Today's Crypto Mining companies have also built capacities to power the AI industry!

Riding the AI trend, proved a smart move for everyone including crypto miners

In recent years, we have heard warnings that we have either two choices - to learn to make use of Artificial Intelligence tools and enhance our productivity or be replaced by a smarter individual who can do the allotted work much faster with enhanced efficiency with the aid of AI.

This prospect was scary at the onset, but there are always those having a mindset that see these developments as an opportunity to grow, develop their skills, improve their productivity and eventually their job prospects and salary.

This AI wave which came in recent years was perceived as an opportunity not just by us but also by cryptocurrency miners, as AI provided them a chance to diversify their business and reap lucrative earnings.

Ethereum Miners' natural transition to use their computing resources to power AI systems

Ethereum Miners during recent years have faced challenges, as their usual avenue of earning through crypto mining operations closed down.

This is because traditional Ethereum Miners who were making money through mining ETH when it was a Proof-of-work Protocol, could no longer do so post Merge as Ethereum transitioned into a Proof of Stake protocol. Their ETH mining business closed down so they had to find another way of earning money.

Since these Ethereum Miners had robust operational data center infrastructure and GPUs whose high computational capacities can be leveraged to power various AI algorithms, they found another avenue to earn money.

Fortunately, the GPU processors used for mining ETH find usage in AI systems as well to power high computational processes with heavy workload requirements for processes like - training generative AI systems, power text to image generation processes, VFX rendering etc.

Therefore, Ethereum cryptocurrency miners found their opportunity to earn revenues with the Artificial Intelligence wave having got kick started in recent years.

As they repurposed their business they had to restructure their Data Center infrastructure with capabilities to support AI systems and cater to the requirements of the AI industry.

Bitcoin Mining Businesses reduced earning potential post halving

Similarly, Bitcoin Mining companies who have foreseen that their Bitcoin Mining Business would tend to be less profitable post-halving have diversified their business by expanding their infrastructural capacities to cater to the needs of the AI industry.

As Bitcoin Block rewards are halved from 6.25 BTC to 3.125 BTC per Block, the cost of producing BTC also rises.

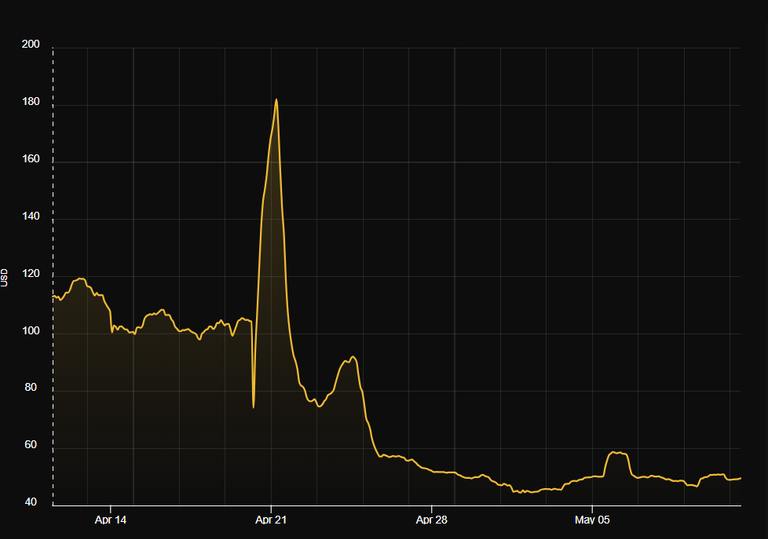

The Bitcoin Hash Price index metric which measures the average earnings Bitcoin Miners make per 1TH unit of their hashing power per day has been on a decline since Halving – from $ 90 on April 24th to $47 on May 9th according to data from Hashrate indes - https://data.hashrateindex.com/chart/bitcoin-hashprice-index.

Bitcoin Hash Price Index reduces since halving

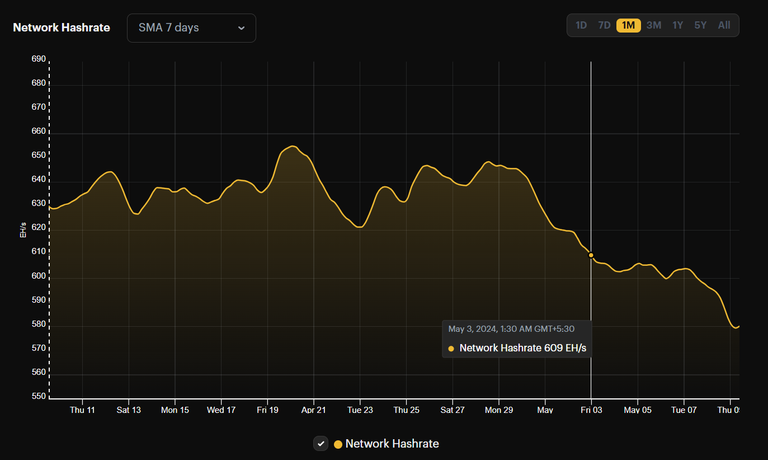

Consequently, Bitcoin Hashrate, the metric that denotes the amount of computing power securing the Bitcoin Network has declined since April 28 from 627 EHs to 588 EHs on May 8th.

This reveals that less competitive Bitcoin Miners have closed their Bitcoin Mining business, which is why there is less hash power powering Bitcoin Network than on April 28. This could be a post-halving phenomenon.

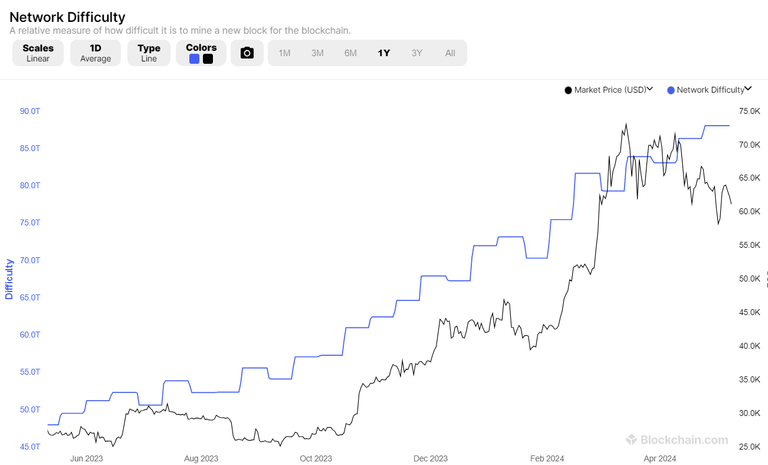

Also, Bitcoin Mining Difficulty levels post-halving increased since April 23 from 86.39 T to 88.10 on April 25th. This implies that Bitcoin Miners need to have more advanced Bitcoin Mining Machinery to mine the same amount of BTCs they were able to mine before with their previous mining machinery.

Sum all this up – Reduced Bitcoin Mining rewards + increase in Network Difficulty + fall in BTC’s price since halving, it all would lead to – Reduced Bitcoin Hash Price and reduced Bitcoin Hashrate.

Bitcoin Miners can easily diversify their operations into providing computing power for AI industry

Taking into account that Bitcoin Mining operations are less lucrative, companies in recent years have diversified their business into also providing computing power to service the Artificial Intelligence Industry.

Here, although Bitcoin mining machines used to mine Bitcoin can't be used to power AI processes, what matters is that Bitcoin mining companies have the required expertise in building data center infrastructure and maintaining them.

Data Center infrastructure is the backbone of Artificial Intelligence systems equipping them with high computational processing power required by them.

Bitcoin Mining companies wanting to diversify into providing computing power to the AI industry need to build new Data Centers customized to meet the high computational requirements of Artificial Intelligence algorithms that are different from the computational requirements needed to power the Bitcoin Network.

AI systems usually need high computational power resources to power data processing, machine learning processes, and GPU processors that can bear the heavy computational workload requirements for training generative AI systems.

Bitcoin Network on the other hand needs high computing resources to power its mining functions which involves solving complex mathematical equations with the aid of mining machines known as application-specific integrated circuit (ASIC) miners.

However, Bitcoin Mining Companies do have most of the resources and know-how required to build Data Centres to power Artificial Intelligence systems.

They already have the base building blocks required to build Data Centre infrastructure, with electrical capacities, electrical and cooling equipments.

They just need to build data center infrastructure with the required capacities to ensure optimal usage of their resources for operational efficiency along with cost efficiency.

Advantages of companies having two streams of generating earnings revenue

This was what was done by Bitcoin Mining companies like BitDigital, Hive, and Hut 8 who now have established an additional earning stream by utilising their computing resources to also power the AI industry.

This makes good business sense, as there is another business in operation earning revenues for these companies, at a time when Bitcoin Mining operations are not providing lucrative revenues.

One can call it a way to hedge against times when revenue earnings from Bitcoin Mining Operations are low due to Bitcoin halving, decline in Bitcoin prices, and reduced earnings through Bitcoin fees when there is low Network activity.

I suppose maintaining such a hedge pays off because there are always times when Bitcoin Miners make a jackpot amount of earnings not only during bull runs, but also due to additional activity in the Bitcoin Network, with operational Layer 2 applications inside Bitcoin now. Quite Cool!

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks for your contribution to the STEMsocial community. Feel free to join us on discord to get to know the rest of us!

Please consider delegating to the @stemsocial account (85% of the curation rewards are returned).

You may also include @stemsocial as a beneficiary of the rewards of this post to get a stronger support.