The Rise of LeoDEX in Maya DEX Ecosystem

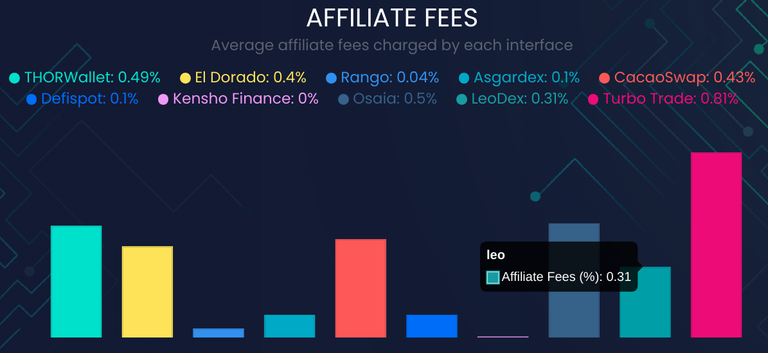

I have been eagerly waiting almost two weeks to be able to write this article. The shortest time frame Maya Scan block explorer prove in their statistics is 15 days when it comes to Interface Wars. These are comparisons of how each front end/DAPP is doing compared to the other prominent players in the ecosystem. At the moment THORWallet, Asgardex and El Dorado are the biggest interfaces earning the most amount of fees. They already have established their community and marketing funnels.

LeoDEX is The New Arrival

The arrival of LeoDEX exposed Maya Protocol (and THORChain) to HIVE users. They are going to benefit from this integration as much as we do. @leofinance has created a brilliant win win scenario for two of the strongest and most underrated projects in cryptosphere.

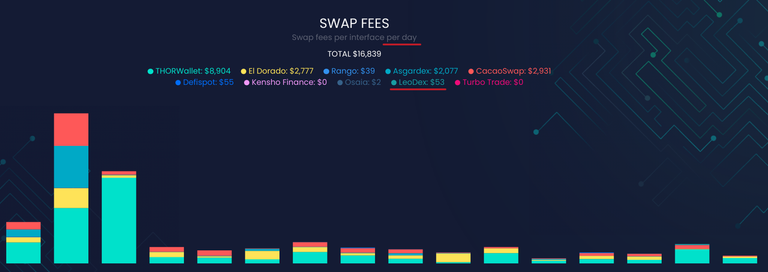

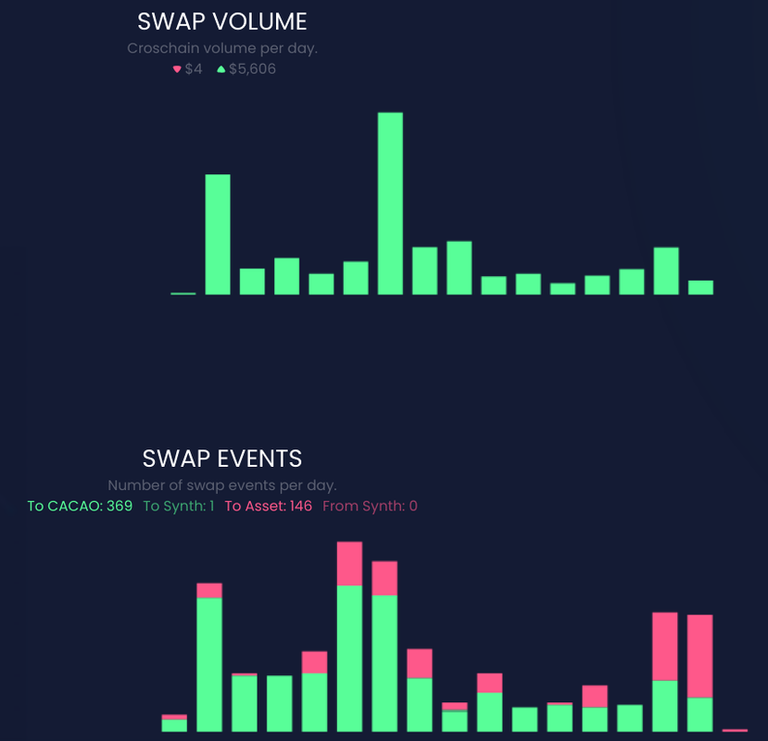

If you see a discrepancy among the swap volume and swap fees, that is because the different interfaces charge different amounts. I think of it as similar to beneficiary rewards some HIVE front ends are charging the users. LeoDEX plan to be among the lowest fees and make it up by the volume of transactions those low fees would attract. @leofinance do not have to depend on the fees to keep building. $LEO is doing many things under its umbrella. This is a strong advantage we have even against the veteran DAPPs that are part of Maya Protocol.

50% of Fees Buy $LEO

At the moment LeoDEX is in the middle of the pack when it comes to the fee each interface is charging. A large part of the swap volume is going through interfaces that have a much larger fee. There is no need for @leofinance to start a race to the bottom yet. We can first try to get some of the users of THORWallet and El Dorado to make a switch in order to save up on fees. If they are using a web wallet, the switch should be an extremely easy one.

Look At The Daily Fees

We have enough data to have a decent understanding of how much value LeoDEX would generate. We may have 1.5 years of bull market left and Maya Protocol has barely started to spread its wings. Trading volumes are going to multiply over the coming months. It is reasonable to expect that there will be $50 or more in fees earned every single day. All of this revenue will go towards a LEO - CACAO Liquidity Pool. At least $25 per day will be used to buy $LEO. This is not the same as burning a token.

On the other hand, burning tokens do not improve its liquidity. Whales don't want to allocate 1% of their portfolio to a promising cryptocurrency with an amazing team and then see that they are going to pump the prices by 20%. I have made splashed half as big during $CUB and $POLYCUB days. It was a major inconvenience and I was nowhere near a Whale. Improved liquidity will allow interested parties to invest in LEO without feeling like they are getting ripped off for swapping small parts of their portfolio.

HIVE-Engine + Tribaldex

The combined daily volume of $LEO on HIVE's two primary DEXs is less than $1,000. There is little reason to trade when they can earn LEO for posting or get paid for delegating HP. This is a very unique dynamic to HIVE.

LEO Pool on Maya Protocol

This is not native LEO that is being pooled and traded. aLEO is the wrapped version of LEO that is Arbitrum L2 of Ethereum. It is similar to an ERC-20 token and it can be redeemed for LEO using this website with a few clicks. There are many arbitrage trades enabled by the wrapped version of LEO. These exist on Ethereum, Polygon BNB Chain and Arbitrum.

These per day volumes are amazing compared to what we have seen on HIVE DEXs over the year. Swap services try to get the best prices by swapping an asset through various paths. If aLEO can provide a profitable route, it can find itself some trading volume. Tribaldex does not have this feature. You cannot swap two assets if they do not have a dedicated Liquidity Pool. I don't know if Dswap does things better. What I know is that we have a lot of room to improve.

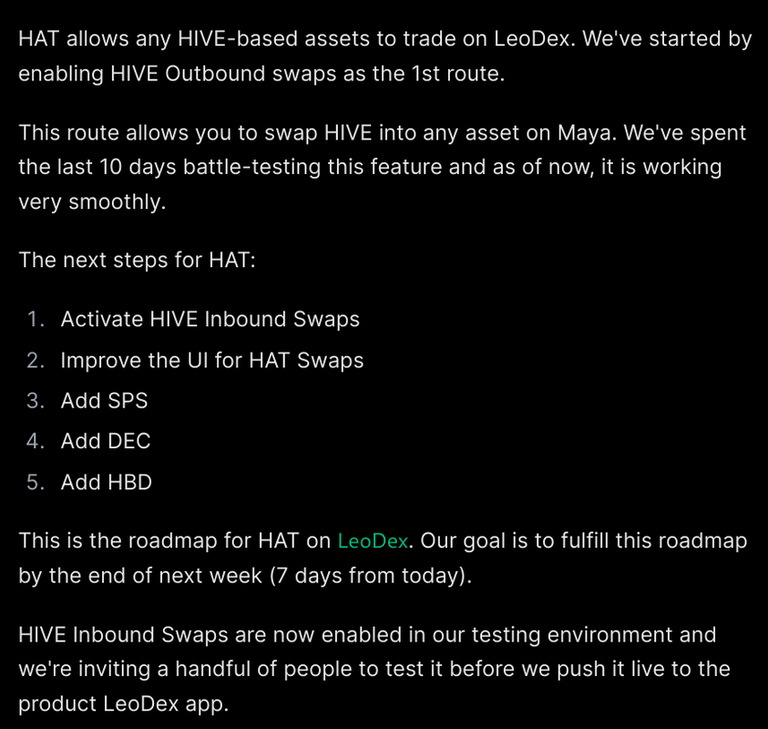

Watch Out for Next Week

These additions of new assets should bring more trading volumes to HIVE DEXs. LEO - CACAO pool is how HIVE get connected to Maya Protocol. It is possible to wrap more assets to Arbitrum. The drawback is that it adds more complexity and maintenance work for @leofinance. This announcement covers more details and plans for the future.

Happy Trading! Happy Investing!

Posted Using InLeo Alpha