Auto-compounding on DeFi Farms - A quick study!

Auto-compounding farms

By now, most Hive users will be comfortable with the idea of DeFi farms. You create your token pair from two tokens, provide that liquidity to the farm, and manually reap the token rewards that the farm creates.

With the advent of Cub Finance Kingdoms, Hive users will also be up to speed with auto-compounding. Auto-compounding reaps and reinvests the farm rewards on a frequent basis. The idea being that users will benefit from higher APYs without having to actively manage the compounding process.

But does it work?

A not-particularly scientific study

Here's a quick study from some of my own investments in another auto-compounding farm, Solfarm on Solana (note that this project is still in beta, so high-risk etc).

Solfarm Tulip Logo

I have two investments:

(1) Liquidity in a STEP-USDC farm on Ray (a traditional Solana farm).

(2) Liquidity in a STEP-USDC farm on Solfarm (an auto-compounding Solana farm which invests in (1)). In addition to the auto-compounding this farm also provides some Tulip token rewards.

Which farm does best?

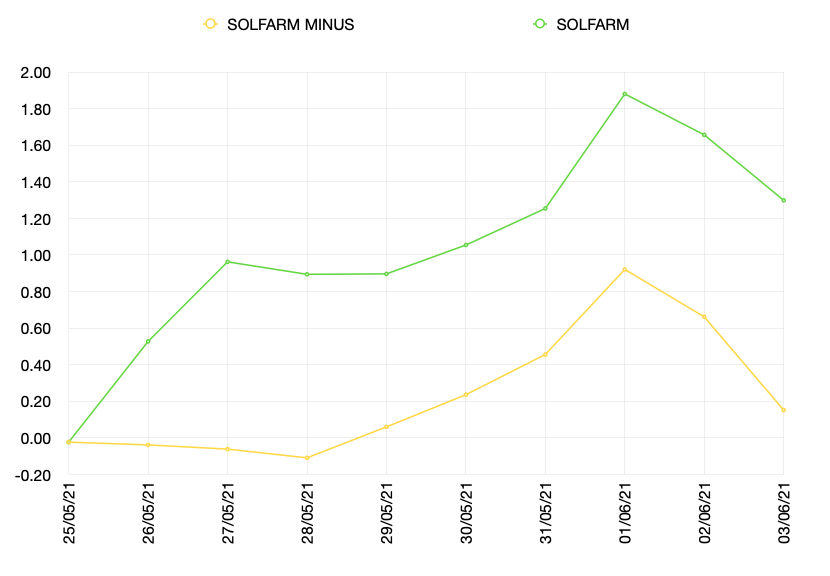

The results across 10 days

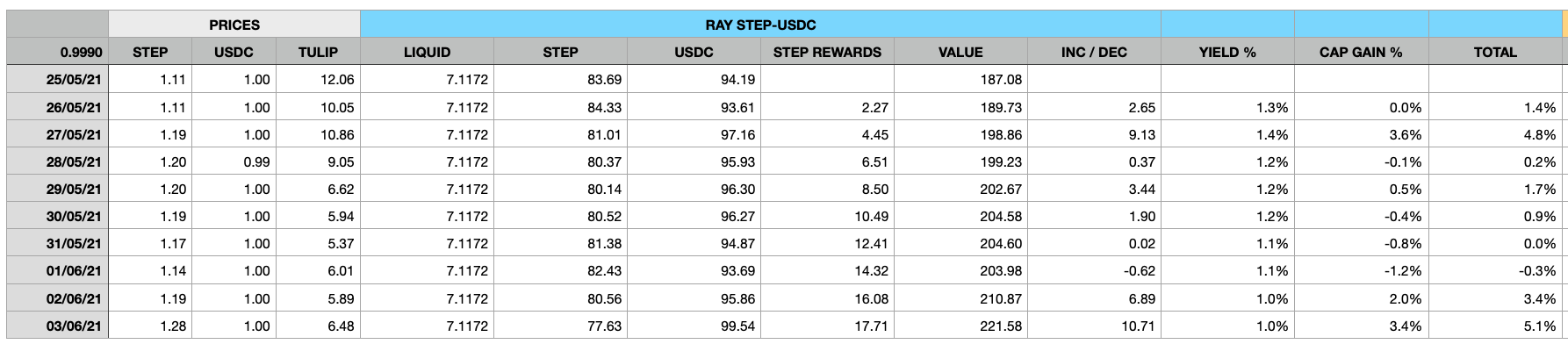

Ray traditional farm:

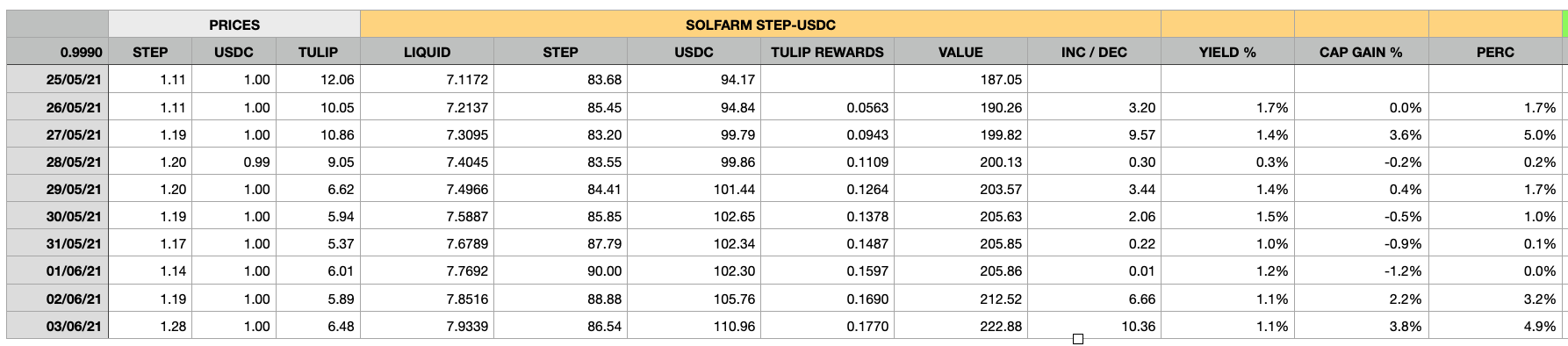

Solfarm auto-compounding farm:

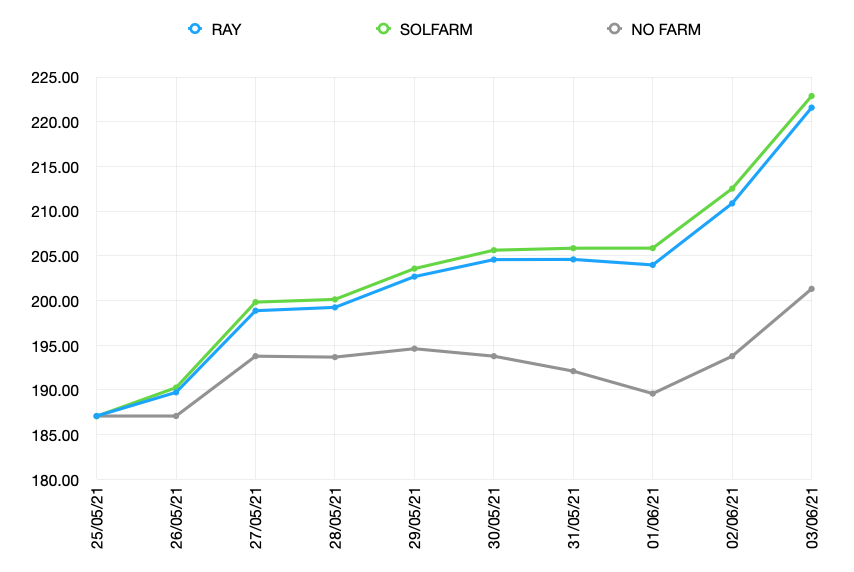

Comparison to no-farm:

Both farms far outstrip the no-farm option, i.e. the option of just holding the coins in my wallet and gaining no yield. This is because the STEP-USDC pool is particularly high yielding. Note that this high yield brings an increased risk (in my view) that the price will decrease over time.

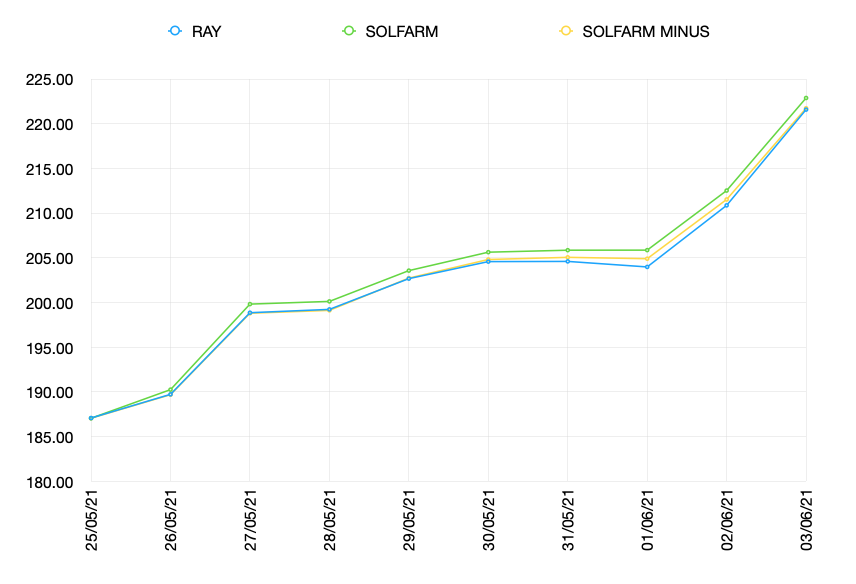

Comparison with and without tulip rewards:

But the results are pretty close between the two farms. Taking away the tulip rewards (solfarm minus) to just examine the auto-compounding effect, shows the results are even closer.

Differences between Ray and Solfarms with and without tulip rewards:

An examination of the differences between the two farms shows the auto-compounding farm winning but not by much and not in all conditions.

Auto-compounding had produced approx $0.90 after a week (out of $187 investment so 0.5%) but this reduced when the conditions went against it.

The additional Tulip rewards added another $1.10 over the 10 days.

What causes this pattern of results?

The main condition affecting the results is the price of the underlying tokens. Here that's the STEP price, since the USDC price is stable.

In the last couple of days the STEP price has increased; by 5% two days ago and then 10% over the last day. The auto-compounding solfarm has been taking the STEP rewards, converting half into USDC, and reinvesting. The Ray farm has left all the STEP rewards untouched, so it has more of them to benefit from the recent price increase. This explains the comparative overperformance of Ray vs Solfarm over the last couple of days.

However the Solfarm is still winning overall, even though the STEP price has risen since I invested, suggesting that the auto-compounding effect is an important consideration.

Additional risks and rewards from yield aggregator

In addition to the auto-compounding, the solfarm provides Tulip token rewards. These have some value which increases the performance of the solfarm.

However the use of this secondary farm (Solfarm) increases the counterparty risk. If Ray is hacked or rugs I lose both investments. If Solfarm is hacked or rugs I lose the second investment, effectively doubling the number of counterparties that I am relying on.

From initial observation it's not a huge additional reward for the extra risk on Solfarm. For other yield aggregator famrs the additional token rewards vs the additional risk will be something that I look at for future investments.

Where will it all end?

At some point I assume another yield aggregator will invest in the Solfarm STEP-USDC pool, potentially passing on both the STEP rewards and the TULIP rewards as well as their own token offering.

Does this work? Perhaps I am missing something but I couldn't see why not. Perhaps the underlying token rewards from the intermediate farms become small if they are being cut-out by newer farms (and so losing trade fees)?

And then another farm and another? Where will it all end???

As always:

Not financial advice.

I'm not linked to any of these projects.

Nor have I done any real research into them.

Do your own research.

Posted Using LeoFinance Beta