Across Protocol: Enhancing EVM Interoperability with Intent-Based Solutions

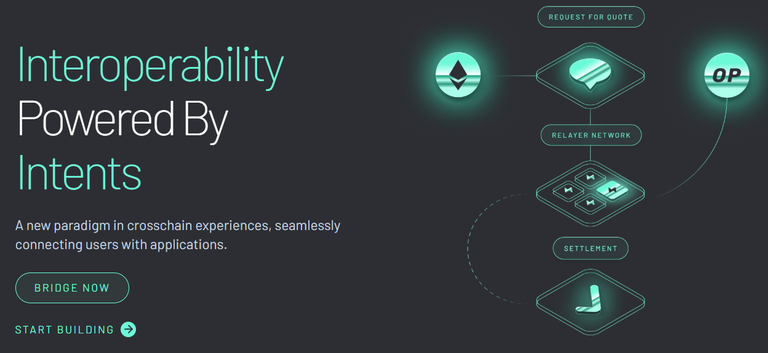

Across Protocol is reshaping the interoperability landscape in Web3 by introducing the first-ever intent-based interoperability solution for the Ethereum Virtual Machine (EVM) ecosystem.

Its intent-powered approach enables seamless, secure, and cost-efficient operations across Ethereum Layer 1 (L1) and various EVM-compatible Layer 2 (L2) networks.

The intent-based design of Across Protocol simplifies interoperability in a secure manner, eliminating the need for developers to invest in creating complex technical infrastructure typically required for existing trustless interoperability protocols.

Additionally, Across’s interoperability does not rely on centralized third parties for asset custody, unlike traditional bridge protocols, making it more secure and trustless.

Overall, Across Protocol’s intent-based architecture offers instant, low-cost, and secure interoperability with an easy setup, which is its most significant unique selling point!

Understanding Across Protocol’s Cross-Chain Intent Orders

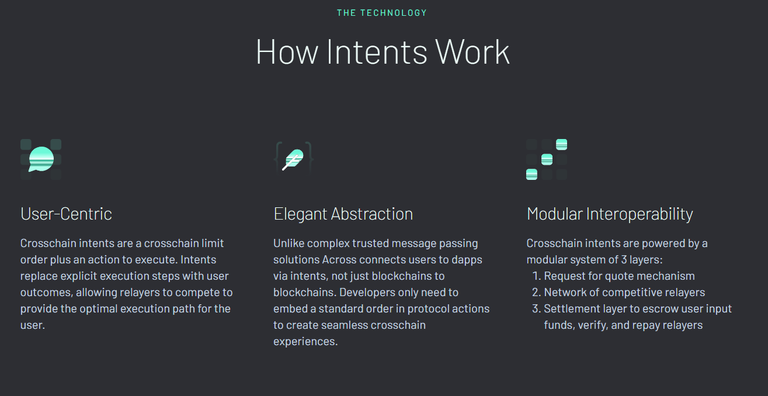

Across Protocol introduces an innovative concept that treats cross-chain transactions as intent orders.

These orders are user-defined instructions that specify the desired outcomes on destination chains. This approach streamlines cross-chain transactions, allowing them to be completed in under a minute.

Across' Intent-Order flow powered interoperability operations make it possible to establish instant cross-chain interoperability as a user’s cross-chain transaction does not go through cumbersome multiple execution paths which all need to go through time consuming verification processes causing latency.

One can think of these cross-chain intent orders as cross-chain limit orders combined with action execution calls.

All users’ cross-chain intent orders adhere to the ERC-7683 standard, ensuring that cross-chain intent orders generated from any L2 Chain is in the format recognized by the Across Network so that cross-chain transaction operations take place seamlessly.

Across’s cross-chain intent order contains necessary details outlining the specifics of the users’ input transaction and the expected outcome in the destination chain.

These details are of - user’s input token, user’s input amount, the Network and address in which output token and agreed output amount need to be sent. The time frame within which intent order needs to be fulfilled is also mentioned.

Apart from this intent order can embedded with an instruction to execute some protocol action in the destination chain (like a cross-chain swap instruction) as a custom message.

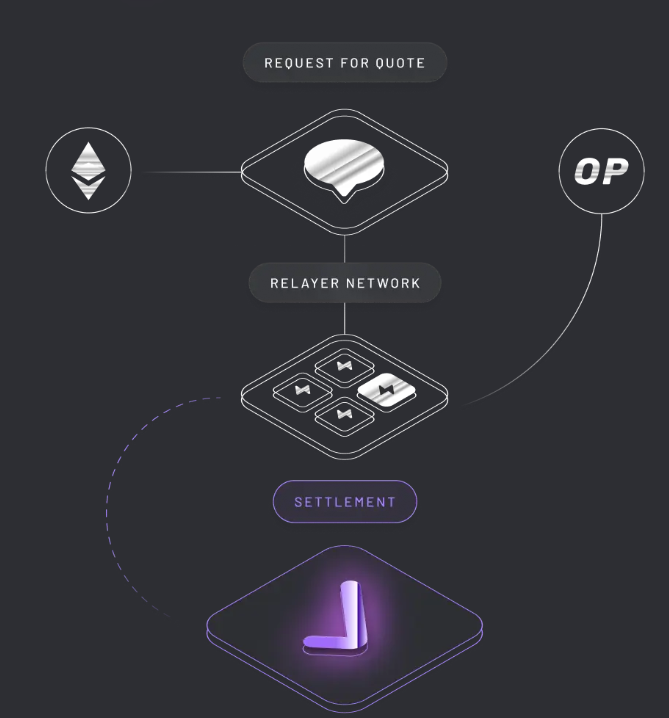

Overview of the Across Intent-Order Based Interoperability Mechanism

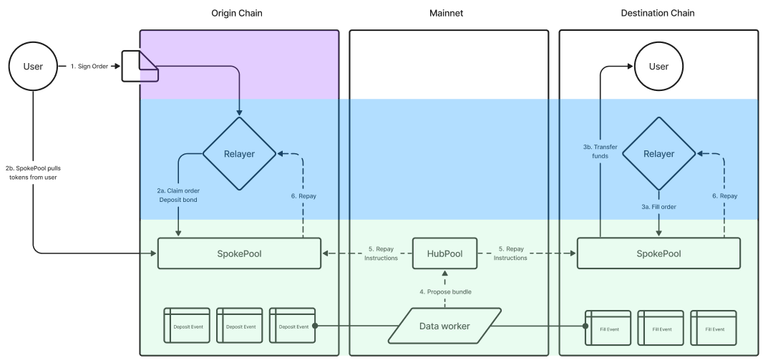

1. Quote Generation: Users initiate the process by requesting quotes from Across's network of third-party relayers. These relayers compete to provide the best fee-based services.

2. Order Activation: Upon accepting a quote, the user's funds are escrowed into the SpokePool Smart Contract on the Source Chain. These funds represent the user's input tokens needed to pay the relayer. A “User Deposit Event” is generated for the relayer to fulfill.

3. Execution: The relayer completes the user's Deposit Event by sending output tokens to the Destination Chain’s SpokePool Contract. The relayer can source liquidity for fulfilling the user's Deposit Event from Across's liquidity providers, in exchange for a fee.

4. Completion of Cross-Chain Transaction:

The user's cross-chain transaction is executed instantly, and they immediately receive their funds from the Destination Chain’s SpokePool Contract at the specified destination address.

Any preceding cross-chain execution calls, as instructed in the user's intent order, are also carried out.

5. Verification & Settlement:

Data Workers verify the validity of the Relayer’s Fill Event by aggregating all valid Fill Events and matching it with User Deposit Event which is made into a repayment bundle and proposed to be optimistically verified by UMA’s Decentralized Oracle.

The verification process occurs within the Across Protocol’s Mainnet.

Data Workers submit the repayment bundle to undergo the verification process to the HubPool Contract in Across Mainnet, along with an ABT Bond (Across Bond Token).

A 60-minute challenge period is opened during which disputes can be raised if someone identifies invalid transaction fill events included by the relayer. A disputant must also deposit an ABT Bond when initiating a dispute.

If a raised dispute is deemed valid, the relayer’s bond will be forfeited and awarded to the disputant, and the submitted transaction bundle will not be processed.

If no disputes are raised, the relayer will execute the repayment bundle locked in the HubPool, which will route payments to the relayers.

This way Across Protocol’s Intend-based interoperability powers instant and secure cross-chain interoperability across the EVM ecosystem.

The delays involved in the verification of cross-chain transactions are borne by Relayers who charge fee for this, while the user's cross-chain transactions and transfers across the EVM ecosystem happen instantly.

Factors determining Relayer’s fees for fulfilling a Cross-Chain intent order in Across

The fee charged by the Relayers will be reflected in the output amount dispatched to the users as is mentioned in Relayer’s Quote, which was accepted by the user. This fee is calculated based on costs that would be borne by the Relayer for filling up the User’s cross-chain intent order.

These costs include – fees paid by Relayer to Across’s LPs, gas fees charges incurred to make the transaction in the destination chain and the Relayer’s service charge fee.

Picturing a user's cross-chain intent order getting filled in Across Protocol

When a user wants to transfer USDC from Polygon to Base, they begin by sending the amount of USDC according to the quote provided by the Relayer, which the user has accepted. This transaction becomes a Cross-Chain Intent Order that the Relayer must fulfill. The USDC tokens are then escrowed in the SpokePool Smart Contract on the Polygon chain.

A Deposit Event is created, and the Relayer transfers the corresponding amount of USDC tokens to the SpokePool Smart Contract on the Base Chain. For this transaction, the Relayer can obtain USDC liquidity from Across’s passive Liquidity Providers (LPs) for a fee.

When sending tokens to Base’s SpokePool Contract, the Relayer specifies the chain from which they want to receive the user’s input funds. Once the USDC is deposited into the Base SpokePool, it is released to the address indicated in the user’s intent order. If the user includes additional instructions to swap USDC for POL, this swap will occur, and the resulting POL will be deposited in the specified address.

The Relayer will receive the user’s input tokens after their Fill Event has been verified as valid. This verification process is secured by UMA’s Decentralized Oracle.

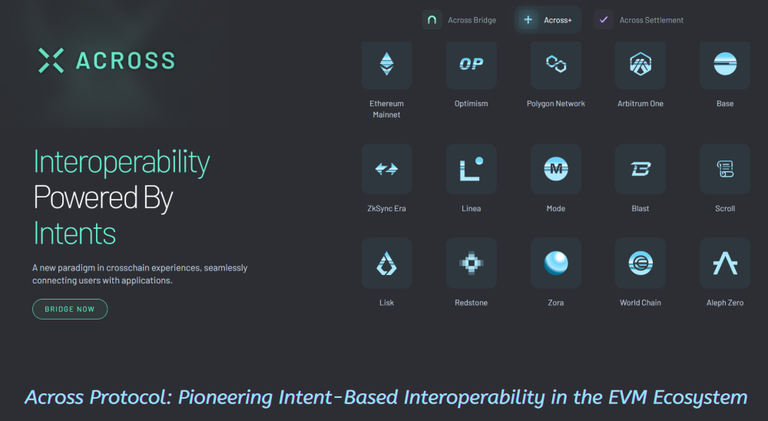

Across Products: Bridging distances between EVM Networks inside the EVM ecosystem

Across Bridge: Designed for token value transfers between Ethereum L1 and various L2 networks.

Across+: A more advanced solution enabling cross-chain hooks, equipping cross-chain transaction to be embedded with additional functionality to execute protocol actions (like token swaps) on the destination chain

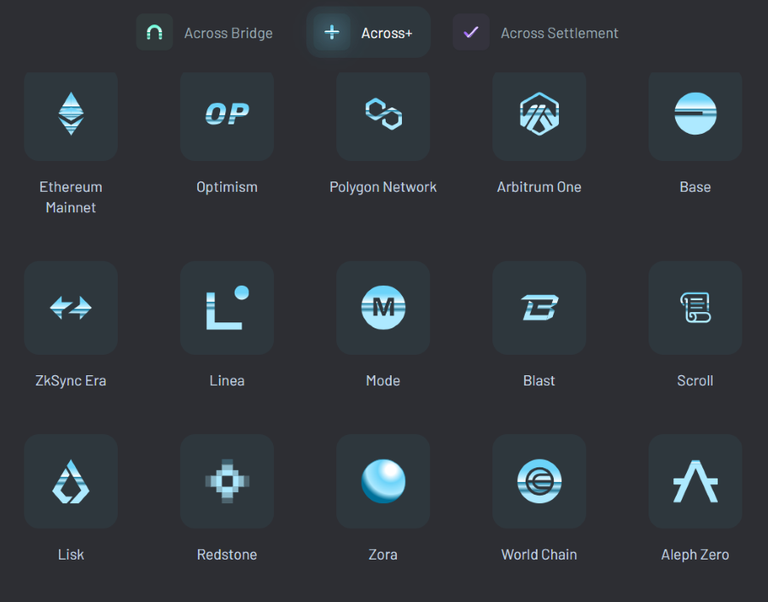

EVM Networks that support Across+ to power protocol interoperability within EVM ecosystem

Advantages of Integrating Across Interoperability Solutions into EVM based Protocols

Developers can easily integrate Across's interoperability solutions into their decentralized applications (dApps) without needing to do any work on their dapp's Smart Contracts.

Once integrated, dApps powered by Across can attract users from other EVM Layer 2 (L2) networks into their protocols.

UX of Across supported protocols is enhanced, as transferring assets from protocols located on other EVM L2 Networks becomes easy.

Similarly, hassle-free cross-chain transactions between dapps on two different EVM chains happen instantly. The liquidity of dapp protocols on different L2 Networks can be accessed by a dapp on any L2 chain.

Users not only don’t experience delays in interacting with different protocols on other EVM L2s and L1 Ethereum Mainnet, but they also don’t feel the complications of making such cross-chain interactions as they become seamless.

Across intent-powered interoperability integrates the entire EVM ecosystem, unifying liquidity, removing fragmentation, allowing users to explore all dapps in Across supported L2’s inside the EVM ecosystem.

Across' intent-powered interoperability integrates the entire EVM ecosystem, unifying liquidity and eliminating fragmentation. This enables users to explore all dApps supported by Across across various L2s within the EVM ecosystem.

Moreover, developers do not need to deploy instances of their protocols on other L2 networks to bring in users from different L2s.

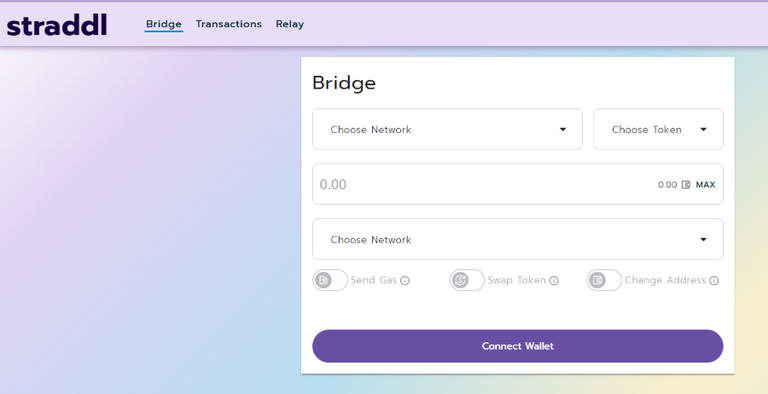

Straddl: The Go-To DEX for Instant and Seamless Cross-Chain Swaps in the EVM Ecosystem

Straddl is a working product built on Across Protocol for conducting instant, low-cost cross-chain swaps between EVM L2 Networks and Ethereum Mainnet.

Do check Straddl out here - https://straddl.io

Across Protocol: Unifying the EVM Ecosystem with Intent-Based Interoperability

Across Protocol’s interoperability to unify the EVM ecosystem is unique because it’s powered by intent-based design. Advantage for the users who a part of the EVM ecosystem using dapp on one particular L2 is that, instant, secure and low-cost interoperability is established between L2s and L1 Ethereum with Across integration on those protocols.

This increases Web3 adoption as well, as EVM L2 landscape is large with Web3’s most used and user liked protocols being spread across the EVM landscape.

Now user’s can interact with all protocols spread across different L2s and utilize the liquidity spread across them!

Check out Across Protocol -

Website - https://across.to/

Documentation - https://docs.across.to/concepts/intents-architecture-in-across

All images for this article are sourced from above sources.

Posted Using InLeo Alpha

Thanks for your contribution to the STEMsocial community. Feel free to join us on discord to get to know the rest of us!

Please consider delegating to the @stemsocial account (85% of the curation rewards are returned).

You may also include @stemsocial as a beneficiary of the rewards of this post to get a stronger support.