When you come out of a storm you won’t be the same person that walked in. That’s what the storm is all about(weekly crypto updates)

What happened in crypto in the past week? What else? Read below:

- Bitcoin: The Bitcoin price is hovering around $70K today, but Monday is only the first day of the week. The BTC future is under scrutiny after a test transaction was made from the US Department of Justice to a Coinbase Prime wallet. Swiftly followed by $2B worth of BTC being transferred to a different address, the BTC that was seized from the Silk Road marketplace, making people panic thinking if all this BTC would be dumped on the market. Talking about negative milestones, Ark Bitcoin ETF managed to surpass Grayscale for the first time, in terms of outflows. Translation: they are losing a lot of money. This is surprising as the total trading volume for Spot BTC ETFs almost tripled, from $42B to $111B in March, with BlackRock being the clear leader in trading volume. Australia got ready for its first spot BTC ETF. Paraguay's energy grid is feeling the heat, and they are proposing a new bill aiming to temporarily ban all crypto mining farms. But there is a problem in the wording, as they suggested a temporary ban on creating, storing and selling crypto, which makes you when you just try to sell some crypto on the exchange. Tether added another 8889 BTC to its reserves, worth a bit over $5B. Not a bad idea, as the founder of Morgan Creek predicted a price rise to $150K by the end of this year.

- Ethereum: ETH fees slightly decreased on the Mainnet after the Deneb Cancun upgrade, but Layer 2 solutions like Arbitrum and Optimism have now notably reduced fees, boosting their on-chain activity. On March 30, the Ethereum Layer 2 Base broke records with a $1B in DEX volume, a 25% increase from the previous day, and, watch this, more than 64% of the volume came from Uniswap. How did this happen? Well, memecoins and FOMO, mostly. Base blockchain also surged over $4B in TVL recently. Consensys actively participated in the ongoing discussions regarding the potential listing and trading of BlackRock's spot ETH ETF.

- Altcoins and stablecoins: AAVE DAO is exploring Oracle Extractable Value (OEV) mechanisms after the UMA Project launched an MEV capture mechanism product called OVAL. In a fun turn of events, Litecoin (LTC) went up 24%, after the US CFTC declared LTC a commodity, which means that this one cannot be touched by the SEC. This means that LTC can have multiple uses, without SEC enforcement fears. Solana is feeling the heat lately, with FTX selling $7.5B (41M of locked SOL). Galaxy Asset Management is the most notable wannabe buyer, but it seems that FTX already sold some SOL with a 70% discount, making many of its creditors angry, as this is not the right way to deal with the bankruptcy. Who knows, maybe the secret client is SBF itself, securing some cushy investments for the future. You need to realise that right now, with all the memecoins dropping around, 75% of the non-vote transactions on Solana are failing. A bit too much! You may want to check Ethena, a project that reached $1.5B TVL in less than 2 months. You can also stake Mantle (MNT) for Ethena shards, basically getting some future airdrop, but you need to hurry, this is only available until the end of April. You can also check Ethena's $450M airdrop here: https://claim.ethena.fi/. But Andre Cronje is not into ETHENA, pointing out that there are potential pitfalls with funding rates in perpetual futures contracts, and being concerned about USDe, its stablecoin, and their risk management practices. Meanwhile, Ethena is bringing BTC into its collateral basket. BNB Chain announced a $1M prize for its Meme Innovation Campaign. A Solana-based memecoin, Boba Oppa, created by the Taiwanese blockchain personality Machi Big Brother, raised $40M on its presale, only to dump soon after. The memecoin creator said that they are different, with a dump and pump strategy, going down first and up later. If you are to believe this, you deserve to lose your money! Yet, there are some lucky ones, like this guy buying $13K worth of MOEW memecoin, only to sell it one hour later for $2M. Bitcoin Cash was a bit funny, managing to drop almost 10% in the day leading up to its halving, recovering shortly after the event took place. Ripple is preparing to launch its new stablecoin, announcing that they are ready to compete with giants like USDT and USDC. Even the Tron Foundation challenged the SEC over jurisdiction and token classification, accusing them of overreaching.

- NFTs and blockchain games: Binance will drop the support for Bitcoin NFTs (Ordinals). On Splinterlands, the second round of Conflicts airdrop activity ended. I got 3 regular cards. The third part of the Conflicts airdrop started, and a new reward system was implemented, as you get Glint tokens for every match you won. You can use Glint tokens to buy cards, Merits, potions and even 3 different titles. You may also want to check Holozing - a soon-to-be-launched Pokemon-like game on the Hive blockchain. Parallel Studios secured a $35M fund getting ready to launch on the Epic Games Store and Steam, as well as introducing the highly expected Planetfall expansion within the game.

- Good news: The leading Thai crypto exchange called Bitkub is planning to do an initial public offering (IPO) in 2025. Bitkub owns a 77% market share in Thailand, this makes it up to three-quarters of the whole Thai crypto-trading. China is working on something big, looking to build a blockchain infrastructure that supports projects aligned with China's Belt and Road initiative. Venture capitalists poured over $1B into crypto projects last month. Crypto-focused investment firm Paradigm wants to raise $850M for a new crypto fund. Crypto exchange insurance funds are now bigger than $1B, with Binance's Secure Asset Fund for Users jumping over $2B. Crypto trading volume nearly doubled in March, reaching an ATH (all-time high) of $9.1 trillion.

- Bad news: SBF answered some questions from ABC News, via email, before going to prison for 25 years. He waslike he never believed that his actions were illegal, and expressed remorse for the losses suffered. Poor rich guy! Solareum, the Telegram trading app, announced its closure following a crypto security breach, leading to $523K worth of SOL being drained from user wallets. Argentina announced a new set of crypto regulations, with specific companies offering crypto-related services being requested to register with the Argentinian Government. Strike, a very popular app in Argentina, has disabled the option for locals to send fiat to bank accounts. Wormhole airdrop is turning into a nightmare, not only there are a lot of scam accounts with Gold checkmarks, on Twitter, but the official X account of its founder was also hacked, starting to shill malicious wallet-draining links. Beware, there is no free money in crypto! It is always a catch! eToro platform is facing heat in the Philippines, being accused of operating without a license and offering unregistered securities. Despite its competitors' BlackRock and Fidelity's pro-crypto attitude, Goldman Sachs said that they are not believers in crypto.

- Joke of the week: This is too good to not be mentioned here, it seems that Craig Wright losing the battle to prove that he is Satoshi Nakamoto, in the UK, and some dodgy moves trying to transfer shares of his London firm, RCJBR Holding, to a Singaporean entity, lead to a judge authorizing the freezing of $8.3M worth of Craig assets.

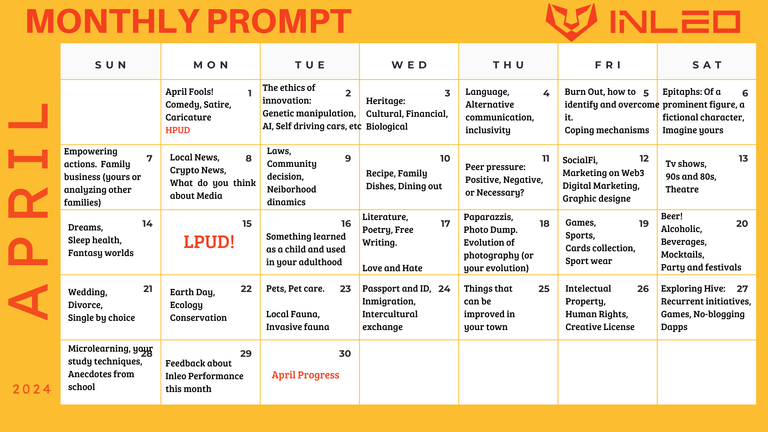

#aprilinleo 08.04.2024

All the best,

George

Why not...

...have fun and win rewards on my favourite blockchain games (Splinterlands- Hearthstone-like card game) (Mobox - GamiFI NFT platform) (Upland - real-life virtual land) (Holozing - Pokemon-like game)and (Rising Star - Music creators game).

...Get ETH while writing on the Publish0x blog, using the Presearch search engine to maximize your income with PRE tokens. Use Torum instead of Twitter. I am also writing for crypto on Read.cash and Hive.

Posted Using InLeo Alpha

0

0

0.000

!DHEDGE