Some considerations on cash flow statements in a company

(Edited)

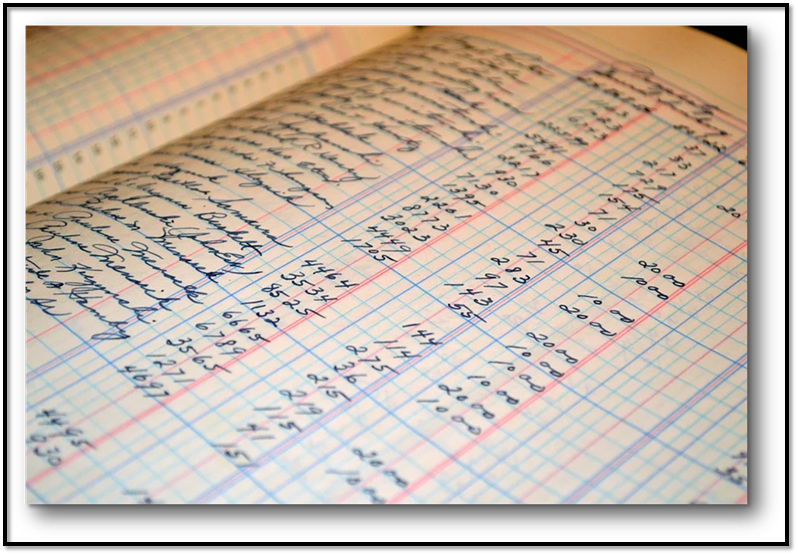

Dear readers, it is important to keep in mind that at the moment of setting up a business unit, no matter what it is dedicated to, cash books or also called cash count should be done on a daily basis. It is worth mentioning that cash books are nothing more than a detailed development of the income obtained during the day. In general, this cash count should specify all the income obtained by point of sale, in transfers and if it is the case in foreign currency. After finishing this phase, all the expenses and also the credits assigned to the clients should be mentioned.

At the moment of entering all the operations of the day, the final balance must be positive, because if the balance is negative, all the transactions must be verified and it is necessary to determine if the shortage is due to a return of an invoice that was not made, it can also be an expense that was not reflected or in any case to monitor the cash register where the invoice is made. This procedure is essential in order to have a better management of the audits that are carried out to manage the company's resources.

The companies that do not carry out this detailed verification from my point of view I consider that they can cause some disadvantages as for example to exceed the expenses or the same ones are duplicated, also the credits to clients since, it is important to stipulate days of credits and that the clients cancel when it corresponds to them, because as credits are assigned and they do not cancel they can be of great problem for the company since it will not be able to replace the inventories that are needed for not counting on the capacity for the payment of suppliers.

Dear readers, cash books can be done in small companies by the owners, in case the company has a larger scope it must have people with experience in each of the areas that this represents, since the cashiers have the obligation to bill everything that comes out of the business unit and an administrative staff to ensure the safety and equity of the company.

| Bibliography consulted |

|---|

Fabricio, C. (2017). Analysis of the internal control of cash in the cash count in the company promise. Degree work presented at the instituto superior tecnológico Ecuador.

0

0

0.000

0 comments