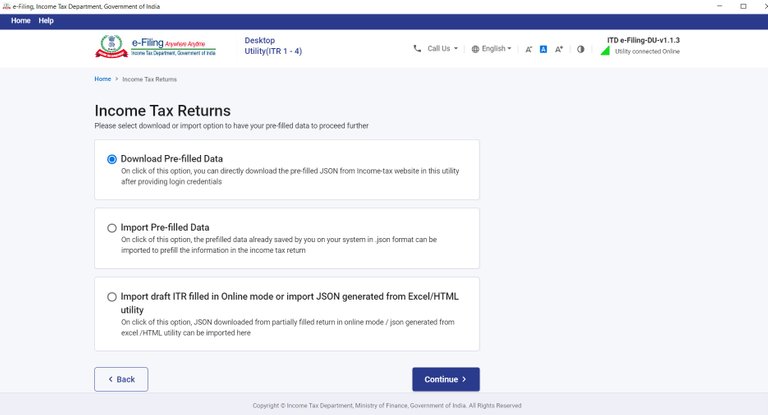

The clock is ticking for the income tax return filling as the date of July 31st is approaching fast. It's always better to fill the return now as usually most people will try to fill them towards the end, and then the site will be slow. Usually I fill it online, but then this year, when I explored the income tax site https://www.incometax.gov.in/iec/foportal/ , I could see an offline utility in the downloads section. I thought it would be better, so downloaded it and ran - its a desktop application that connects to the income tax site to download your prefilled data ( available with them based on your data provided by your employer) after you provide your login information.

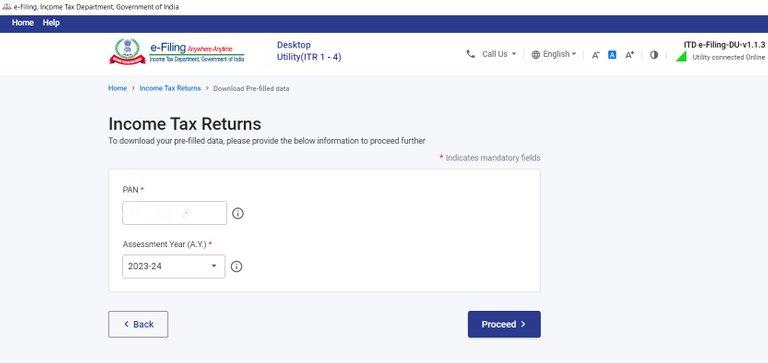

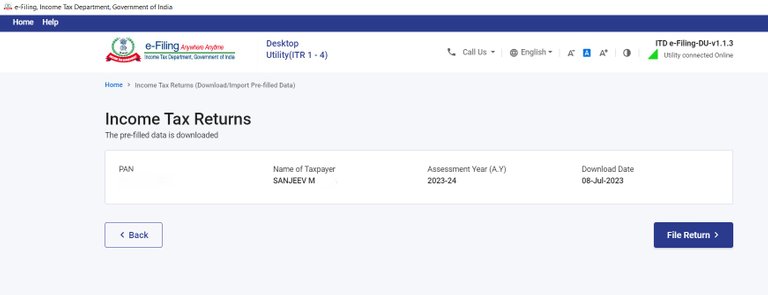

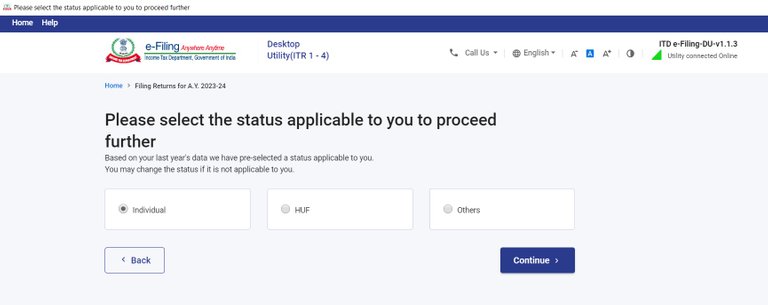

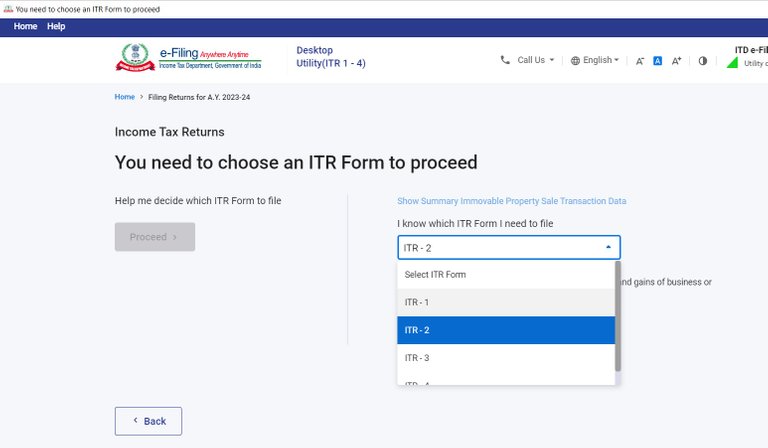

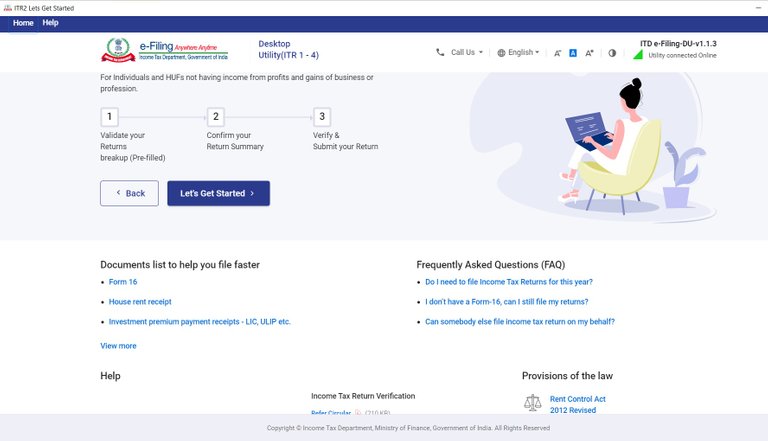

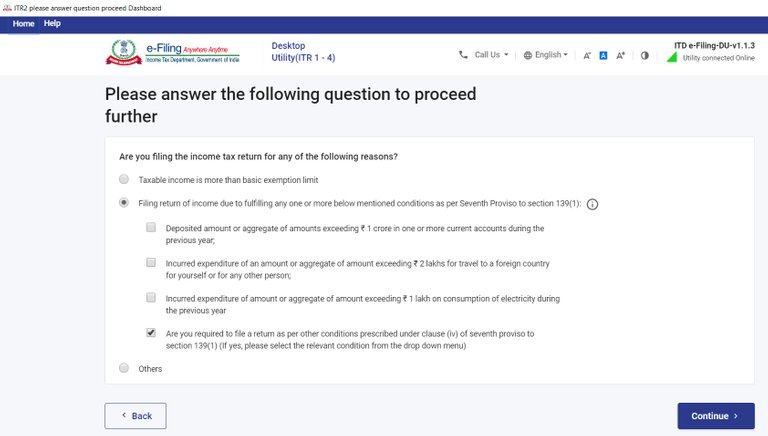

The steps are pretty straight as you can see in pictures below :

You need to put your PAN, and I have whitened them, as its a sensitive info.

It defaults to this option above, which is applicable only for few people whose taxable income is not more than basic exemption limit and they do not file the return but they need to fill the return because they fall into these categories. So you need to select the first option : taxable income is more than basic exemption limit - that is the reason you are paying tax and need to fill the return.

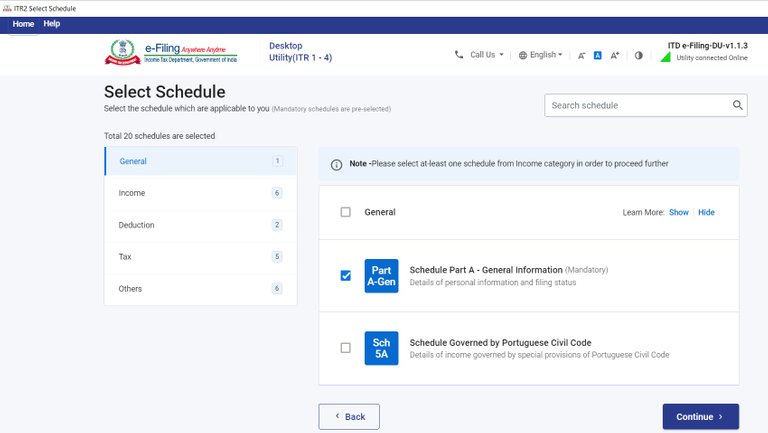

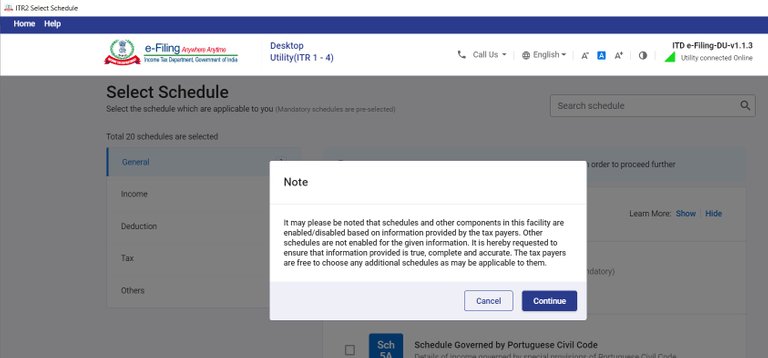

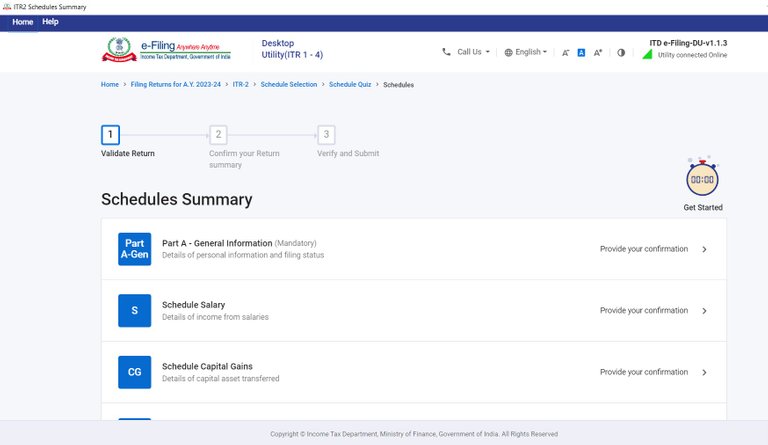

Look at that - 20 schedules are selected and on the top they say mandatory schedules are pre-selected. Not all of them are applicable for me, but then there is little I can do. And as it shows, I must ensure the information provided is true, complete and accurate - helpless citizen.

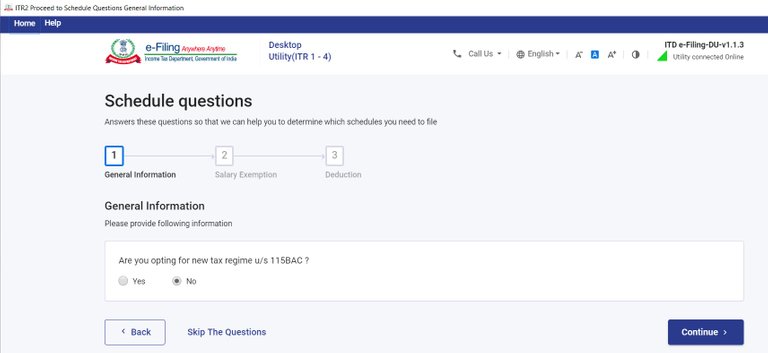

Then comes the schedule questions.

You have to be careful to select the tax regime here. It should match with what you provided to your employer because the tax calculation would have been done by your employer accordingly. After you select press Continue.

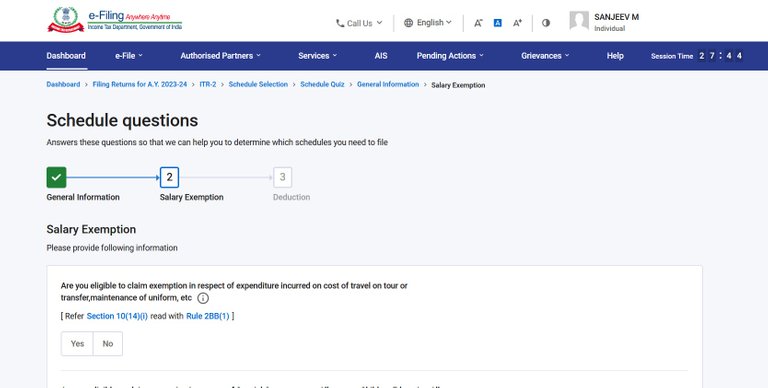

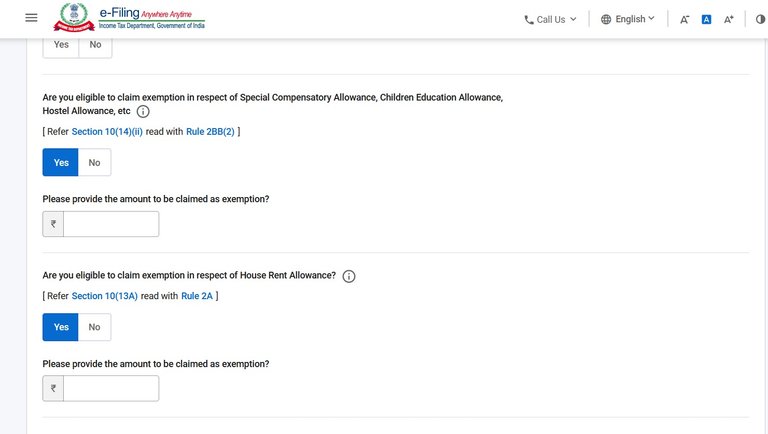

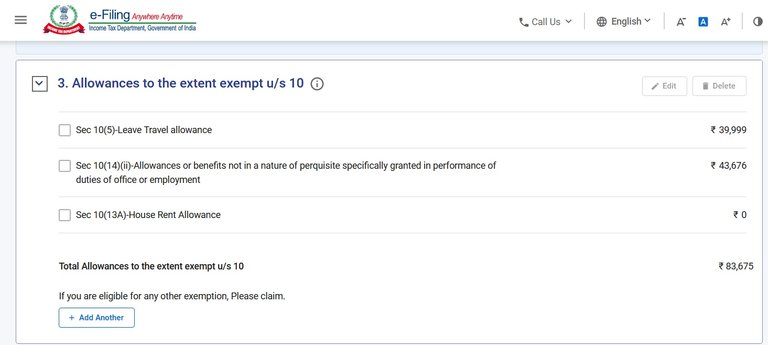

Salary Exemption is the most important piece of information that is relevant to many of us. It covers exemption in respect of various expenditures like travel allowance, children education allowance and any other reimbursements ( like Transport Allowance or Fuel Reimbursements, Telephone Reimbursement Meal vouchers), as per actual. And you cannot show it on your own, your company should have provided you the reimbursements based on the actual cost incurred. They clearly mention it in the Form 16 as well. However, I really don't understand why the data is not filled automatically, and we have to fill it.

And even the House Rent under section 10(13A) - the form 16 provided by the employer mentions it very clearly. But its missing here. So it's your responsibility to fill them and save to have the right tax computation. Most of the time people miss this and as a result the tax computation does not match with what it should be ideally.

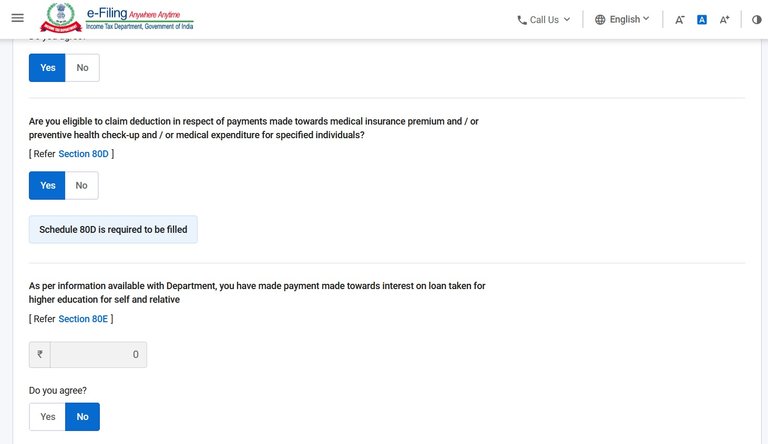

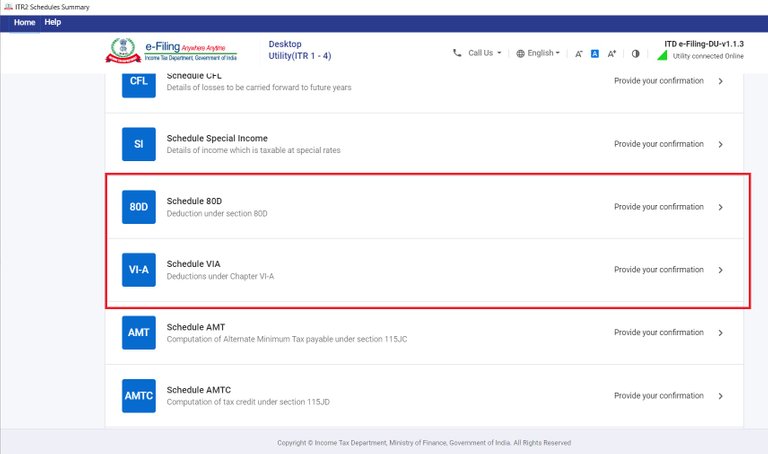

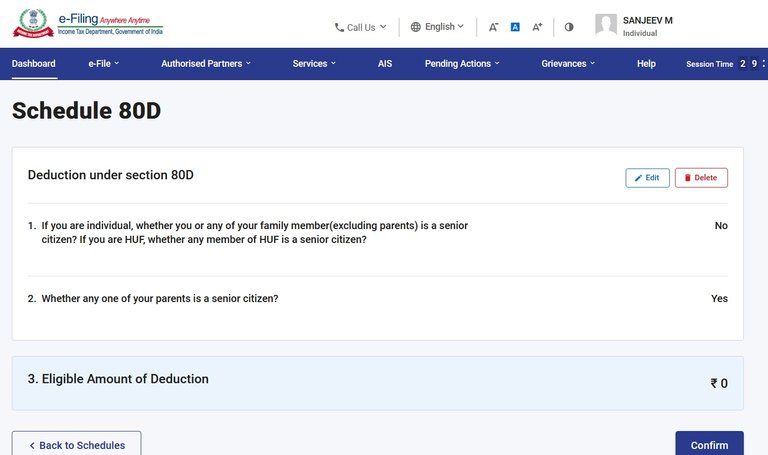

Another very important section is 80 D that covers medical insurance premium, preventive health check-up and / or medical expenditure. I believe almost each of us definitely pay for medical insurance. And this also covers your parents who could be Senior Citizens ( Senior Citizens have a higher limit). If you click yes, it pops up with a message saying "Schedule 80D is required to be filled", but then there is no direct navigation to Schedule 80D. So you have to find it and fill it, so press Continue and you will land in the Schedules Summary.

From here, you will have to select the 80D Schedule and fill the amounts and save.

Click on Edit and enter appropriate entries and then confirm. Now this amount should reflect inside Schedule VI-A. You should enter the amounts paid by you. So if your employer gives you medical insurance free , then you don't need to enter anything for that. However, if they provide any add-on insurance for which you pay, then you can enter that here. Also you can include any personal medical insurance premium by clubbing them. It will consider the maximum as per limits. I really did not understand why they included the 80D as part of Schedule questions inside Salary Exemption, if its completely a different schedule.

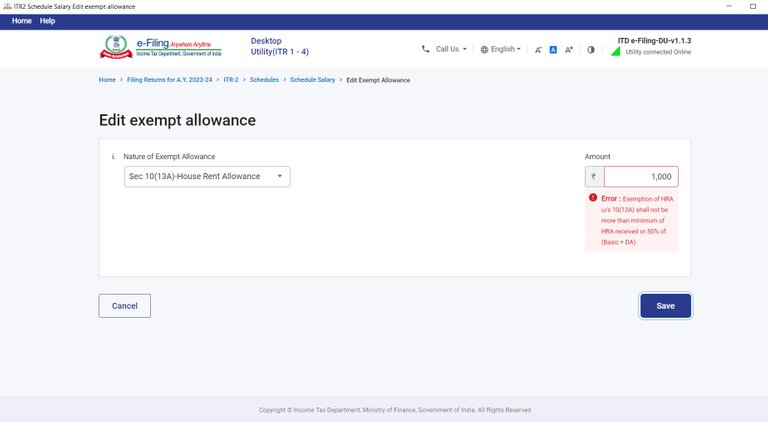

Before going further let's open the Schedule Salary and check again to make sure the exemptions are taken into consideration.Look at that, it does not consider the House Rent. Check that box and Edit and enter the amount again and you land here.

A weird bug in the ITR-2 form that does not allow to save the House Rent exemption saying : Exemption of HRA u/s 10(13A) shall not be more than minimum of HRA received or 50% of (Basic + DA). You enter any amount, it ends with same result. So this where I am stuck and there is no solution. It feels like the Income Tax Department has published the ITR2 utility without adequate testing - poor quality assurance. I tried to look into the videos they have published and even left my comments on one of their videos.

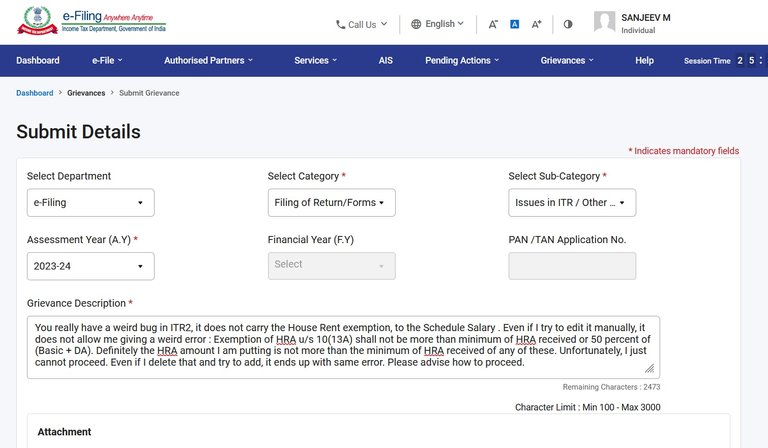

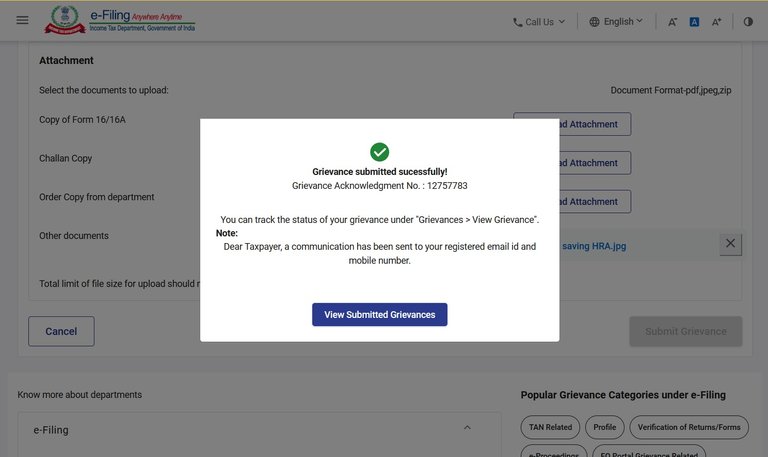

I have also filled a grievance with them. You can do so by selecting the Grievances drop-down.

I will be waiting for few days to see if they respond or not. In the mean time, I tried one more work around. Instead of filling the House Rent Allowance under Allowances, I added another and put the description and filled the amount. It does not have that validation, so it works and considers that amount. So if I do not hear back from them in next couple of weeks, I will go ahead with this approach as July 31st is the last date. Hopefully, they will fix this bug and let me know - helpless citizen.

And do you notice anything unusual in these images ? If you see closely, then you can see some of the images are from the application and some from the online filling. So I tried online after I faced the issue in the application and the bug exists in ITR-2 form at both places. There is one other option to explore - the excel utility which I have not tried yet.

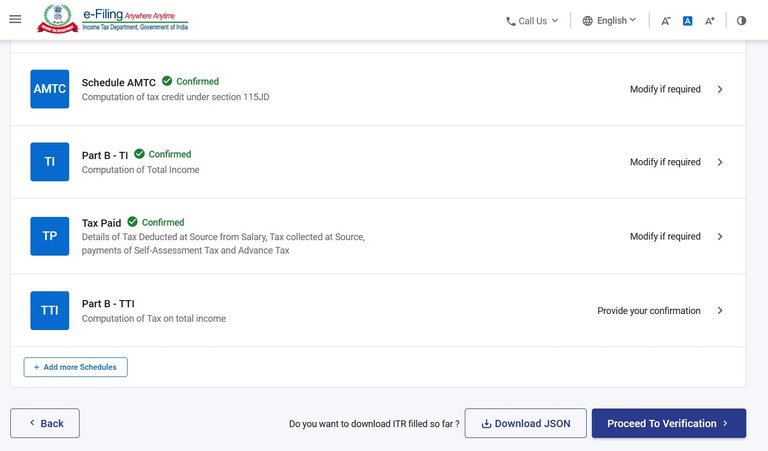

If you are using ITR-1, then that may not have this issue. So if you good with that, then all you have to do is to go through each other schedules and Confirm each. Most of them may not be applicable to you ( e.g. Schedule Capital Gains, Schedule 112A, Schedule Income from other sources, Schedule BFLA, Schedule CFL, Schedule AMT, Schedule AMTC) but you still have to navigate and confirm them. And then finally look at the most important schedules : Part B - TI, Tax Paid, Part B - TI Computation of Total Income.

If all is well, then you can confirm them and proceed to verification to finalize your returns. Hope this helps to fill your return, in case you need any help, let me know. I can assist you, but promise me, you will help others in a similar fashion.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.

AI free content - do not loose your natural intelligence.

Posted Using LeoFinance Alpha

Very nice my dear friend you are giving best information regarding to the fill up ITR. This is very helpful for the Indian people. Thanks my dear friend

At present, we do not have that much income to file income tax return, @sanjeevm bhai. 😌

I have not such system to which I have to go through but your post about that is really informative.

You have well elaborated all these steps and any one can get help through it very easily.

Its very helpful. Good.👍

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

What about crypto?

Did u declare the crypto earning for the year?

Thank you.

Nope, I have not earned anything so far as I have not done any of this. You first have to show your income and then calculate tax on it and that is only possible only when you encash in INR, isn't it ? Staking rewards are taxable, but then one has to receive it to pay tax, right ? Unless there is earning from stake benefits, there is no way I can show it in my income.

Posted Using LeoFinance Alpha

True.

So did u declare your crypto holdings? Or not yet?

Not yet, but I guess we have to do that, it's all in her account and she does not have any income :)

There is correction I think. You're liable for tax even if you don't encash. When you sell and book profit then tax is applicable.

I have gone through it and everyone says the same. Govt will not wait for years if you don't cashout in INR

I haven't sold anything, so then what to do ? All I have is in HIVE here.

Posted Using LeoFinance Alpha

Hi @sanjeevm

If you have sold crypto on profit during the year then there is tax liability.

I have gone through some of the videos on Youtube and this is what they say. Below is the site that can be helpful if you want. Their team explains better. You can drop them your query and they mostly reply within 4 work hours. I have no affiliation with this and found it during my research/study, so I am sharing it here. Hope it can help you. I also have their support team's contact number so let me know if you need it. Lots of people are struggling with taxation this year.

https://www.koinx.com/

I heard that many people hire accountants for all their tax related work. Maybe everyone is not confident of filing it themself ?

Ya, people don't even try, but its not damn difficult. In fact they would learn about their income and spending more, if they do it themselves.

Posted Using LeoFinance Alpha

You are right but people have become so lazy that they don't want to learn something new. They are rather paying an accountant but they will not bother to learn and do it themself.

!BBH

@sanjeevm! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @kahkashan. (1/1)

https://twitter.com/LovingGirlHive/status/1678301249693966337

If my country can actually implore this system in their tax stuff, it will also be great

Proces have been eased out a lot in these years..anyone can file it...as most of companies are already furnishing the tds so it's matte4 of few click to file itr

https://twitter.com/lee19389/status/1678330971333218304

#hive #posh

My tax filing is also pending and I wanted to do it this weekend however could not get through. Now next weekend is the plan but after going through your post I think that I need to check it first at least to see if things are good to go or not.

Have you declared your crypto before ?

No, I haven't.

Posted Using LeoFinance Alpha

ok..

I have never fillied income tax return, but seeing you doing that, is encourage me to do so.

How are you dear friend @sanjeevm good day

It's a pity that the filling in of the form has this error, since it is a lot of work to load the data into the system, it is frustrating to do all this, and that in the end you cannot complete the load due to the error, I hope you receive the answer to your request soon. claim

Hopefully.

So July is the ITR filing in India. In our country, it's April.

I also tried filling the the IT return today and got stuck at the same place for HRA..not taking any value..for now I have just safed the details.. let's see if there is any update from IT dept. Thanks for sharing..🙏🙏🙏

It was disappointing - how could they publish a utility with a bug that blocks !!! Some basic testing would have brought up this. Let's see, otherwise I have a plan - Add Other, put the description as House Rent and put the figure. It works.

Yes, the other option of adding the HRA was working. I will also see if I get a workaround - maybe we are doing something wrong here. cheers

You are prompt with filing the income tax return.

Thank you for sharing this detailed post about the ITR-2 form and the bug that you encountered. It is very helpful to know about this issue so that others can be aware of it and avoid getting stuck.

I understand that you are frustrated with the lack of response from the Income Tax Department. I would suggest that you continue to follow up with them and let them know that this is a serious issue that needs to be fixed.

yea.. I hate when online forms or like that don't work right. I was just on a site trying to just update my address. it let me delete my old one, but not edit it or create a new one. 😐😒😠

A services company must have developed this :)

😁👍 yup.

In this way people get into the habit that we do the same way that when the due date of the bill comes, we fill it up and sometimes it happens that even the next month also comes for the previous month. We all have to break this habit. You are very good at getting things done on time.

Regarding the Tax declaration, it is always good to avoid sanctions and file them as soon as possible since, as you say, most of the people leave everything for the last minute and the site, being online, can present inconveniences.

It is always good to fulfill our commitments and be exemplary citizens

This is very well explained and also what a curious error to fill the data in ITR-2, it should not happen something like this and it is a big failure on their part, I feel that with a considerable amount of people send them a complaint they have to solve it, a greeting friend and thanks for spreading this!

This post is very interesting for those having to do this process. I still find amusing how taxes can get you in so much trouble if you do it incorrectly but there are several issues that are not in your hands.

Hi! I saw your article shared on Twitter. Thanks for showing the world your content from Leo Finance. Since you are sharing there, if you want to be elegible for our Twitter Outreach Curation there are some simple guidelines to follow:

It doesn't exclude you from other type of curation, but by sharing the best way possible you are getting more opportunities to be seen, also help Leo and Hive to get more traffic.

You can get more info about it on this article

Hi @sanjeevm,

If you've made a profit from selling cryptocurrency this year, you'll need to consider the tax implications. I've been researching this topic and found some useful resources on YouTube. Additionally, I came across a few websites that might be helpful. They have teams that offer clear explanations and usually respond to queries within four working hours. I'm sharing this information based on my own research and have no connection with these sites. Hopefully, this can assist you. If you're interested, I can also provide you with the support team's contact details, as many people are facing challenges with tax issues this year.

Websites for reference: https://www.catax.app, https://coinroot.com , https://taxbit.com