HumpDayChartDay #16 is a reminder not to be fooled by Dollar Cost Averaging

Welcome to week 16 of #HumpDayChartDay

If you are reading this, please be aware of the value in reviewing previous #HumpDayChartDay blogs. From charting and observing some basis elements of a technical analysis to compliment a fundamental analysis we can greatly improve our annual net return from trading tokens. For several weeks, data has been saying that BTC is on a downtrend. Plus, the negative impact of a bearish BTC is continued pressure on Hive secondary token market. Meaning, it is best to understand the fundamentals of your favorite tokens if you plan on holding for a better time. It is very common for some style of investing to implement a dollar cost averaging strategy. Be very careful with this thinking because it only applies in certain conditions and selective investment. If there is no underlying and measurable fundamental value to support long term holding of a token then averaging your cost on a down trend is extremely risky and seldom works out well for most investors. For example, know the Price-to-Book Ratio (P/B) for the tokens you hold. One use of dollar cost averaging is with growth stocks that pay dividend and have a record of continued growth with increasing dividend where the dividend is re-invested. Known as dividend re-investment plan. Food for thought. Now back to our chart series.

Now we review our Weekly Bitcoin Guessing game.

#ShowMyURL

https://peakd.com/hive-167922/@spinvest/the-weekly-bitcoin-guessing-game-rybgaj

This week I am guessing $29,270 again.

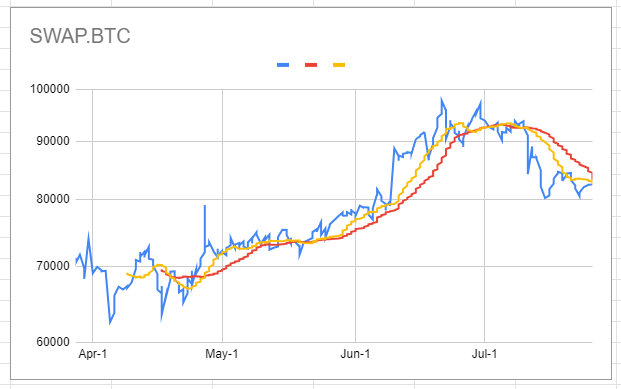

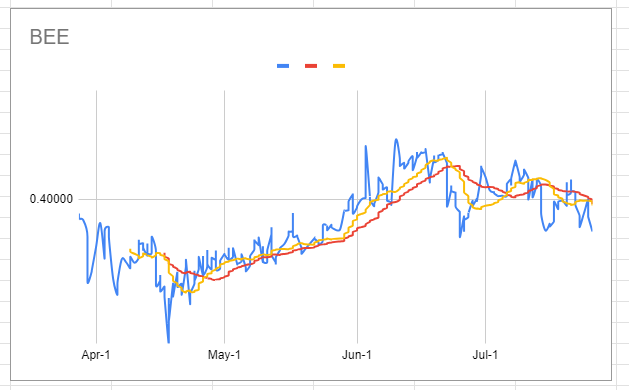

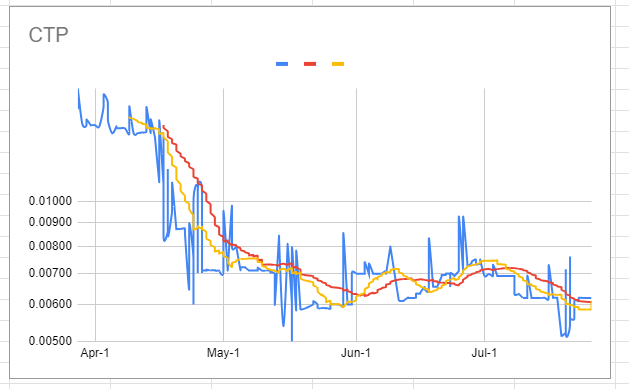

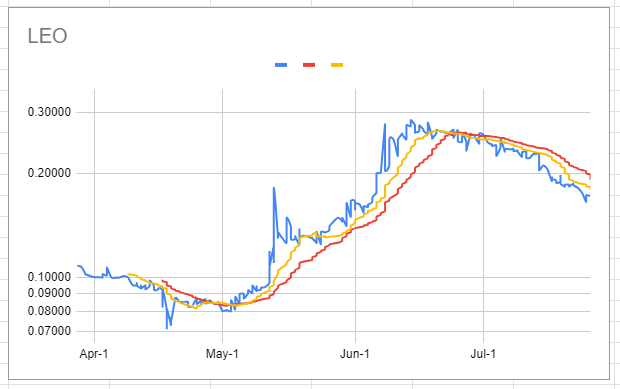

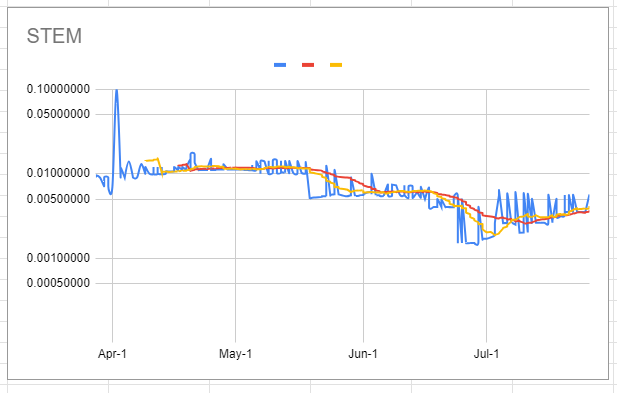

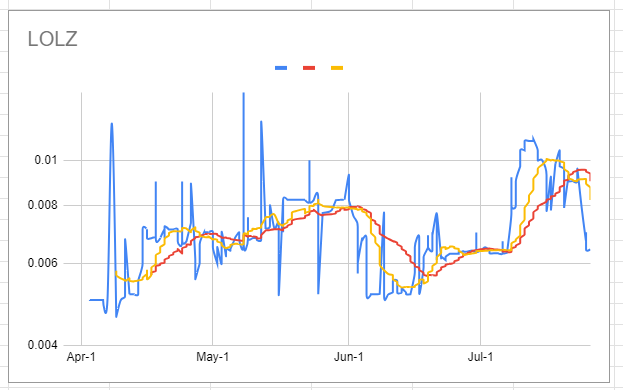

NOTE: Blue is the spot price, orange is the average of the previous 20 spot prices while red is the previous 40 spot prices.

#bee as previous weeks, I am preparing to buyback.

#ctp price movement continues to fuel my short term and long term strategy for our #PEPT traffic exchange community tokens.

#leo price movement is predictable as with many tokens. The challenging part is balancing measures that are influenced by bot trading activity, human technical trading and emotional investors. It is a reliable trader but is it a reliable holder? This is why I suggest a strategy that involves short term trading in combination with long term holding.

#stem was re-added last week because trading was looking more predictable and it looked like there was renewed interest for a more predictable long term uptrend. I am looking forward to the next 2-3 weeks to confirm expectations and to measure results form being more active in the community.

#lolz did provide more trading above the 0.01 level but not in a good way. I will keep it in the series for now as an example of tokens that can have dramatic swings.

I am not sharing any new charts until I have more data collected on several tokens of interest. Some of these tokens have produced good returns while others are more disappointing. In some cases it looks like implemented bot traders are working against the desire of human traders.

I hope readers/followers find this weekly chart series beneficial. I know I do cause it helps me better understand the marketplace for my own tokens. I trade daily but I am more focused on long term growth. Why I promote a P/B ratio analysis for all valued stocks, tokens or whatever you want to predict. Including a Hemline index. #lolz

If you take a position in #PEPT and/or #ePay and comment on this blog I will send your 100 ePay tokens. ePay is the essence of Project ePayTraffic and our Hive traffic exchanging community. I am very aware that my method of releasing tokens in our Hive marketplace is different than most other tokens. Just like when I entered the manual traffic exchange world, I created a unique way of using the same set of tools that other business owners used. I have seen many traffic exchanging sites fail as I will see many tokens fail here on Hive. So that in itself tell me that doing something different is not all bad. Today, I am very pleased with the knowledge I have gathered from the Hive community. Many, many, Hivers have been very supportive. I look forward to seeing more Hivers adopting new ways of thinking that can be used to create a more reliable return from time spent on our beloved Hive blockchain.

Congratulations @fjworld! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Most people I know who have bitcoins don't cost average. They just keep stacking and buying cheaper bitcoins.

I agree that cost averaging for some tokens and coins is bad.

Thanks for sharing your thoughts and charts. I found your post on ctpx. I agree with the traffic exchanges that fail and I like if some TEs do it differently. That's why I joined ctpx and ePayTraffic.

!ALIVE !DHEDGE

@fjworld! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @chaosmagic23. (7/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power and Alive Power delegations and Ecency Points in our chat every day.

This post has been selected for upvote from our token accounts by @chaosmagic23! Based on your tags you received upvotes from the following account(s):

- @dhedge.bonus

- @dhedge.leo

- @dhedge.ctp

- @dhedge.stem

@chaosmagic23 has 7 vote calls left today.

Hold 10 or more DHEDGE to unlock daily dividends and gain access to upvote rounds on your posts from @dhedge. Hold 100 or more DHEDGE to unlock thread votes. Calling in our curation accounts currently has a minimum holding requirement of 100 DHEDGE. The more DHEDGE you hold, the higher upvote you can call in. Buy DHEDGE on Tribaldex or earn some daily by joining one of our many delegation pools at app.dhedge.cc.