Straddl, the Intract quest, the 100 transactions and some nice rewards from Across Protocol

This one started quite funny as I was checking an airdrop for Lisk (0fRpWD is my refferal if you feel like trying it), and Across was the bridge that I like to use, so I was transferring a small amount to Lisk Network, using the aforementioned bridge:

So, as I did this, as quick as ever (speed is one of the main reasons why I use Across), my little project started.

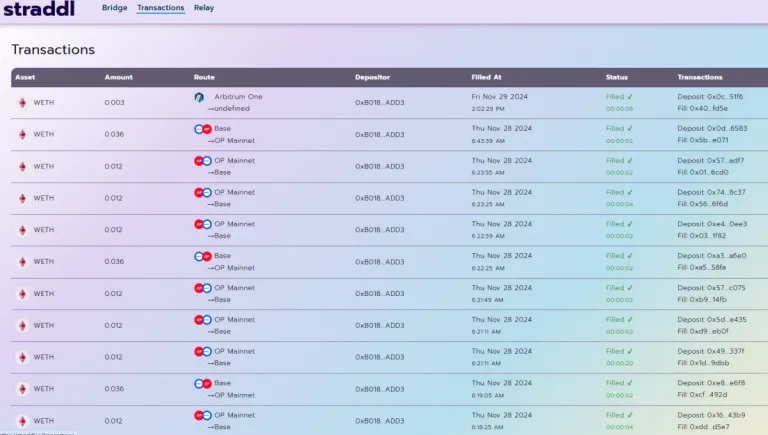

No longer we need to use bridges that take hours, or even days to transfer our funds from one blockchain to another. In these times, where people got not a shred of patience, speed is king. As I was saying, I started with Lisk, but then I noticed when I was checking Across, that on the Intract website there is a quest for Straddl - starting easy with website, Twitter and then, you needed to make up to 100 transactions/bridge transfers to Base, and of course I used Across bridge to do it, via Straddl. As a side quest, I transfered ETH from OP to Base using Straddl, and I transfered some amounts back from Base to OP, using Jumper Exchange (maybe there is some airdrop incoming), selecting once more Across Bridge (you see a pattern in here, right?).

Can you see those transfers, most of them taking 2-4 seconds to happen? So, Straddl, as a product, offers extremely fast and low-cost bridging between Ethereum mainnet and several L2 chains, currently on Arbitrum, Optimism, Base, Polygon, zkSync, and Linea. Straddl leverages Across Protocol and also introduces its own, unique bridging design. Until now we got ETH/WETH, USDC, USDT, and you can also perform cross-chain swaps at very competitive rates, saving you the effort of having to use a DEX after you bridge. I was satisfied with it, doing more than 100 transactions in the course of 3 days. We have the following blockchains for now: Arbitrum, Ethereum, Base, Optimism, Linea, Polygon and zkSync, with more to come soon.

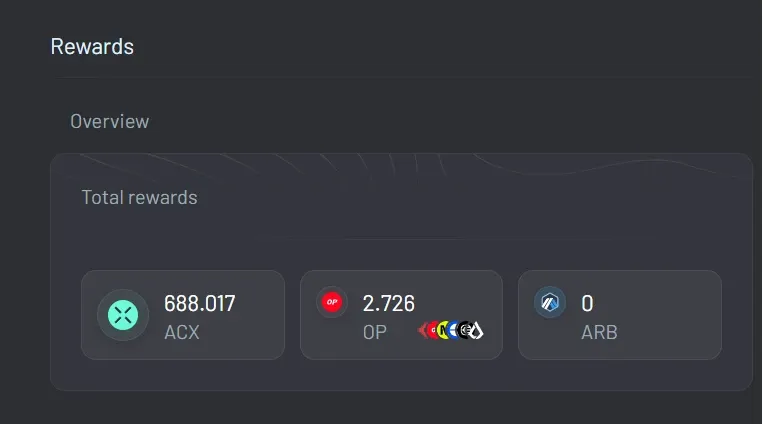

And that is not all. I got rewards doing all my transfers, as you can see:

The rewards can be seen on the Across website, and with ACX around $0.40, I made 556 ACX this month ($227), and 2.7 OP worth another $5. Gains everywhere, with the Straddl contest result still waiting to come. Every little helps, as I need to save enough money in December to buy a new phone for myself. I was supposed to exchange my last one in December 2022, but I still kept it, as some other money emergencies appeared every month, and here we are, 2 years later, with a phone having a 1.5 hours battery life.

I am still giggling now, looking at some of my writing from two and a half years ago, when one of my first posts was about Across. Still current today, as you can see:

If someone will ask me why I would prefer Across Protocol Bridge over the other ETH Layer 1 — Layer 2 bridges that I used in the past, my answer is ready, and I can prove it, point by point. I like to use Across Protocol because it is secure, it is fast, has enough liquidity available even for a serious transaction (don’t you have it when you try to move couple of thousand dollars and it will take half a day because there is not enough liquidity for the transaction that you need, just because it is some niche Layer 2?), and on top of that, it is fast, very fast. Not to mention with the first reason that I should have mentioned, the fees. I am monitoring what is happening around the cryptoverse, I can notice quite often tweets about random people being surprised about how much they can save in terms of fees using Across Bridge.

Let me prove this to you, talking about each reason to use this bridge, at least to know that I share this with you, some of my favourite people. Everybody is winning if we can prove that ETH blockchain is usable and not just living from their enormous transaction fees

Premise number 1: Across Protocol bridge is secure.

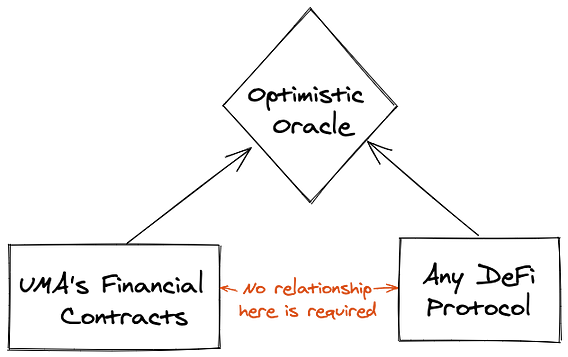

There are two essential parts regarding the security of the bridge, tested smart contract and UMA’s Optimistic Oracle. UMA has a history working on smart contracts security, has never been hacked and it is providing solutions focused on decentralization. It is in the name — Universal Market Access. Risk Labs, the team behind UMA and Across, has also been audited by Open Zeppelin (if you are like me, you may like to read all about the audit in here). The Optimistic Oracle can be used to resolve markets and bring all types of data on-chain, and unlike other Oracles, it is not limited to UMA Protocol, as any DEFI protocol can use it, given the right conditions.

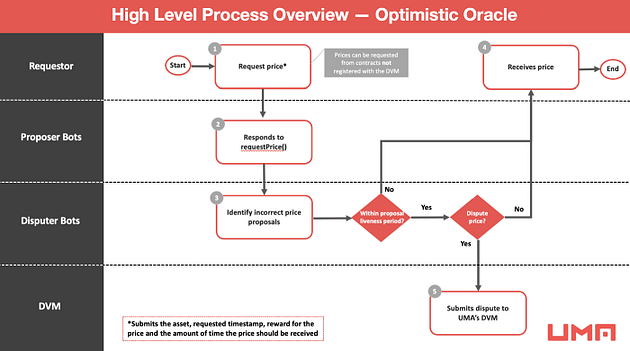

The Optimistic Oracle operates optimistically, as most of the time you will get an answer very quick. Anyone can provide an answer on-chain, and it will generate a dispute only if it is wrong. This way it will decrease the gas usage, reducing the costs. We got 3 main actors for any transaction, the requester, asking for a price and specifying the dispute period, and the proposer, posting a bond and offering a price. If the dispute period finishes and nobody disputed the price, the transaction is finalized and the proposer is getting back his bond. If the requester disagrees with the proposed price, can post a bond equal with the proposer’s one, and the dispute is escalated to UMA’s Data Verification Mechanism (DVM), where UMA token holders will vote to resolve the dispute in the next 48 hours. Here is the interesting part: if the disputer is correct, it will get the proposer bond as reward, and vice versa. So, this reason is enough to not try to be dishonest, as you lose your own funds if you try, and in the past year we had only 5 legitimate disputes, so the optimistic system is working very well, in this case. Each use of the DVM costs money, so the flood event is highly unlikely. And the UMA token holders are incentivised to vote correctly, as this is the only case when they are rewarded (if you vote wrong you get no rewards, and UMA value may drop), so the ‘’skin in the game’’ is a real-life concept when you use UMA’s Optimistic Oracle. (If you want to read more about the Optimistic Oracle, find about it here.)

Premise number 2: Across fees are lower than any other bridge solution from the market right now.

There are three types of fees used on this bridge:

Liquidity provider fees (set by the protocol)

Slow relay fees (set by the user)

Instant relay fees (set by the user)In order to start to talk a bit about each, I will begin mentioning that Across as a bridge will provide incentives to relayers to offer short-term loans to users on L1. These loans are repaid to the relayer within two hours, from liquidity pools on L1. The pool is refreshed once funds from the canonical L2 transfer settle. The user initiating the transfer will pay the fees, and those fees will be used to compensate the relayers and the liquidity providers. Right now, Across users can bridge USDC, ETH, WETH, WBTC and UMA from L2 Arbitrum, Optimist or Boba to L1 Ethereum. (You can be a liquidity provider also, getting some decent rewards doing it.)

Premise number 3: Across Protocol is fast, almost instant (I remember the times when transferring across layer 1 — layer 2 was taking days). There are Liquidity pools on ETH Mainnet, created to facilitate fast withdrawals of tokens from Layer 2 networks like Arbitum, Optimism or Boba. When someone is using the bridge, it is paid instantly, most of the times, and few hours later when the deposits from Layer 2 are sent to the ETH Mainnet, the liquidity provides are rewarded, and the pool is reimbursed. It is a short dated loan of some sorts, on ETH Mainnet, secured by Layer 2 deposits.

Premise number 4: There is always enough liquidity for every transaction, even if you are a whale.

So, are you ready to check Across? Not all the bridges are the same!